Income From Mutual Fund Which Itr Form

The income from selling capital assets house property and interest on deposits needs to be disclosed in your itr form.

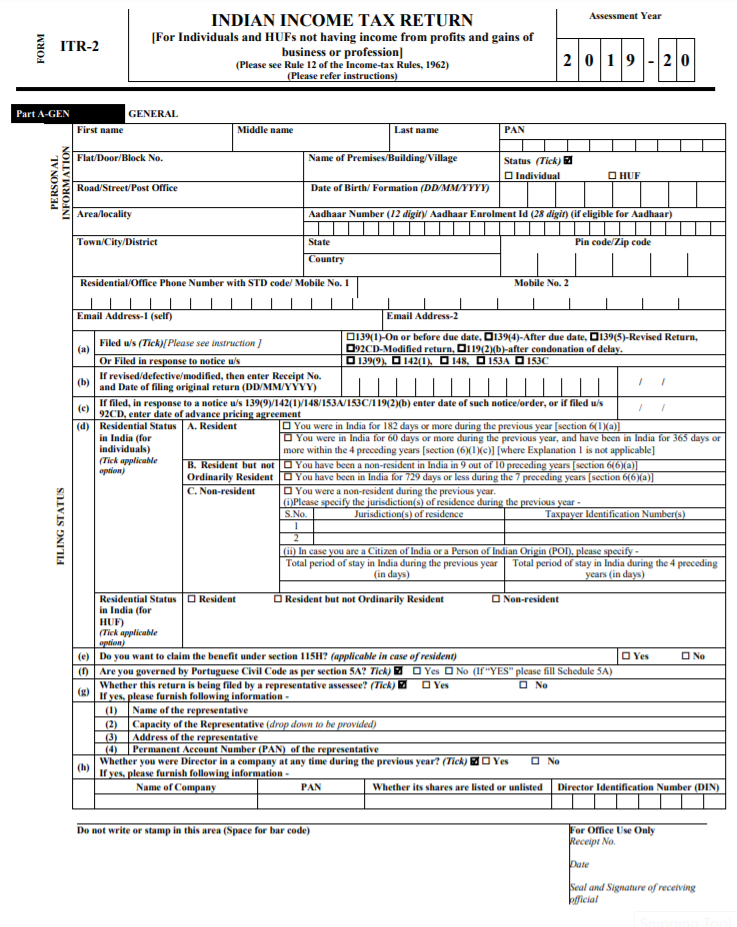

Income from mutual fund which itr form. Salaried equity and mutual fund mf investors can no longer use the itr 1 sahaj form to file their return if they have sold or redeemed any share or fund. Dividend on mutual fund both debt and equity fund profit on sale of shares one house property jointly owned with my wife my total income is less than inr 50 lacs. Kindly advise which itr form i have to use. For an individual there are four income tax return itr forms applicable itr 1 sahaj itr 2 itr 3 and itr 4.

Unlike itr form 1 and for 4 you cannot file this form online. If you have invested in retail mutual funds then the income earned from the redemption of these units will be tax free up to a number of rupees 10 lakhs in one year. Excess and above of rupees 10 lakhs might be taxed. In case of incorrect filing income tax.

With companies starting to issue form 16 to their employees many individuals have begun the process of filing the income tax return itr for the financial year 2019 20. The dividend that you will receive will be considered as your earnings against your investments in the mutual fund. In case taxpayers choose the wrong form they will have to go through the process of filing their itr again. Which itr form to use for individuals having salary income along with income from business or profession are required to use itr 3 form for filing itr.

You will have to list the same in the same xml form. Concealing or misreporting income from these sources is a sure shot invitation to a tax notice. Tax authorities are tightening the noose around. Filing the correct itr form is imperative.

This itr form can be filed with the income tax department electronically on the e filing web portal of income tax department. India s top entrepreneurial platform recognises the best smes msmes and startups of the year. When you sit down to file your income tax return itr form 16 issued by your employer may not be the only document you need. Equity balanced mutual fund 1 year.

And not from a single fund. Apart from pension and the bank fd interest that is the only additional income she had. I believe she can use itr 1 and declare the earned profit on mutual fund as exempt income under sec.