Income Tax On Mutual Fund Withdrawal

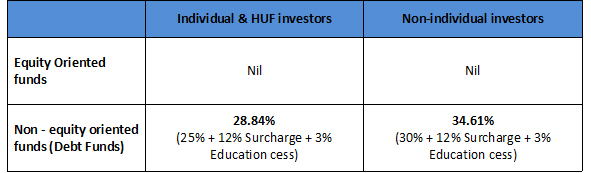

Mutual fund taxes typically include taxes on dividends and earnings while the investor owns the mutual fund shares as well as capital gains taxes when the investor sells the mutual fund shares.

Income tax on mutual fund withdrawal. However it s important to know when an entire withdrawn amount will be subject to tax and when only a portion will be. Even if you turn around and re invest that 12 in another mutual fund you have a realized gain and you ll pay tax on it. You would also like to read how to withdraw mutual fund. Updated on 17 06 20 home personal finance blog tax taxes on mutual funds withdrawal.

Calculating the taxes you owe on mutual fund income and distributions can be extremely complex even for the most seasoned investor. You may also like. It should provide you with a form 1099 int if you received any tax exempt interest distribution. The basics of mutual fund withdrawal.

The mutual fund company should provide you with a form 1099 div for any taxable dividend distributions you receive. In that case the usual rules apply. If you buy a fund for 10 per share for example and sell it later for 12 a share you ll have a taxable gain. P p this gets us to the third category of funds.

There are also taxes due on distributions from qualified retirement. Unlike other forms of investments mutual funds come in handy in case of urgent emergencies. You should use these forms to report your mutual fund withdrawal income when you file your federal income tax return. Realized gains and losses are the third component that completes the mutual fund tax story.

However we need to time the mutual fund withdrawal well so that we are able to extract maximum performance from our investments. And even if you ve only held the mutual fund for a few months and have not sold any shares it is possible that you could receive a long term capital gain distribution assuming the mutual fund held the stock for more than a year. Taxation of regular mutual fund sales most of the time if you want to make a withdrawal from a mutual fund you have to sell some of the shares that you own. Irs publication 550 can be some help in informing you about.

This is how tax is calculated on returns from mutual fund swp while systematic investment plans sips are being used by investors to build a corpus in a planned manner systematic withdrawal plans or swps can be used to redeem their investment from a mutual fund scheme in a phased manner.