Income Interest Journal Entry

Interest income journal entries.

Income interest journal entry. The interest portion got accrued in accounting year ending in 2018 but not received. When the business earns and receives interest income the journal entry is. Interest income journal entry overview. Otherwise interest income is to be presented as other income.

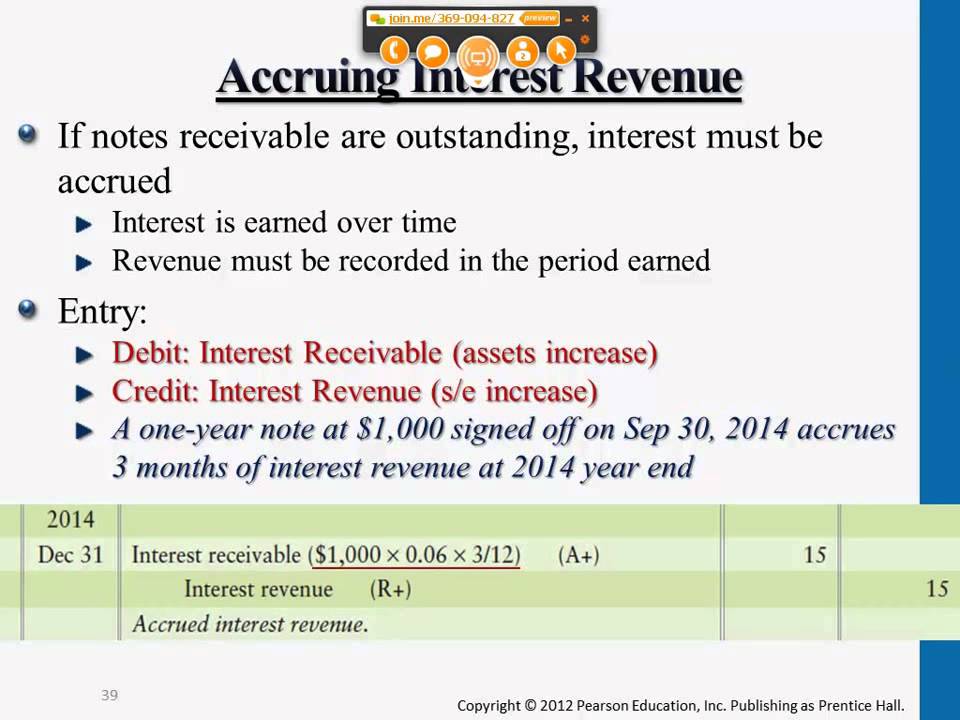

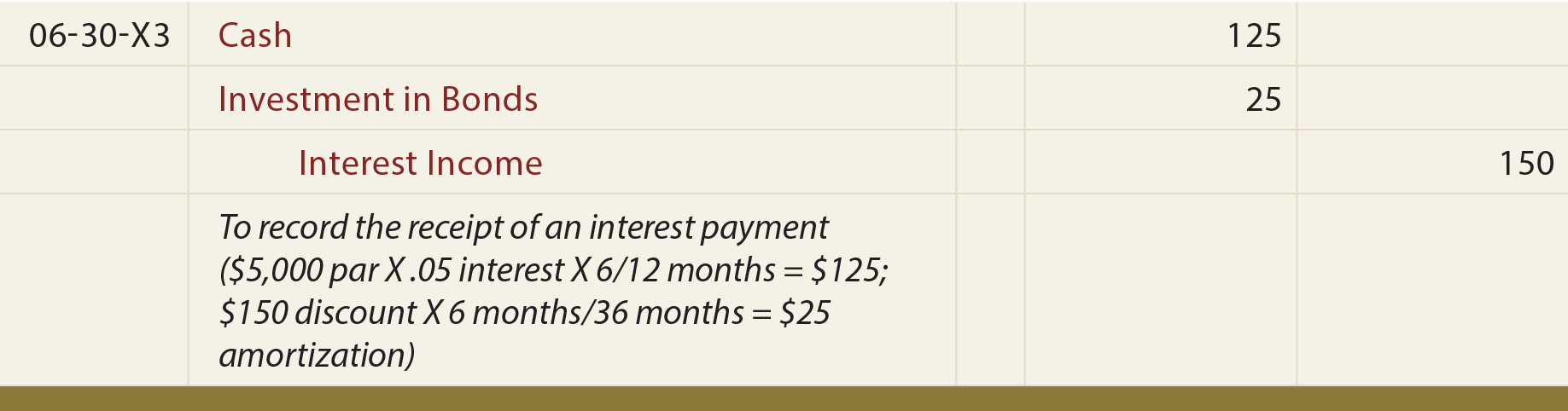

You will recognize the periodic coupon payment using the following journal entry. A business earns interest on its money deposits of 1 000 but does receive the amount into its bank account until after the month end. As the bookkeeper you re rarely required to calculate interest income using the simple interest or compounded interest formulas described in the earlier sections of this chapter. Hence the company needs to account for interest income by properly making journal entry at the end of the period.

