Income Tax Installments Journal Entries

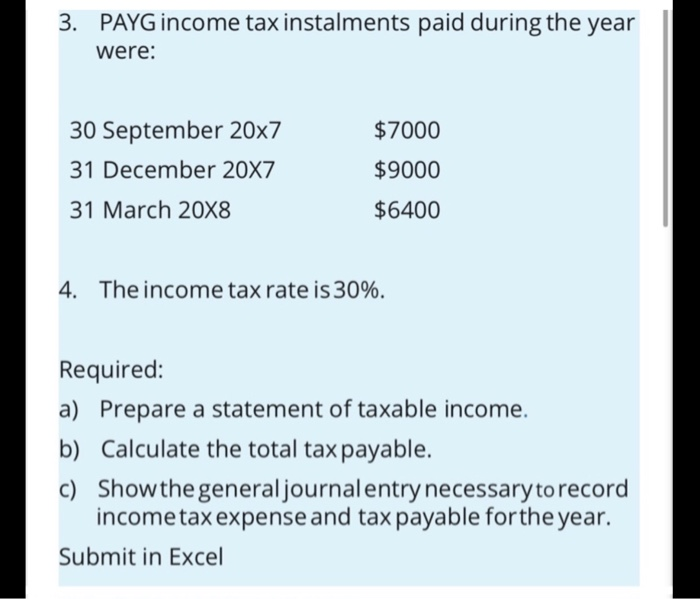

How do i record the corporate income tax installments in quickbooks online hello this year i was asked my cra to make 4 installments payments quarterly.

