Income Method Journal Entry

George gets 10 500 from this job in cash.

Income method journal entry. The big company sold 5 batteries to small traders on credit 200 per battery. Journal entry for income received in advance. Investment income under equity method. Cash 10 000 1 000 6 2 300 000.

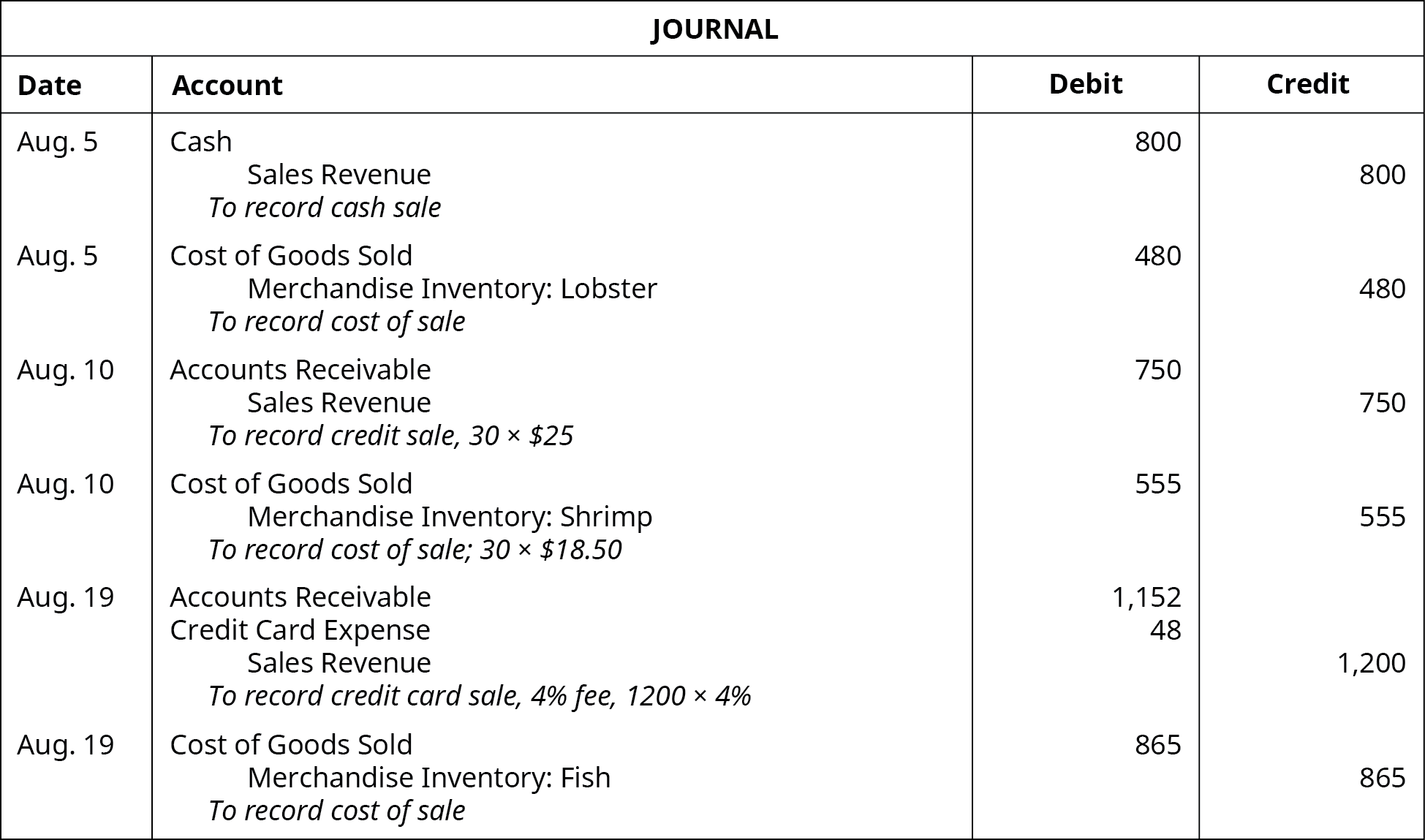

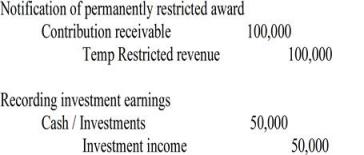

The journal entry for a credit sale is given below. At december 31 2016 one third of the commission revenue 3 600 1 3 will be converted into unearned commission liability. As usual we re first going to look at which accounts would be affected in this transaction and the impact on our accounting equation. Examples of accrued income interest on investment earned but not received.

It is treated as an asset for the business. Entry 14 pgs has more cash sales of 25 000 with cost of goods of 10 000. Results of journal entry merchandise balance decreases by 5 000. Green light will record the following journal entry at the time of receipt of cash.

