Family Income Limit For Roth Ira

Amount of your reduced roth ira contribution if the amount you can contribute must be reduced figure your reduced contribution limit as follows.

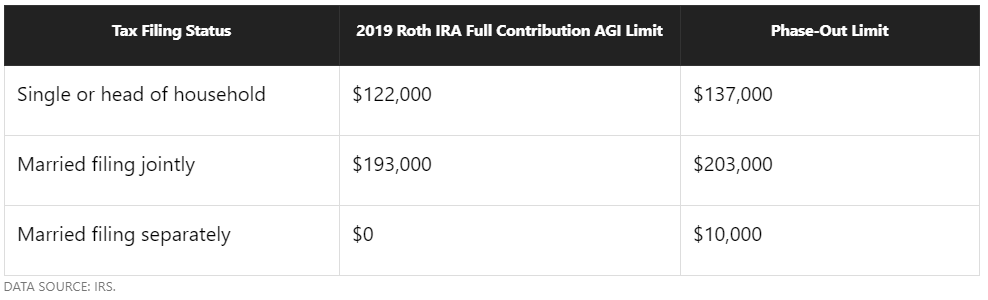

Family income limit for roth ira. Start with your modified agi. Subtract from the amount in 1. 196 000 if filing a joint return or qualifying widow er. What are the roth ira contribution and income limits.

Eligibility to make a roth contribution if you are married and filing separately single or filing as a head of household you can contribute to a roth ira in tax year 2021 up to the limit for your age if your modified adjusted gross income magi is less than 125 000. As a result anyone regardless of income. 2 for tax year 2020 income limits on roth ira contributions begin to kick in at. Most people are unaware that you can have a roth ira account for anyone and everyone in your family who has earned income.

Income limits on roth ira contributions exist because the tax advantages of ira accounts are meant to benefit average american workers. Magi is less than 125 000. Ira income limits ira s are a phenomenal way to limit your tax liability in the present traditional ira and in the future in fact the irs views them as such a benefit that they put rules in place to ensure that if you have too high of an income your ira contribution maximums or deductions will begin to phase out and disappear altogether. Income limits prevent highly paid people from benefiting more than the average person or family.

2020 roth ira income limits filing status modified agi contribution limit married filing jointly or qualifying widow er less than 196 000 6 000 7 000 if you re age 50 or older 196 000 to. In fact there s even an exception for your spouse. Currently roth contribution limits for those under 50 are 6 000 and 7 000 for those. If you don t know your magi see below for information on how to calculate it.

Your roth ira contribution limit depends on your tax filing status and your modified adjusted gross income magi. You can contribute an extra 1 000 if you are over the age of 50 meaning your limit is 7 000. This is because in 2010 congress eliminated the income limit on roth ira conversions.