Income Limit For Roth Ira 2021

Roth ira income limits for 2021 after tax roth ira contributions qualify you for tax free investment growth and tax free withdrawals in retirement.

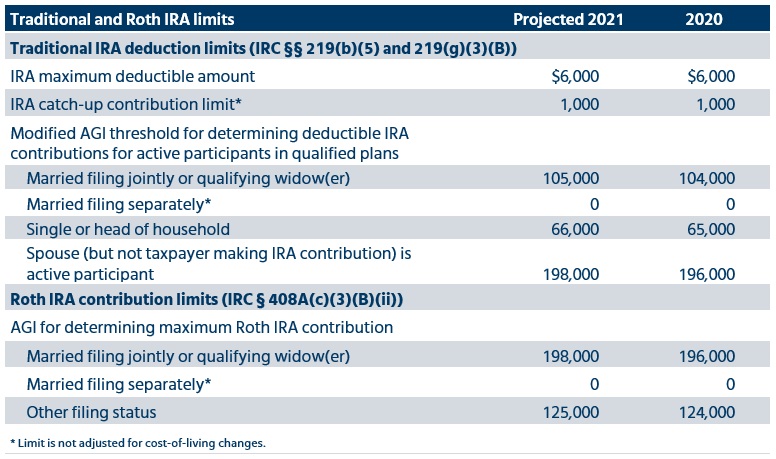

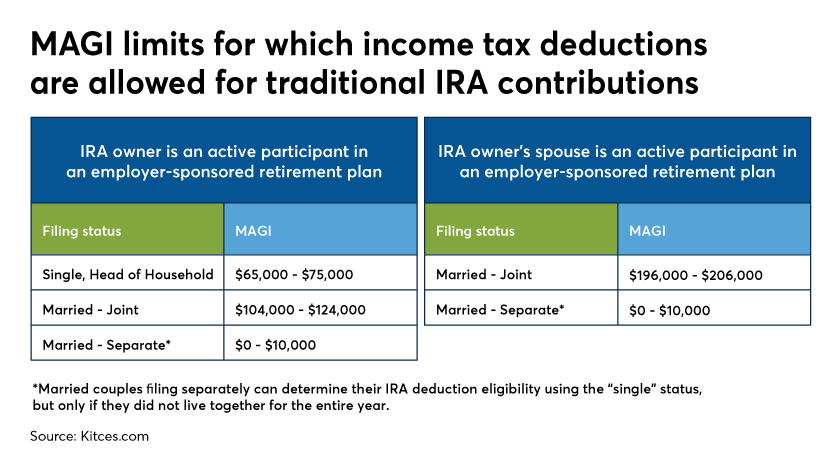

Income limit for roth ira 2021. For married couples filing jointly the income phase out range is 198 000 to 208 000 up. If you weren t able to contribute in 2020 because your income was too high your income may qualify in 2021. If your modified gross adjusted income magi is 198 000 up from 196 000 or less you can contribute up to the 6 000 max. Married filing jointly or qualifying widow er.

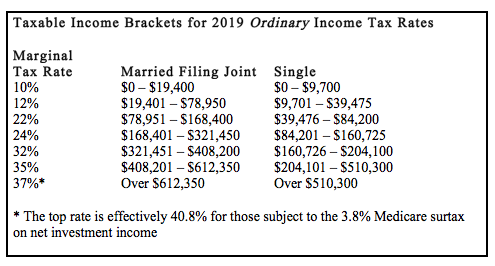

2021 roth ira income limits the 2020 roth ira income phaseout limits are as follows. The income phase out range for taxpayers making contributions to a roth ira is 125 000 to 140 000 for singles and heads of household up from 124 000 to 139 000. A roth tends to be better for those who have a long time to invest and for those who are in a lower tax bracket seurkamp says. Anyone earning less than 125 000 per year or married couples earning up to 198 000 and filing jointly will be able to contribute the maximum amount to a roth ira in 2021 a slight increase.

2021 roth ira income limits filing status modified agi contribution limit married filing jointly or qualifying widow er less than 198 000 6 000 7 000 if you re age 50 or older 198 000 to. The amount you can contribute is reduced if your magi is between 125 000 and 140 000. Up to the limit 198 000 but 208 000 a reduced amount 208 000 zero married filing separately and you lived with your spouse at any time during the year 10 000 a reduced amount 10 000 zero single head of household or married filing. Year roth ira contribution limit single filer and hoh income phase out range married joint filer income phase out range married filing separate income phase out range 2021 6 000 7 000 if 50 or older 125 000 140 000 198 000 208 000 0 10 000.

In 2021 the agi phase out range for taxpayers making contributions to a roth ira is 198 000 to 208 000 for married couples filing jointly up from 196 000 to 206 000 in 2020.