Journal Entry Of Income Tax Refund

If a tax refund was expected then likely there was a tax receivable item already setup somewhere.

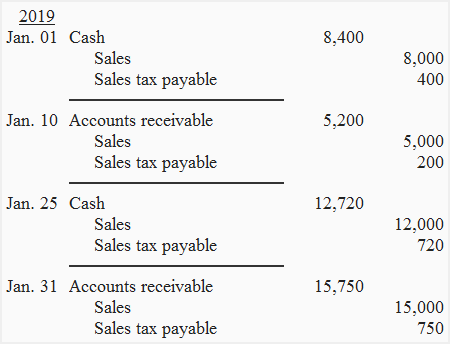

Journal entry of income tax refund. Private limited companies. Helen what is the journal entry for income tax re assessment. Tax refunds are not considered revenue. I will assume this tax refund related to income tax from last year and that last years accounts are already closed.

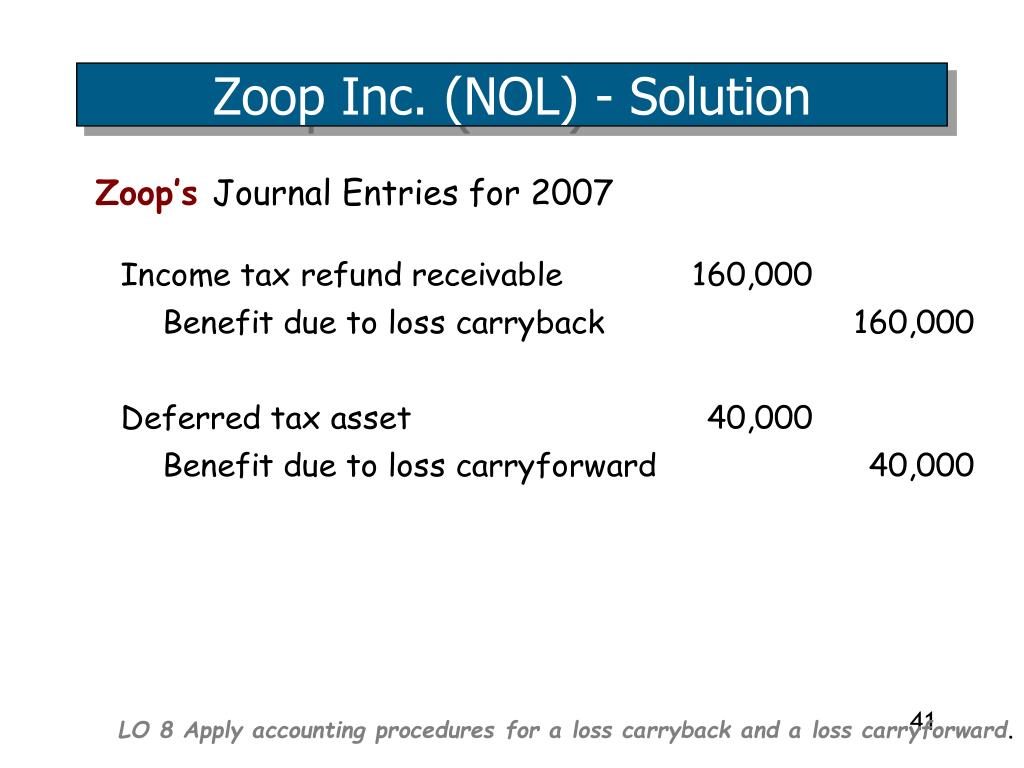

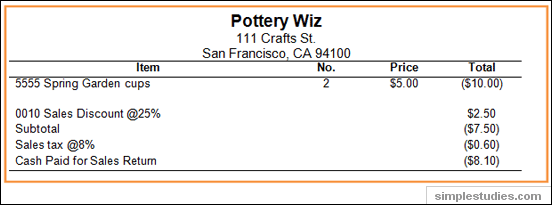

Income tax refund receivable is to be grouped under other current assets. Capital a c for tax refund and cr. Journal entry for income tax income tax is a form of tax levied by the government on the income generated by a business or person. How to record a journal entry for a tax refund you need to keep a few things in mind to record an income tax refund journal entry.