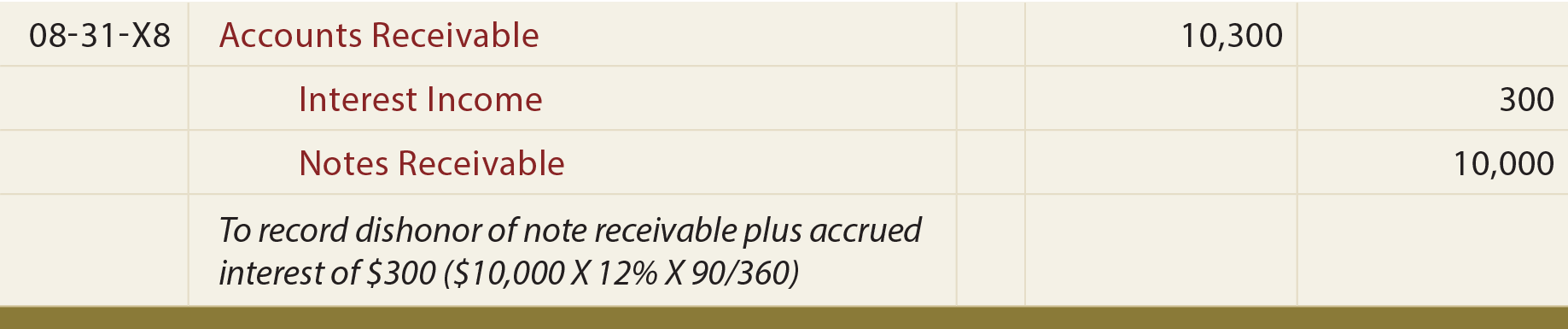

Cash is debited for the receipt of the amount. In most cases the financial institution sends you. This is done with an accrual journal entry under the cash basis of accounting interest revenue is only. So the bank will recognize its income of.

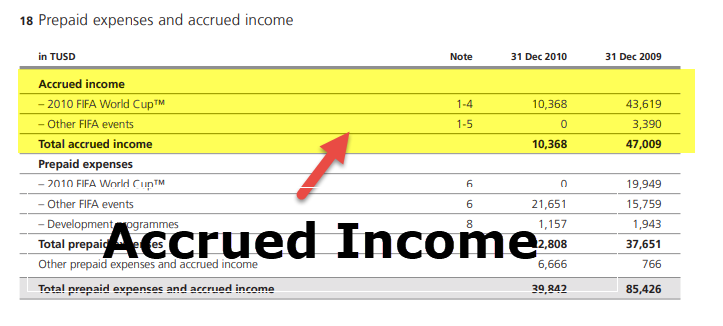

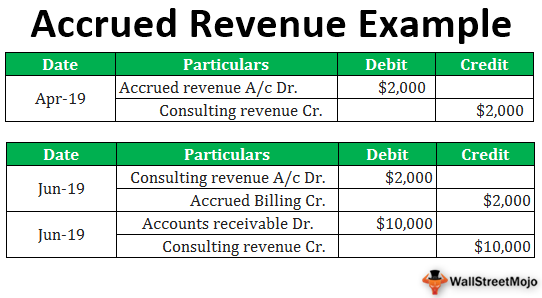

Hi how can i make journal entry regarding income of interest and charge for remittances for account by applying multi currency directly from accounting adviser journal entry create. Analyze the treatment of the interest received by the company and pass the necessary journal entries in the books of the bank. Examples of accrued income interest on investment earned but not received. It is income earned during a particular accounting period but not received until the end of that period.