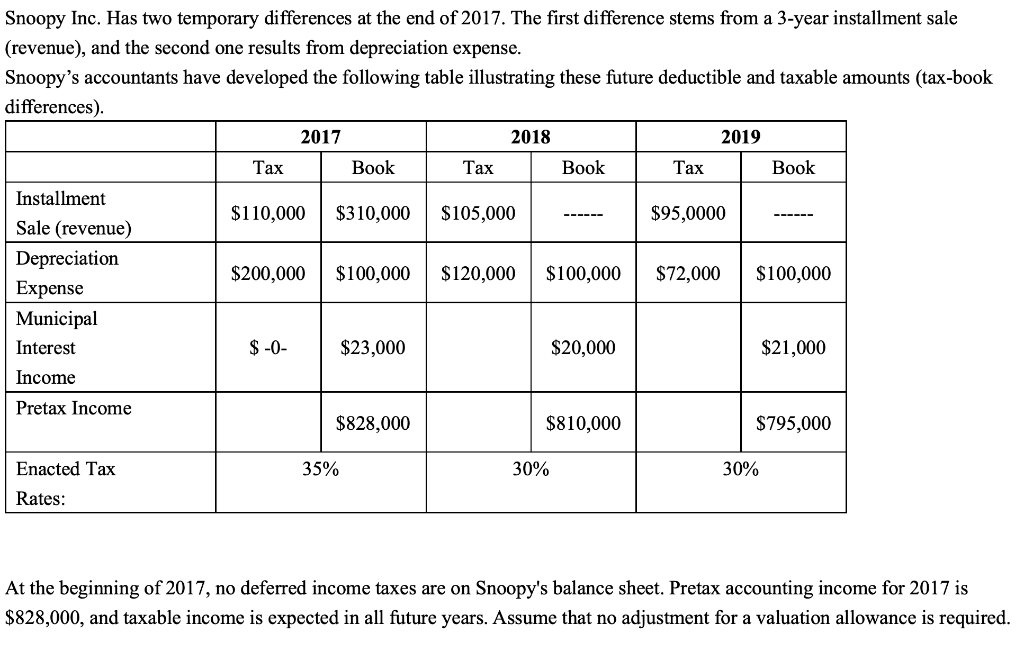

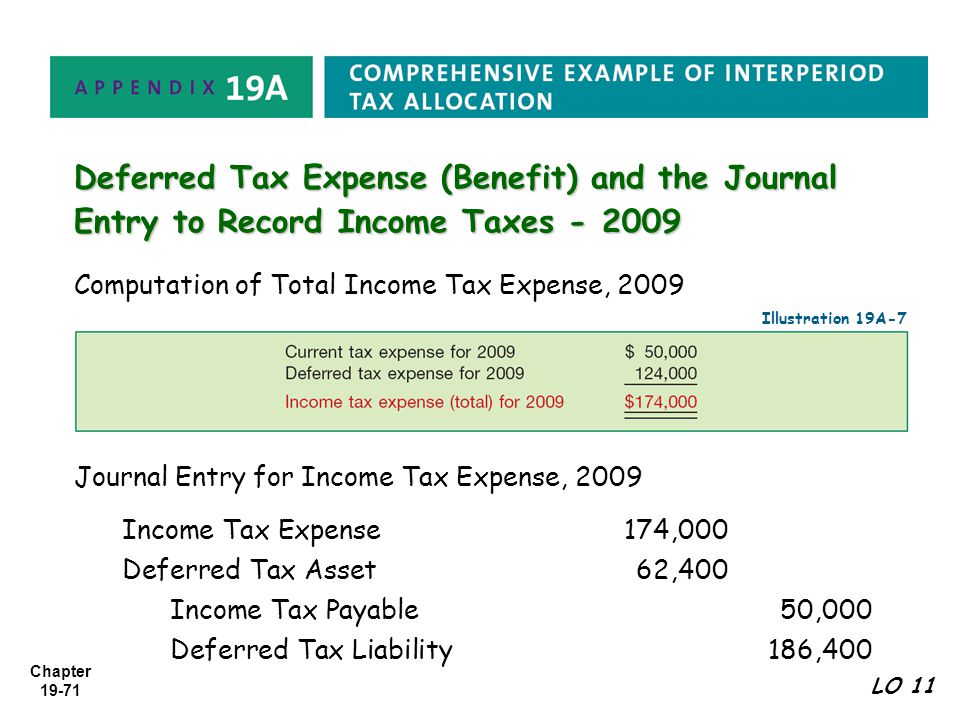

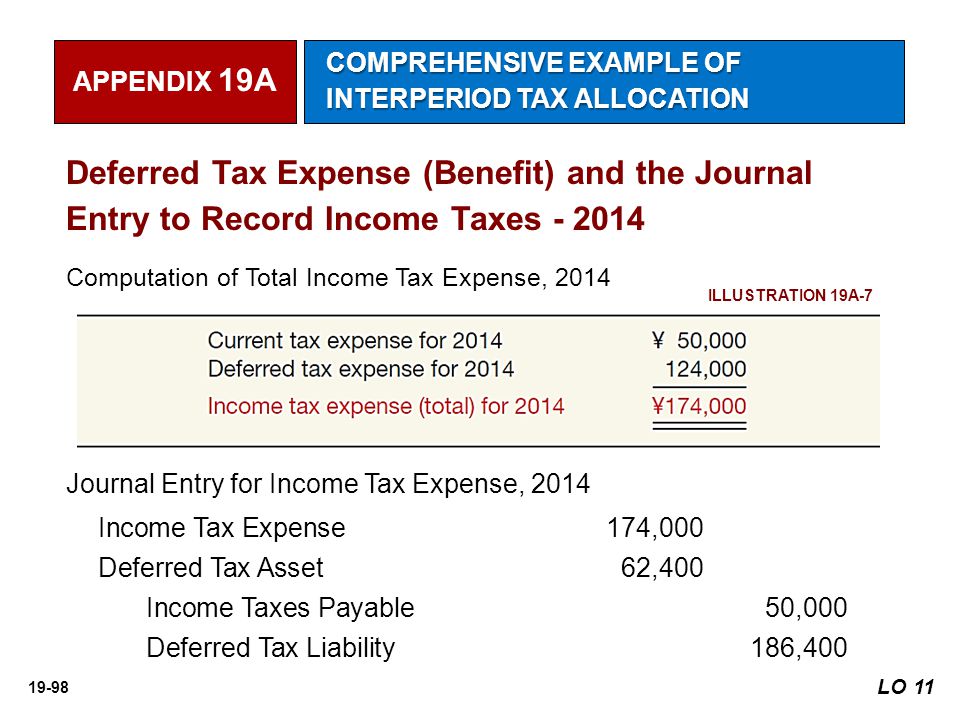

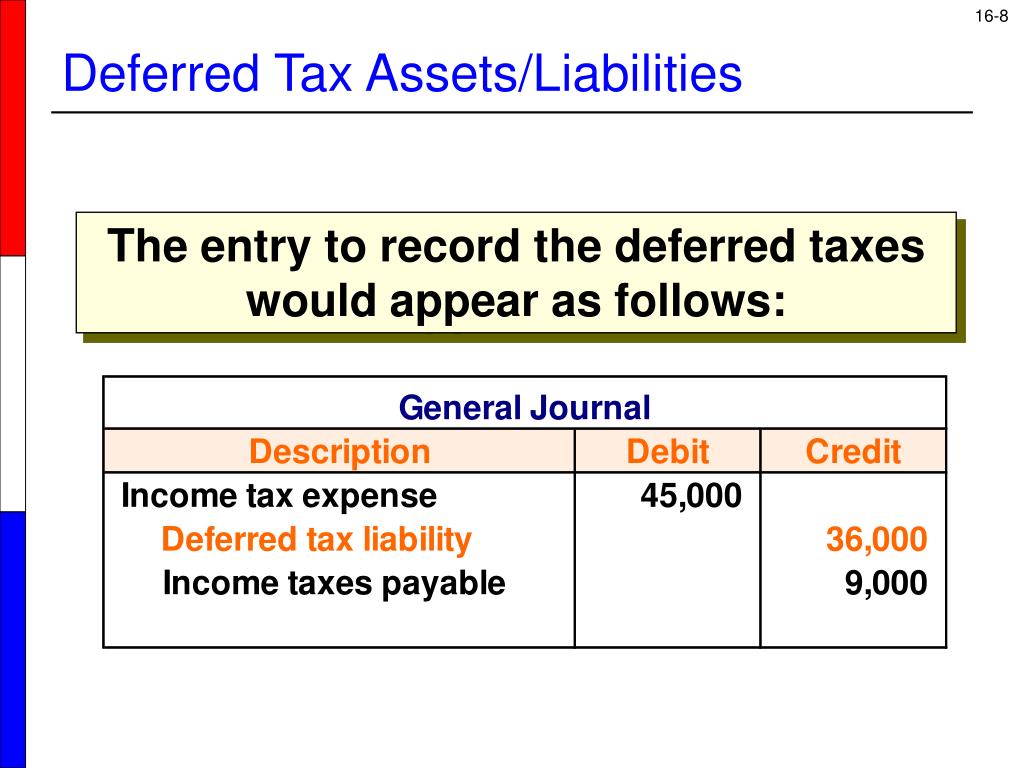

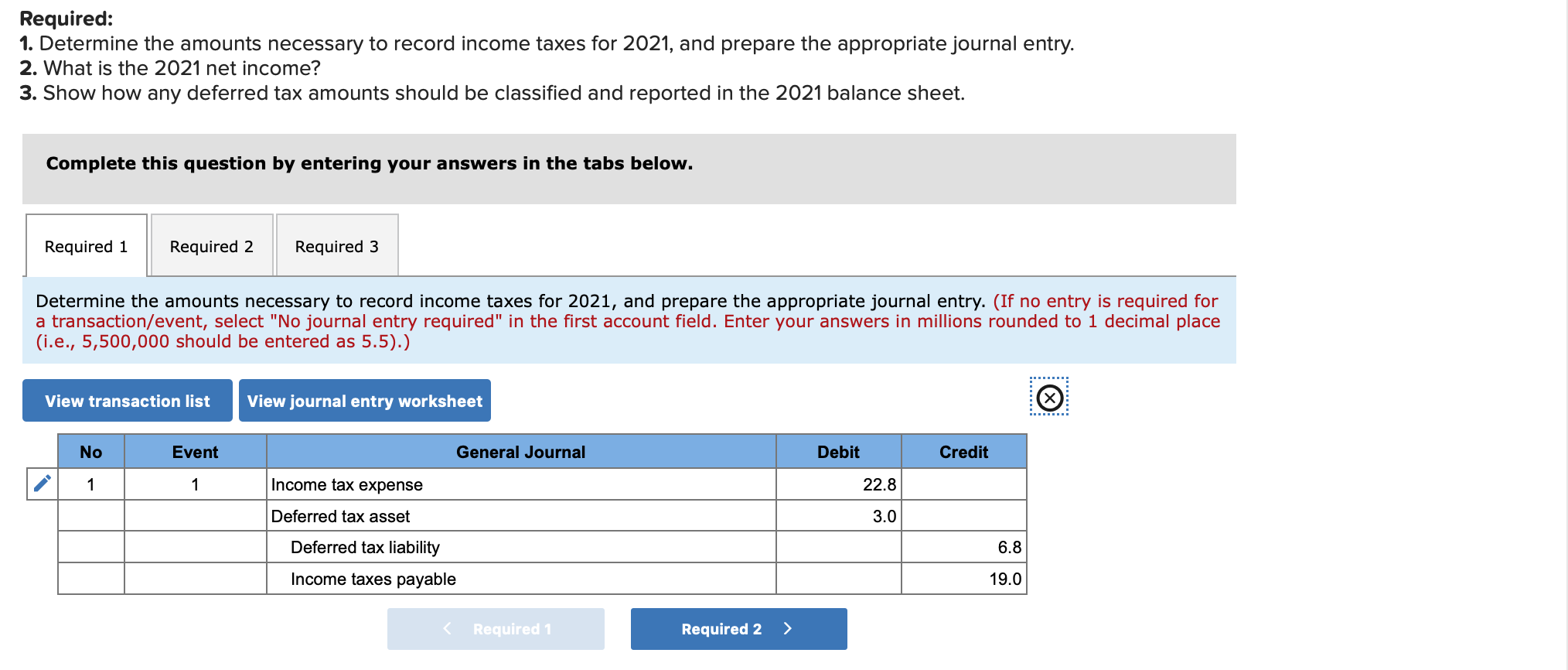

