Household Income Of 100k Mortgage

As a rule of thumb mortgage lenders don t want to see you spending more than 36 percent of your monthly pre tax income on debt payments or other obligations including the mortgage you are seeking.

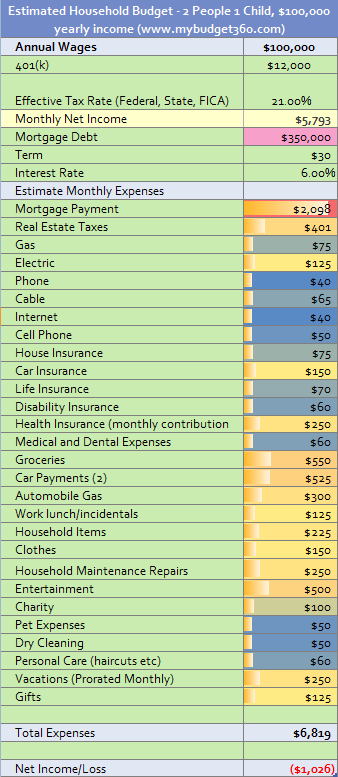

Household income of 100k mortgage. Ideally you want to make sure your mortgage payment doesn t exceed 28 to 30 of your monthly household income. Earning requirements for a 300k mortgage. Find out how much house you qualify for nov 18th 2020 in this article skip to. Earning requirements for a 200k mortgage.

What yearly income would he need to be on to get the 100k morgage. That s the general rule though they may go to 41 percent or higher for a borrower with good or excellent credit. Using a single source of income. Earnings needed for a 250k mortgage.

If a mortgage is for 250 000 then the mortgage principal is 250 000. First knowing your dti ratio can help you gauge how much home is truly affordable based on your current income and existing debt payments. Annual income total amount of income earned yearly. Earning requirements for a 150k mortgage.

Monthly debt also known as recurring debt which includes car loans student loans minimum monthly payments on any credit card debt and any other loans you might have. While i don t completely agree with them they don t answer your question namely what price home can you afford. Let s look first at what you qualify for then at what y. You pay the principal with interest back to the lender over time through mortgage payments.

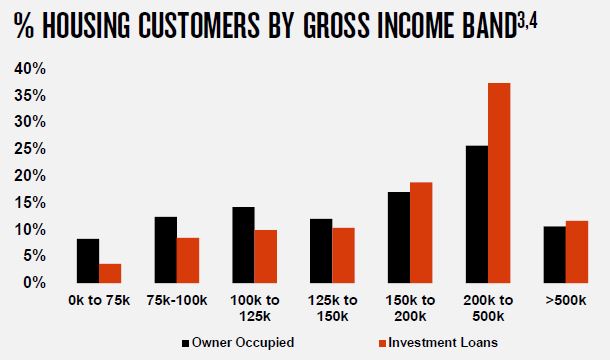

To comfortably afford a 100 000 mortgage you ll need to make the minimum monthly incomes outlined below based on your down payment. Earning requirements for a 100k mortgage. While you may be approved for a 500 000 mortgage based on strong credit and a solid income for example paying 3 000 for a mortgage each month may not be realistic if you have substantial student loans or other debts you re paying off. Some will consider you with a 10 or 15 deposit and many are likely to accept if you have 20 25 as there is less risk association.

How much can i borrow on the help to buy scheme. Mortgage principal is the amount of money you borrow from a lender. Mortgage affordability calculator definitions. Is there a website for such calculations.

My son is looking to buy his first house in the near future. Provided you pass the other lender checks a handful of providers will offer you a mortgage with just 5 deposit meaning a 5 000 deposit may be enough to afford a 100k mortgage. Mortgage affordability on buy to lets. Earnings needed for.