Income Guidelines For Ssi In Ky

A non citizen must also meet all of the other requirements for ssi eligibility including the limits on income.

Income guidelines for ssi in ky. Generally those who earn less than 1 650 per month are eligible for a decreased ssi benefit but determining whether you fall within ssi s income limits as well as figuring out what your ssi payment might be is pretty complicated. Maximum family income level requirements can be confusing for families of children with disabilities collecting supplemental security income ssi. A rule that lets people who stop getting supplemental security income ssi benefits due to work income keep their medicaid health coverage while earning up to 31 106 per year. The non citizen must be in a qualified alien category and.

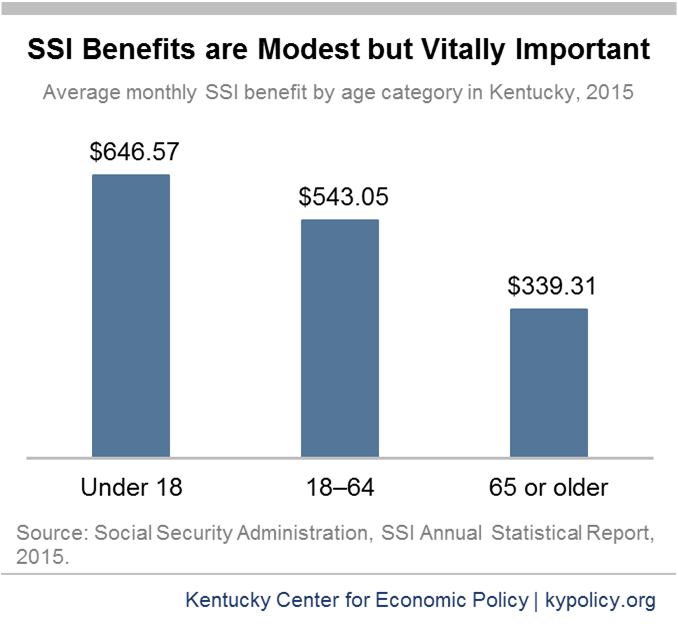

Call us or contact us online today for a free discussion of your ssi claim. It is meant to help recipients meet basic needs for food clothing and shelter. 1619 b also makes it easier to get ssi benefits started up again if your countable income goes below ssi s income limit. Supplemental security income ssi is a federal program managed by the social security administration that pays monthly cash benefits to disabled blind or elderly people and even some children with little income and few assets.

The guidelines change depending on if there is a single parent or two parents in the home. Supplemental security income is monthly payments made to people who have low income and few resources. To get disability benefits from ssi you can t have much income or assets though social security gives you some breaks when counting your income. Ssi is a federal program managed by the social security administration ssa and paid for by general funds from the u s.

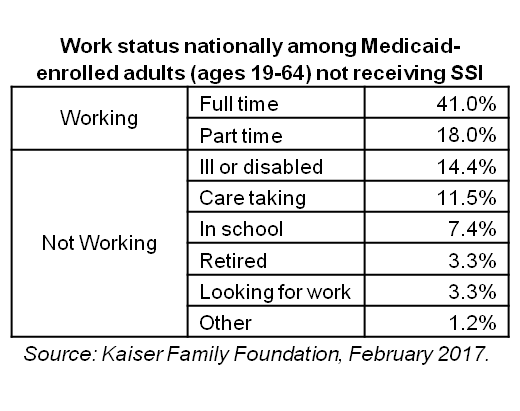

Supplemental security income or ssi is a monthly benefit program that assists older and or disabled people who have limited income and resources through cash payments. Treasury not social security taxes. In june 2019 8 1 million people collected ssi benefits. Also whether the parents income is earned or unearned makes a difference.

The ssi program has strict limits on the amount of income and assets you can have and be eligible for ssi. Requirements for eligibility in kentucky. 28 240 total wages the social security income limit of 18 240 10 000 income in excess of limit because this is a full calendar year during which rosie is receiving benefits but is not yet full retirement age the benefits reduction amount is 1 reduction for every 2 in excess wages. What is supplemental security income.