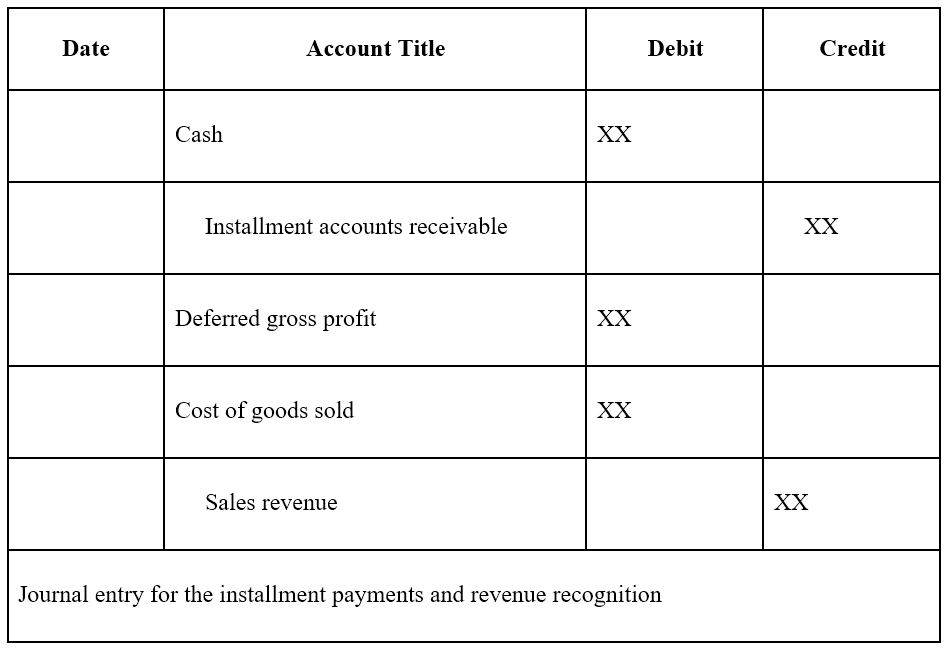

Income tax installments journal entries. Debit income tax expense 14 250 00 credit income tax payable 14 250 00. Debit income tax expense 14 250 00. Accounting and journal entry for income tax is done in a distinct way for different types of business establishments i e. Direct tax and indirect tax have different accounting implications for a business.

