Income Tax Paid Journal Entry

Sole proprietorship partnership and private limited company.

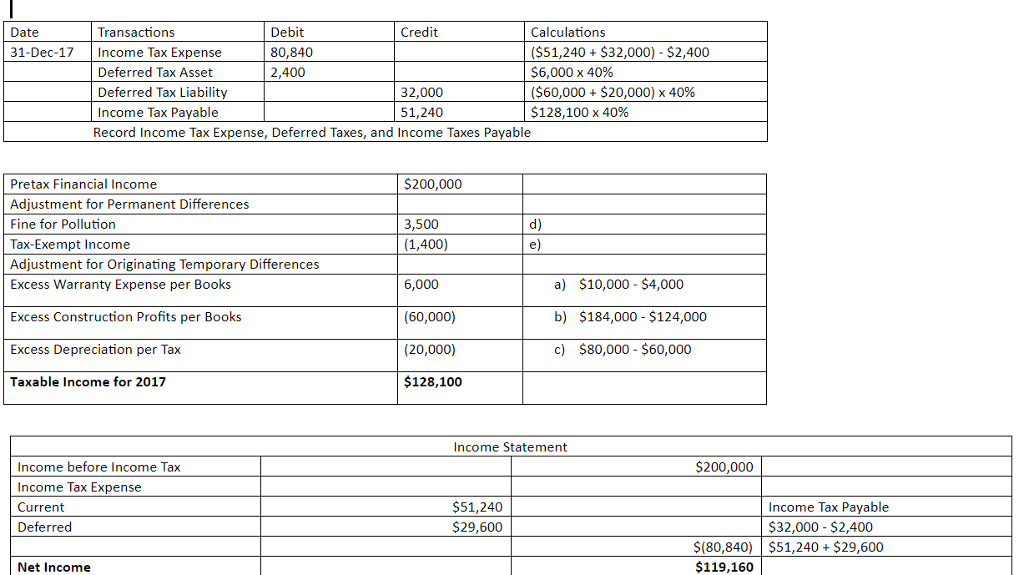

Income tax paid journal entry. Debit income tax expense 14 250 00. Income tax is a form of tax levied by the government on the income generated by a business or person. In conclusion this is one of the most common cases leading to prepaid income taxes. The company tax rate is 28 5 and thus the projected tax payable will be 14 250 00.

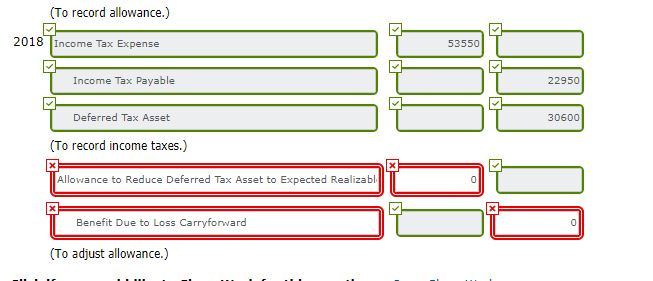

Being income tax paid and refund claimed this entry sets off the provision with the asset and gives rise to another asset i e. There have been no income tax instalments paid in advance. I would like to know the whole solution to this income tax entry i e. Today i just stuck up thinking how the entries for income tax payment are passed in companies partnership firms etc.