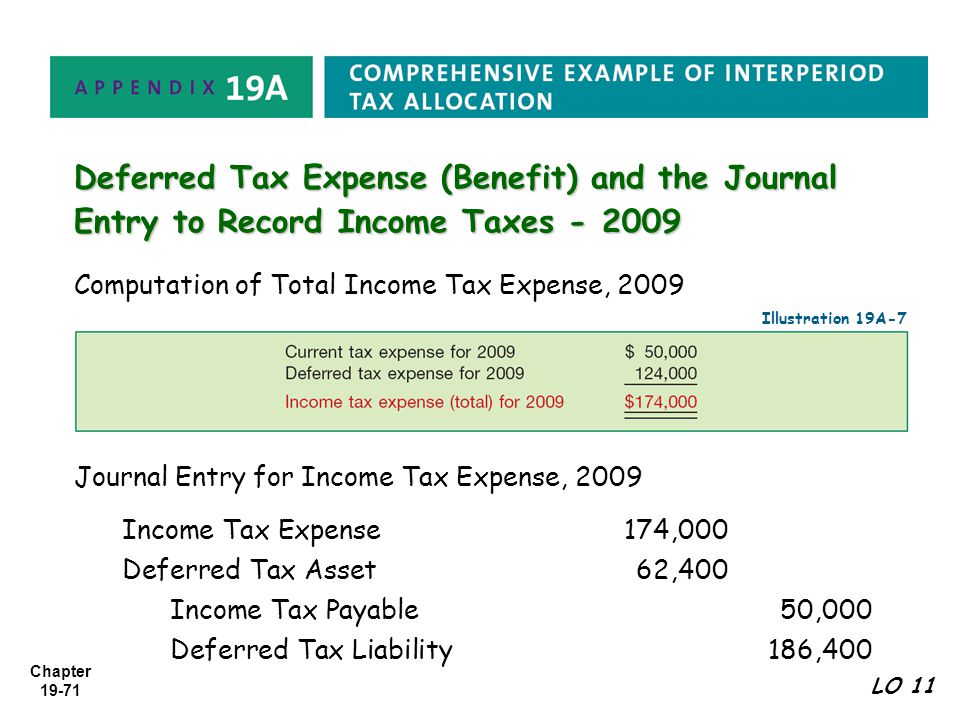

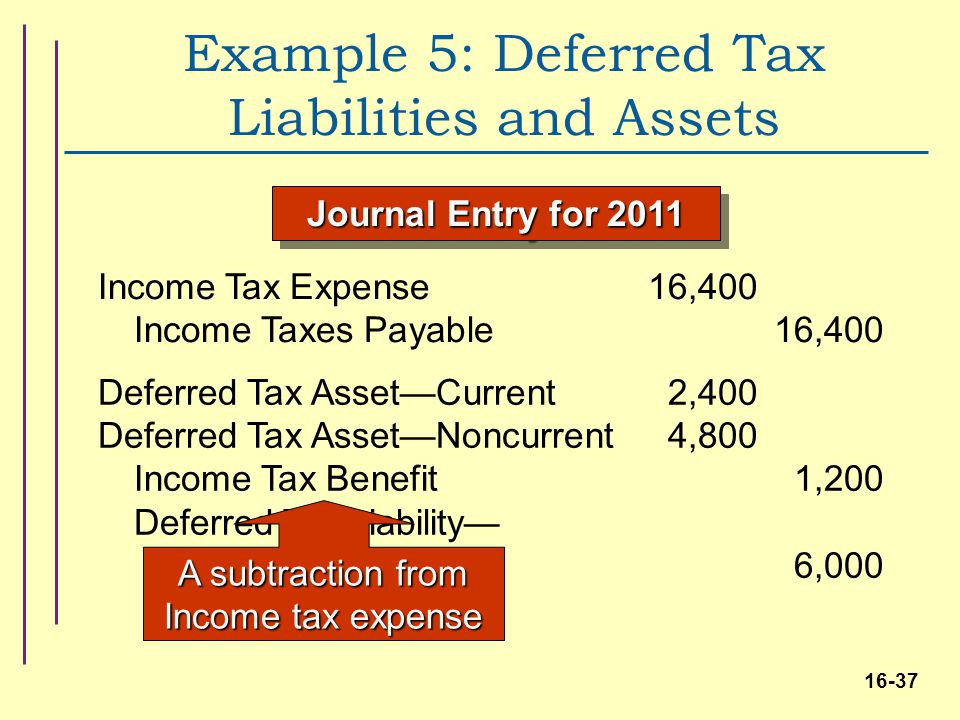

Accounting and journal entry for income tax is done in a distinct way for different types of business establishments i e. Tax return payments are paid to expenses taxes state income tax. This is for a corporation. What will be the accounting entry for income tax refund in case of company accounts a c entries hi manish amount of refund will be set off against the provision for tax created for the respective ay regarding which you have received the amount.

22 september 2014 you should have made journal and payment entries for income tax paid and tds in the previous year. I see the income tax payable account has a negative amount which matches the amount we just received from cra. As at 31st march the balance sheet will show income tax. Journal entry for corporate income tax re assessment for pervious year by.

When the refund we do the following. Hi i m using quickbooks desktop pro 2019. Income tax refund receivable. Sole proprietorship partnership and private limited company.

Debit income tax payable 14 250 00 credit bank account 14 250 00 in the event that income tax instalments of say 15 000 00 have been paid in advance we account for the expected refund by doing the following journal. My fiscal year end is 09 30 2012 on the income statement the income tax for year 2012 is 5000. As i itemize my federal deductions each year this lines up with what i need to put on my federal taxes where i deduct the state income tax whether automatically paid from my paycheck or whether i needed to pay it directly for a prior year in the year. This entry sets off the provision with the asset and gives rise to another asset i e.

Using double entry bookkeeping you reverse the original entries you made for paying taxes. If you have shown the tds in capital account then you have to make a receipt entry as dr. It could be in accounts receivable or it could be.