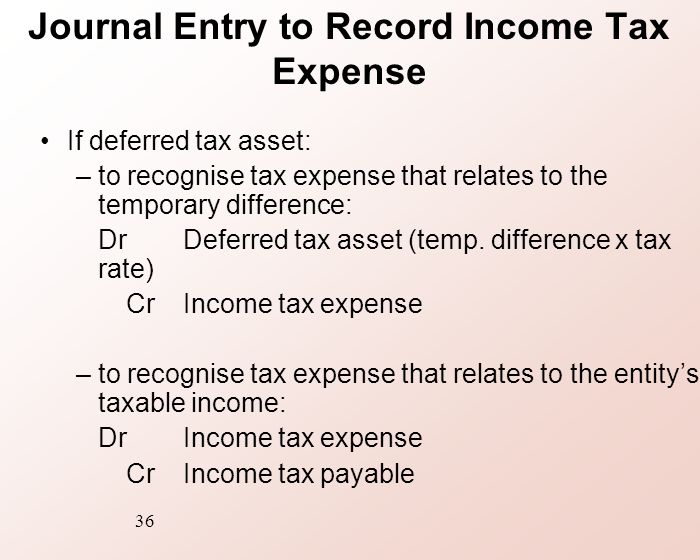

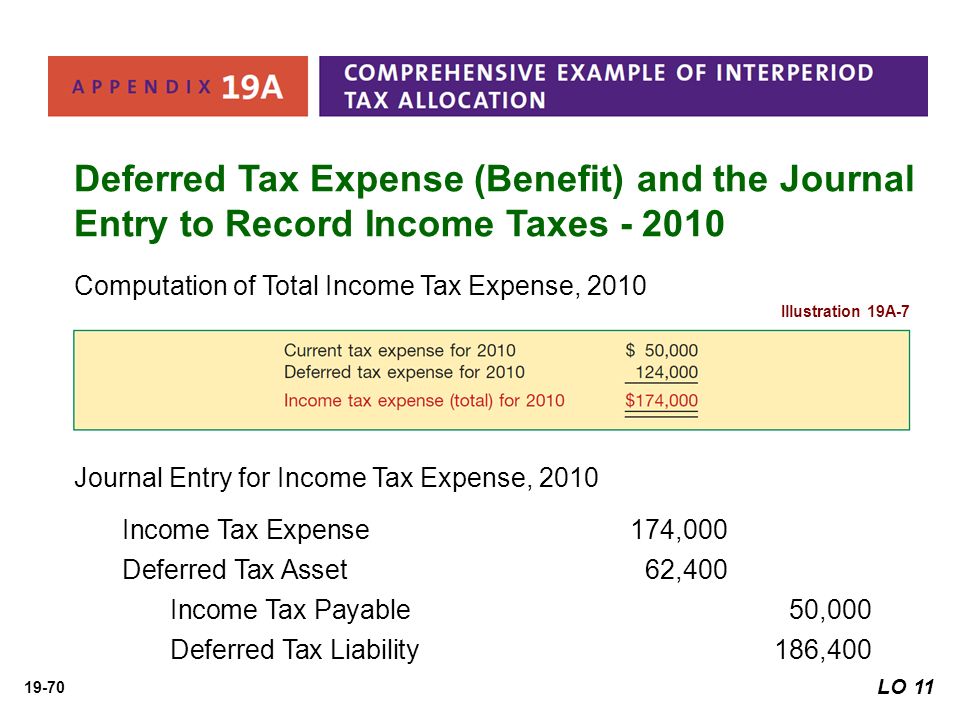

If income tax instalments of say 15 000 00 have been paid in advance we account for the expected refund by doing the following journal. As at 31st march the balance sheet will show income tax payable under short term provisions 30 9 tds receivable current assets 20 advance tax paid current assets 5 this entry is to be passed on the date of filing of return provision for tax a c. In most cases the tax accounting rules differ from gaap. Journal entry of income tax accounting.