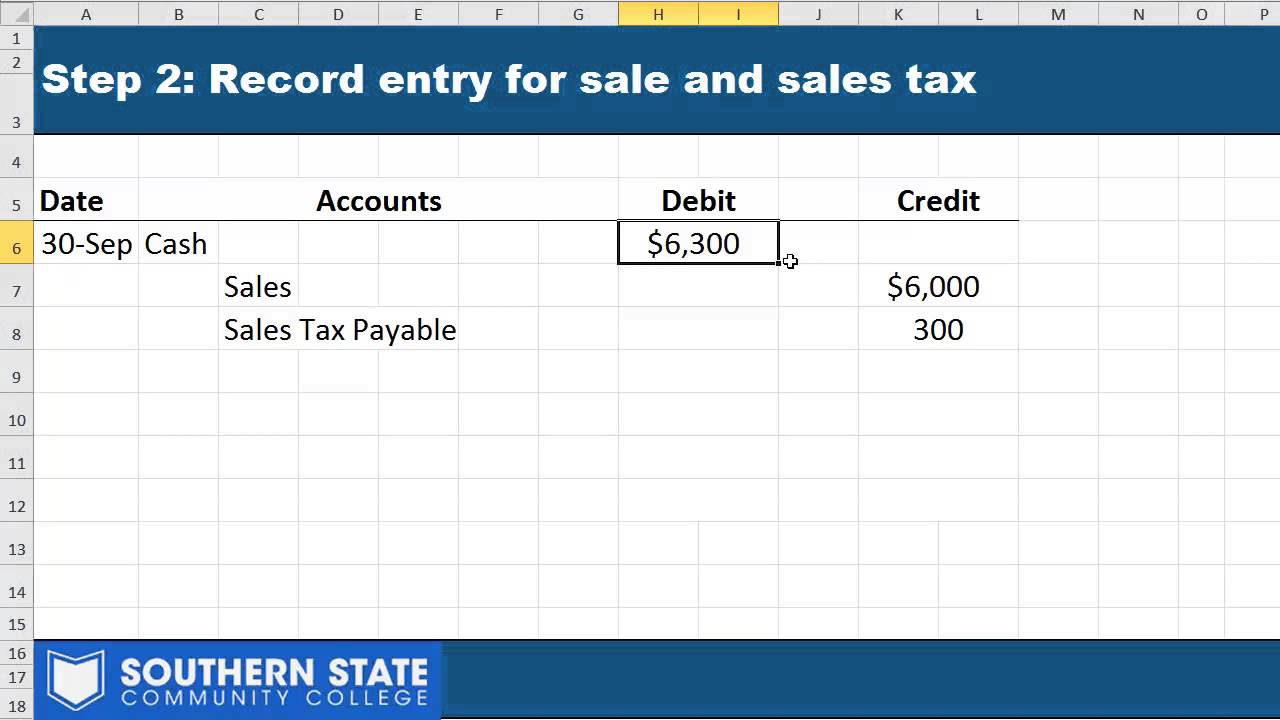

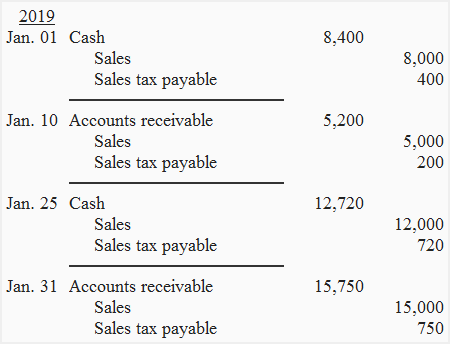

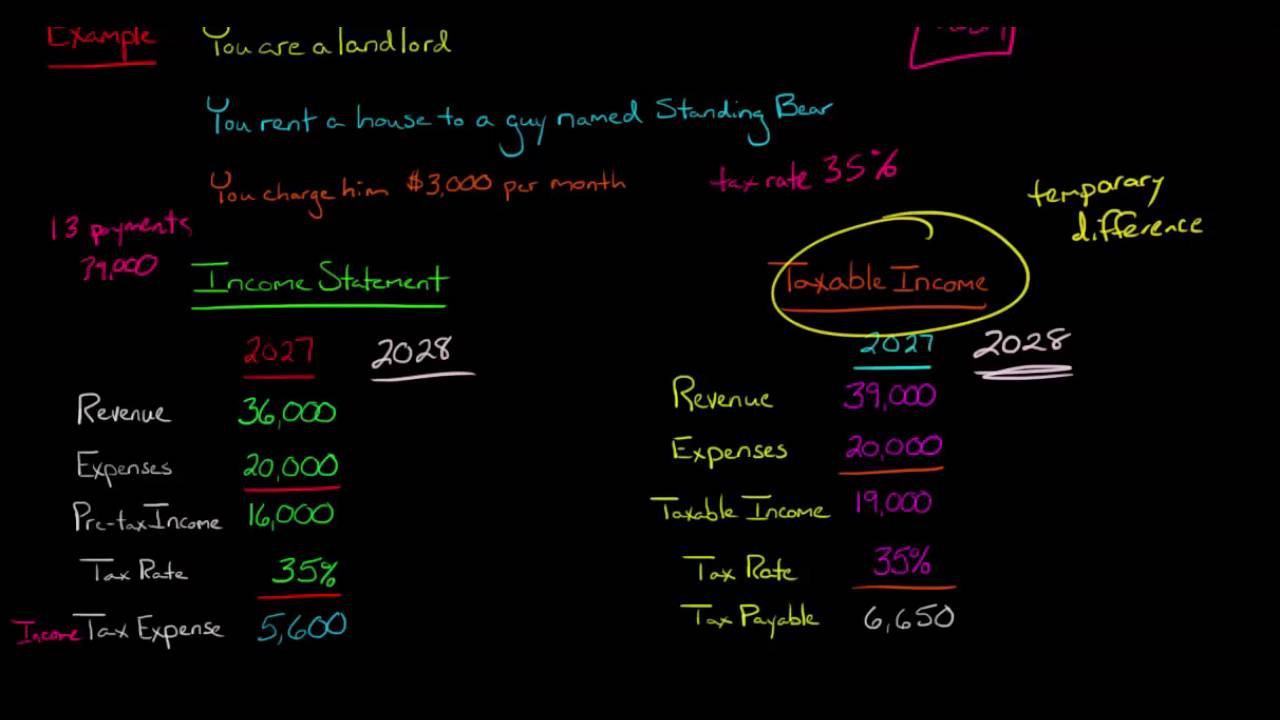

Journal entry for income tax. The company s tax accountant determines that the company s revenue for the period under tax accounting rules equals 48 million while its allowable expenses are 23 million. Types 1 without creating provisions for income tax applicable to companies firms etc income tax ac dr to bank cash account profit and loss acco. Income tax is a form of tax levied by the government on the income generated by a business or person.