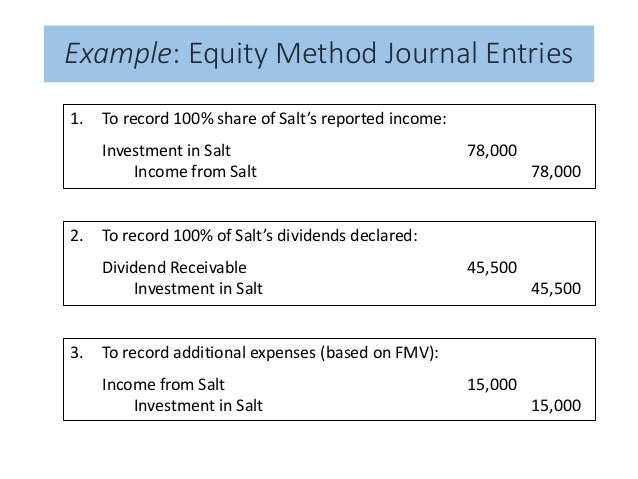

E now george s catering provides catering services for a wedding. Decrease in assets cost of merchandise sold account balance increases by 5 000. If a company purchases 20 50 of the outstanding common of a company. Journal entry for accrued income.

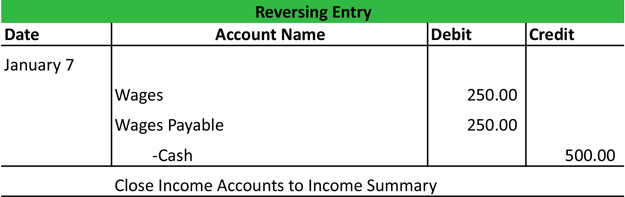

Journal entry for accrued income recognizes the accounting rule of debit the increase in assets modern rules of accounting. Entry 13 pgs s first bank loan payment is due. Increase in expense. Cash income journal entry example.

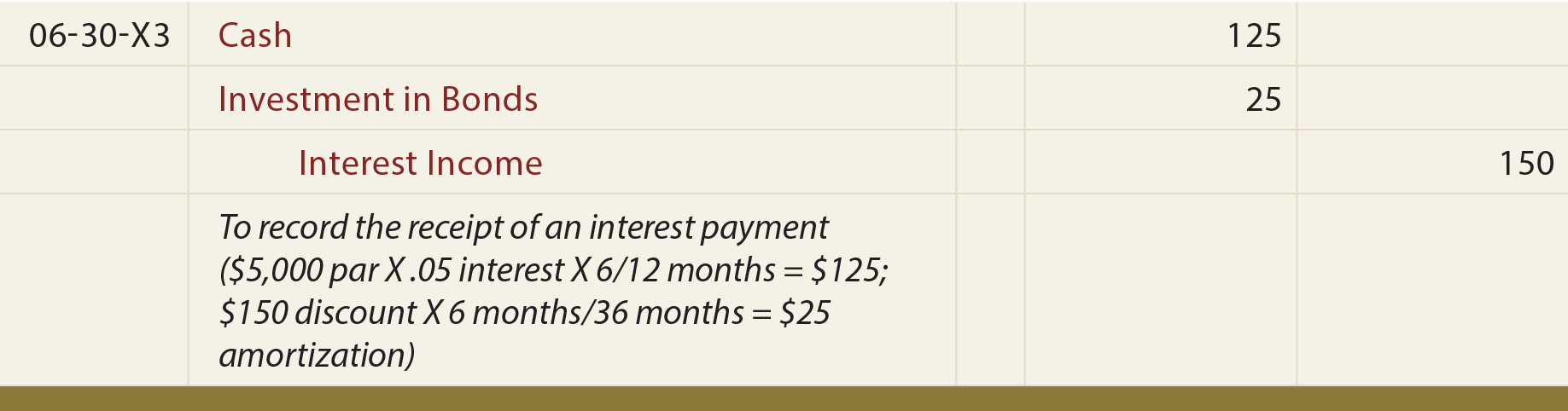

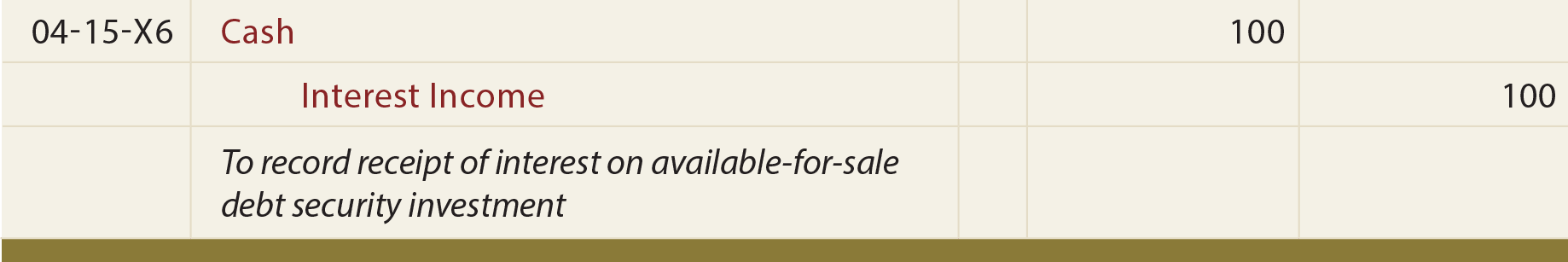

Also known as unearned income it is income which is received in advance however the related benefits are yet to be provided it belongs to a future accounting period and is still to be earned. It is income earned during a particular accounting period but not received until the end of that period. Is deducted from the gross sales revenue in the income statement and sales discount forfeited recognized under net method appears as income in the other revenues section of the income statement. You will recognize the periodic coupon payment using the following journal entry.

0 0 1. If income method is used. Then after that we ll work out the double entry.