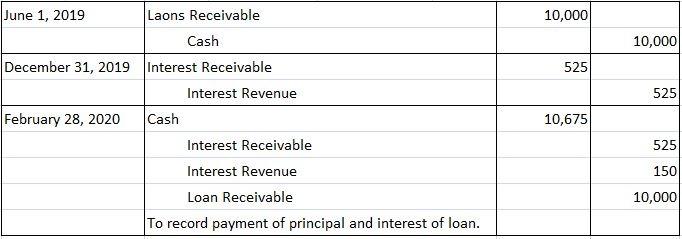

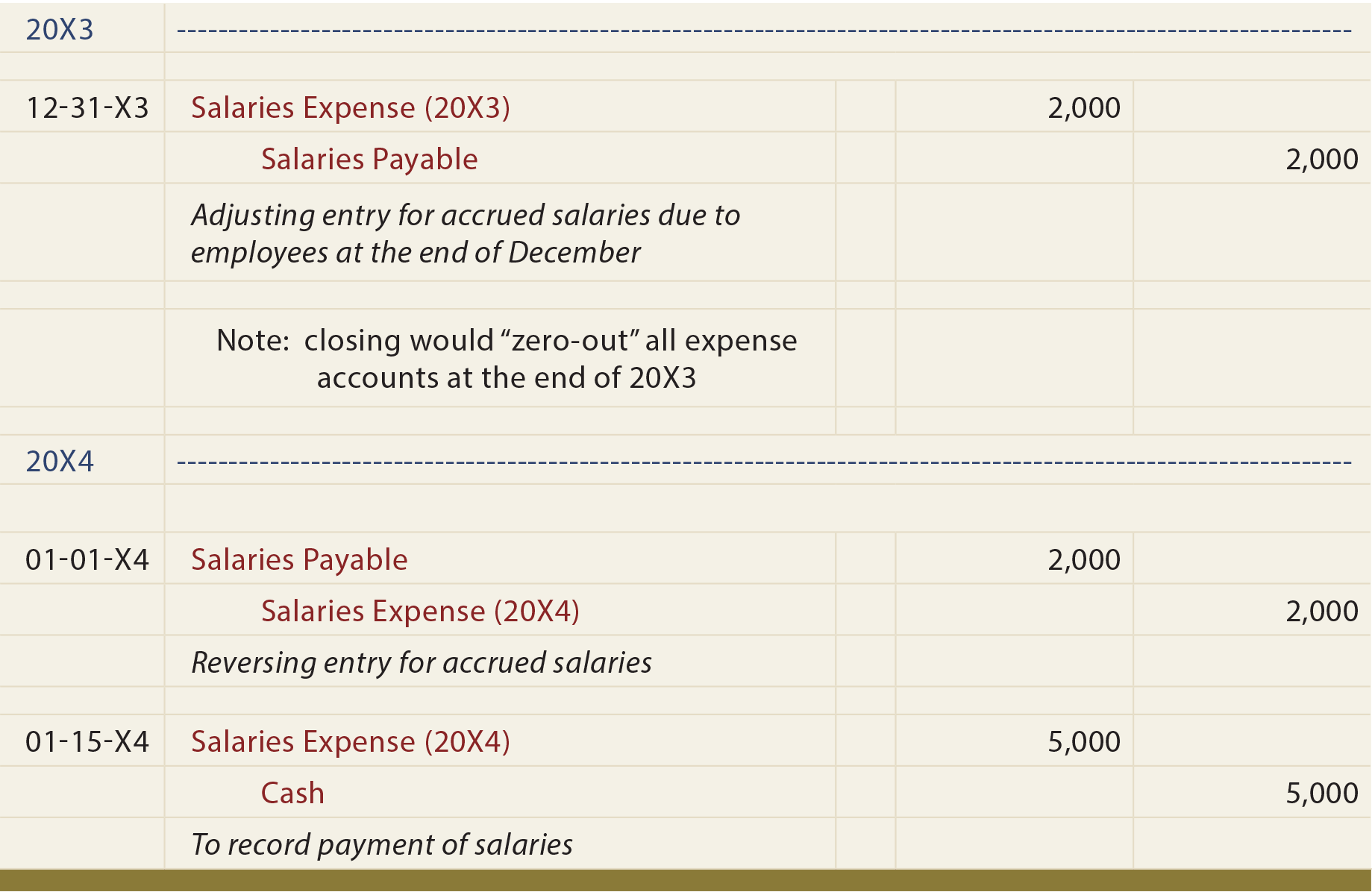

Cr interest payable 1 000. Dr interest expense 1 000. In the present case the employee was not able to pay the loan principal amount as well as the interest portion on the due date. Under the accrual basis of accounting a business should record interest revenue even if it has not yet been paid in cash for the interest as long as it has earned the interest.

For example if interest of 1 000 on a note payable has been incurred but is not due to be paid until the next fiscal year for the current year ended december 31 the company would record the following journal entry. Likewise this type of income is usually earned but not yet recorded during the accounting period. It is treated as an asset for the business. Journal entry for accrued income recognizes the accounting rule of debit the increase in assets modern rules of accounting.

Interest revenue is the earnings that an entity receives from any investments it makes or on debt it owns. An asset account is debited to increase it. Interest income is a type of income that is earned and accumulated with the passage of time. Journal entry for accrued income.

The double entry bookkeeping journal entry to show the accrued interest income is as. Cash 10 000 1 000 6 2 300 000. The income that your business earns from its savings accounts certificates of deposits or other investment vehicles is called interest income. Anyone know this how we can generate entry.

As the income has been earned but not received it needs to be accrued for in the month end accounts.