Income Insurance Through Super

Insurance paid through super is a tax effective way to protect you and your family should anything happen to you.

Income insurance through super. Avoid loadings and exclusions because of pre existing conditions. You may have decided to take out insurance cover after a conversation with your adviser or you may have acquired insurance cover as part of a previous employer plan and when you left that employment you retained your insurance cover. Most super funds offer life total and permanent disability tpd and income protection insurance for their members. Super based income protection insurance is cheaper.

This means they will need to contact their fund to request this insurance if they want it. When reviewing your insurance check if you re covered through your super fund. Income protection through your super provides cover for total or partial disablement only. This cover provides a monthly income if you can t work because of an accident or illness.

If you re not earning an income for more than 12 consecutive months there may be no benefit payable to you. It s worth keeping in mind that newly passed legislation will mean that starting from april 2020 people aged under 25 will not receive default life insurance cover through their super when they join a new fund unless they re working in a dangerous job. It doesn t cover redundancy or lack of shifts. More than 70 of australians that have life insurance hold it through super.

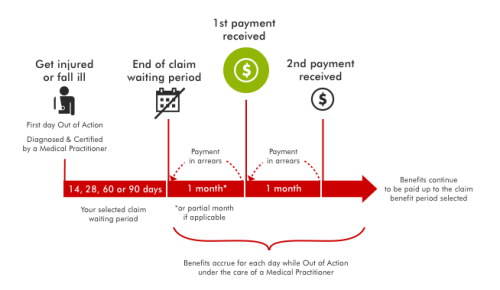

Premiums are also deducted directly from your super balance making it very convenient as well. Income protection through super income protection can help if you become ill or injured at any time and can t work temporarily. Income protection insurance can cover up to 85 of your salary including up to 10 super as a monthly payment if you can t work because you re injured or ill. It provides monthly payments to support you while you re not earning your regular salary.

When considering of taking income protection insurance through your super please remember these points. Owning income protection outside of superannuation can provide clients with more product features and flexibility when compared with owning insurance inside superannuation. Income protection cover for industry super if you re working in a professional or non manual occupation you can apply for income protection cover through industry super. The claim has to get a tick of approval from the fund trustee as well as the insurer.

Income protection cover through super is similar to stand alone cover but is often a more affordable option as the policies are sold in bulk. You can reduce or cancel your cover at any time.