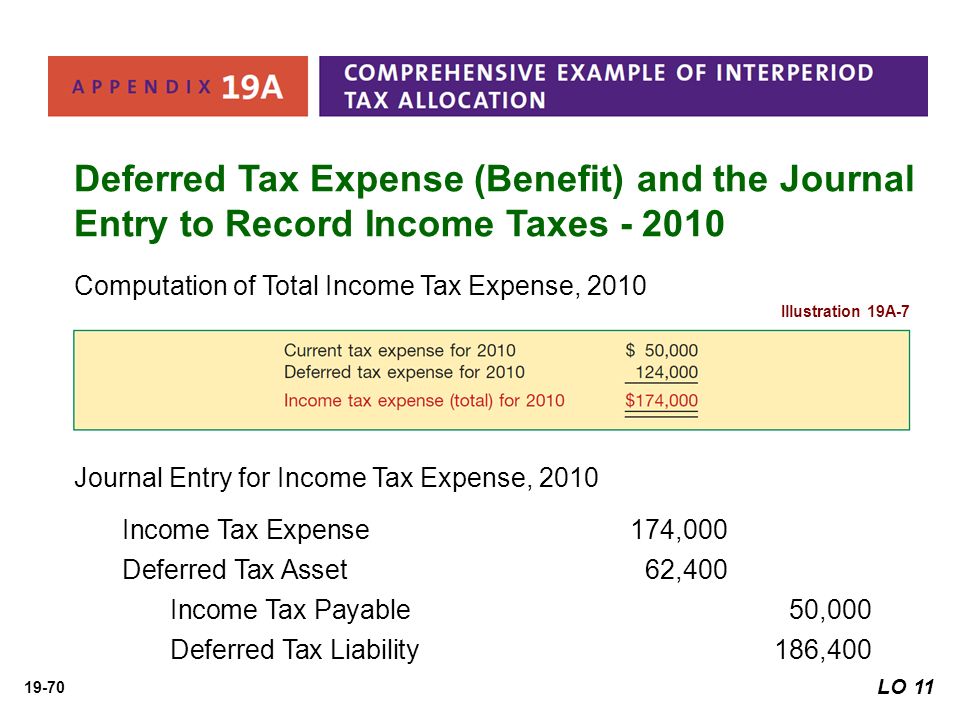

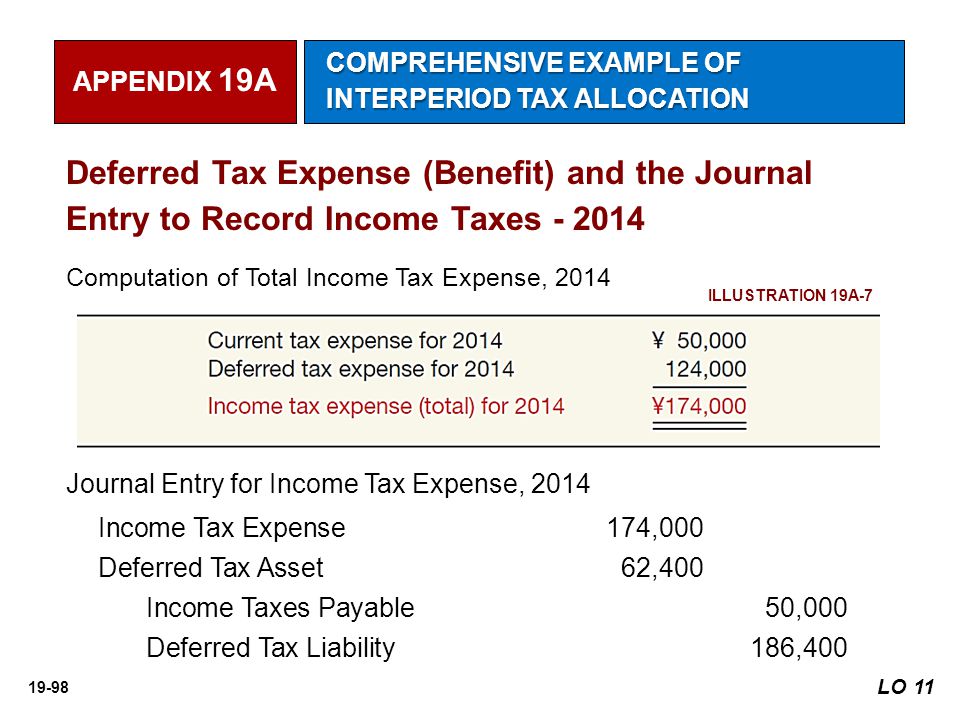

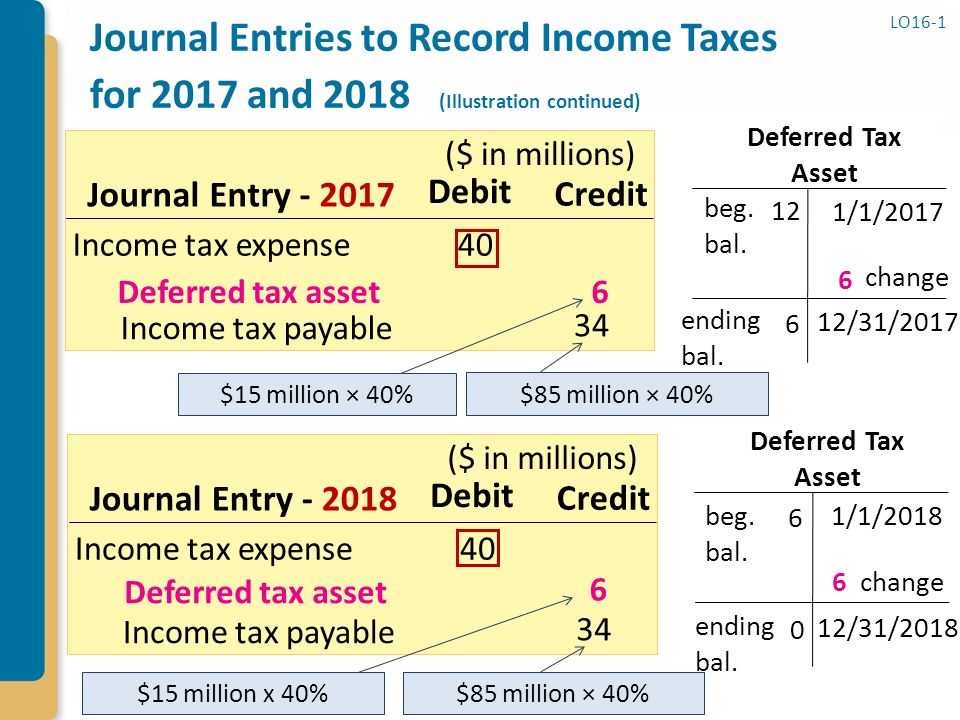

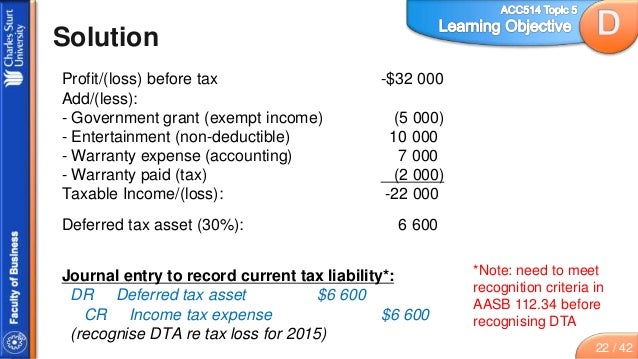

Since tax accounting rules are different than the financial accounting rules net income for the income tax purpose is different than the financial accounting net income. Income tax refund receivable. Accounting and journal entry for income tax is done in a distinct way for different types of business establishments i e. Journal entry of income tax accounting.

Debit income tax. Generally company controllers overestimate the needed tax deposits. All the aspects eg tds advance tax and provision for income tax. Have different angles towards it.

The firm estimated its annual income tax expense as 100 000. Income tax refund receivable is to be grouped under other current assets. We account for this by the following end of year journal entries. To record the first payment of federal income taxes on march 15 20x3 bokssnel company would make the following journal entry.

Prepaid income tax journal entry. Credit income tax payable 14 250 00. Often prepaid income taxes are the result of poor assumptions. Bokssnel company pays federal income taxes in four installments throughout the year.

Provision of income tax provision of income tax recorded in books of account by debiting profit loss a c and it will show under liability in balance sheet. When the refund we do the following. Accounting and journal entry for income tax is done in a distinct way for different types of business establishments i e. It all depends on the type of assesse and the type of method of treatment they are adopting.