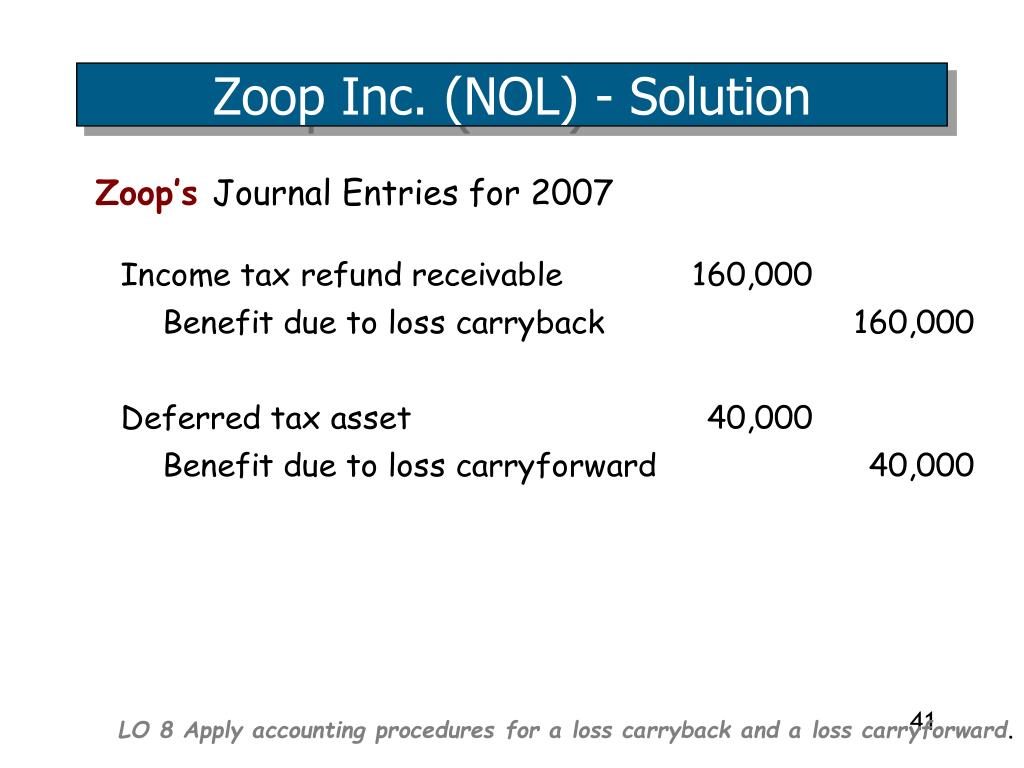

Record the original entries for the tax payment. Income tax refund receivable is to be grouped under other current assets. Debit income tax. When the refund we do the following.

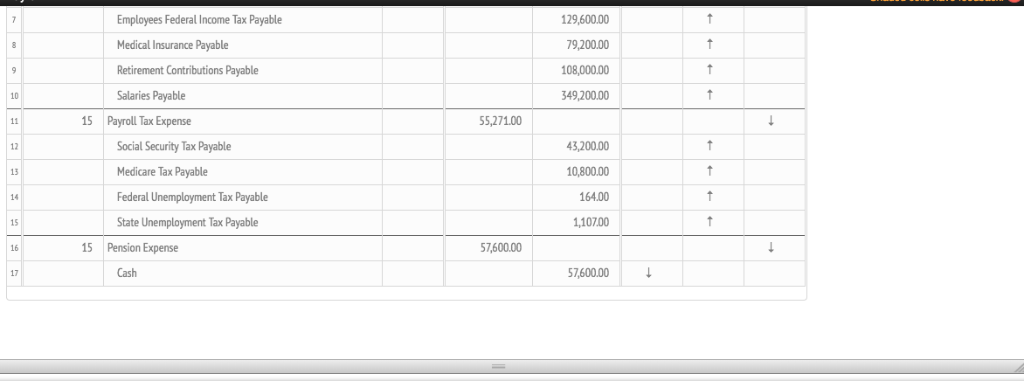

Provision of income tax provision of income tax recorded in books of account by debiting profit loss a c and it will show under liability in balance sheet. Income taxes are determined by applying the applicable tax rate to net income of a business calculated in accordance with the accounting rules given in the tax laws. Debit the income tax expense account. There have been no income tax instalments paid in advance.

We account for this by the following end of year journal entries. I used to pay the income taxes every year when i file my income tax but they said i have to pay as installments to avoid any interest because my taxes over 3000. 2 thoughts on accounting journal entries for taxation excise service tax tds. Accounting for direct taxes.

Credit the cash account. Journal entry for income tax income tax is a form of tax levied by the government on the income generated by a business or person. The company tax rate is 28 5 and thus the projected tax payable will be 14 250 00. Sole proprietorship partnership and private limited company.

You can record a journal entry for a tax refund with the following two steps. In the above example the deferred tax will arise at 100.