Income Protection Insurance Waiting Period

The excess period for income protection insurance is sometimes known as the waiting period or the deferred period.

Income protection insurance waiting period. The longer the waiting period you choose the lower the premium you pay. It generally starts on the day you have sought medical treatment advice following a sickness or accident and the doctor confirmed you should not go to work. Income protection insurance is crucial for anybody who depends on their monthly income. The sweet spot for this wait time is usually 13 weeks but it s up to you.

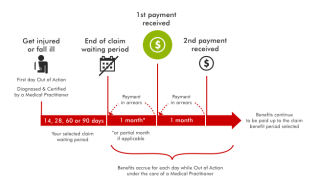

The benefit period is the period during which you receive your income protection payments. The shorter the waiting period the higher your premiums will be. You choose the waiting period when you take out your policy but there are minimum waiting periods that. You can choose a waiting period of either 30 or 90 days on your income protection insurance.

This is the time you would have to be off work before the policy would start to pay out. The reason for this is is simple. As outlined above when making a claim on your income protection insurance you must satisfy the waiting period before you can make a claim. At rate detective we have found that the majority of our clients choose a 30 day wait however other common waiting periods are 14 days 60 days and 90 days.

You can generally choose between two or five year benefit period or up to age 65. How long should my waiting period be for my income protection insurance. Shortest and longest available excess periods. How do waiting periods affect making a claim.

You may also like to know that premiums for income protection are usually tax deductible whether you are employed or self employed. The longer the waiting period the less you have to pay for your income protection. Waiting periods generally range from 30 90 days. As a general rule the longer the excess period the cheaper the premiums.

If you had a policy with a 30 day waiting period you would have to wait for 30 days before you were eligible to receive any benefits. Most income protection insurance waiting periods are between 14 and 90 days. An income protection insurance waiting period refers to the amount of time that you need to be off work following the advice of a medical practitioner before your benefit period commences. However if your income protection insurance is through your superannuation fund like most australians you ll likely have the default waiting period chosen by the fund.

Many will give you a number of options for example 14 28 60 or 90 days. The longer you decide to wait until you start receiving the payments the cheaper your insurance premium. When applying for income protection you get to choose how long you want to wait from the time you make your income protection claim to the time where your insurance company starts making regular payments to you.