Income Tax On Mutual Funds Redemption In India

Even though you might not have to pay taxes but you need to let the income tax department know about this income by.

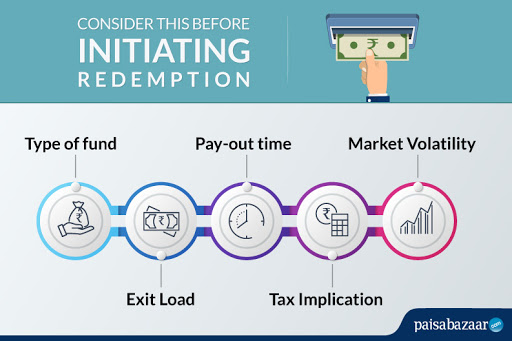

Income tax on mutual funds redemption in india. Some mutual funds gives us deduction under section 80c of income tax act 1961. Taxation of mutual funds. Excess and above of rupees 10 lakhs might be taxed. Here s all you need to know october 7 2019 11 17 am mutual funds can be an ideal investment option for wealth creation.

While most regular equity funds do not have a lock in period elss funds come with a lock in period of three years. Capital gains tax on mutual funds in india for fy 2019 20 stt on mutual funds. Investing in these funds can reduce our total income however the maximum limit is rs 1 50 000 and a lock in period of 3 years. These are called tax saving mutual funds or elss equity linked saving scheme.

Income tax on mutual fund. In addition to above there is 0 001 securities transaction tax stt changed from 0 25 from june 2013 is levied on redemption of equity mutual funds irrespective of the holding period. In other words the tax rates are different for equity mutual funds and debt mutual funds. Tax rates charged to investors depend on the asset class.

Best tax saving investments u s 80c. There is no stt for non equity mutual funds. How mutual funds are taxed in india. Rates of tax on mutual funds.

It is important to note that tax on mutual funds is chargeable only on the gains made by the investor. The limit of 1 lakh is cumulative of capital gains on all equity instruments such as stocks and equity mutual funds. The short term taxes are higher of course as shown in the table above while long term taxes are lesser. Please tell me that amount received on redemption of mutual fund is exempted or taxableif there is ashort term redemption or long term and if its any relation with sec 10 35 samely if the amount received on its sale is it will be considered as capital gain or not income tax.

An investor is not required to pay stt separately as it is deducted from the mutual fund returns. If you have invested in retail mutual funds then the income earned from the redemption of these units will be tax free up to a number of rupees 10 lakhs in one year. Income includes both dividends and capital gains on mutual funds as per the definitions given in the income tax law. Securities transaction tax stt a securities transaction tax stt is applicable at the rate of 0 001 on equity oriented mutual funds at the time of redemption of units.

Best elss top 10 tax saving mutual funds for fy 2019 2020.