Rules For Roth Ira Deposits

Compared to traditional ira rules roth ira withdrawal rules are quite different.

Rules for roth ira deposits. Contributions are the money you deposit into an ira while earnings are your profits. The trio of 5 year rules one of the much touted boons of the roth ira is your ability at least relative to other retirement accounts to withdraw funds from it when you wish and at the rate. There is a bit of a. If your income is above a certain level the option isn t available.

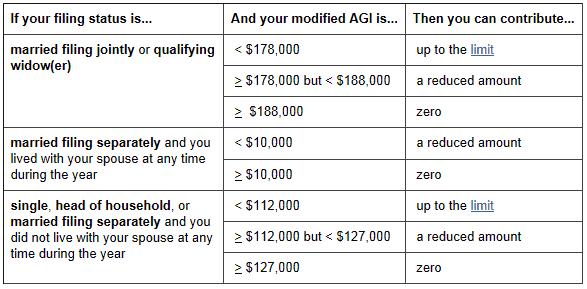

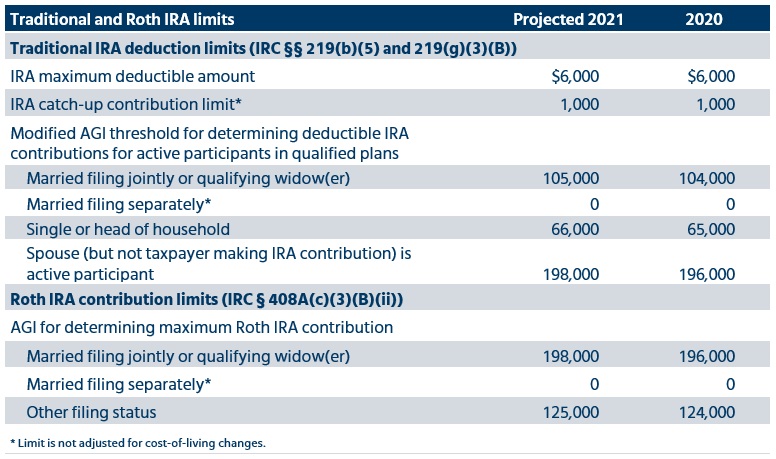

Discover 2020 and 2021 roth ira rules complete with income contribution historical limits and much more so you know what you can save for retirement now. For instance if you are married and file a joint tax. Roth ira rules 2020. You cannot deduct contributions to a roth ira.

Contributions withdrawals roth ira rules limit 2020 contributions for people with income above certain amounts. For 2020 the maximum contribution to a roth ira is 6 000 per year but if you re 50 or older that increases to 7 000 per year. You can make contributions to your roth ira after you reach age 70. Dayana yochim andrea coombes.

Penalty free and tax free withdrawals of contributions are allowed at any time which is what makes the roth a. Learn how they work so you can take full advantage of them. Roth ira withdrawal rules unlike traditional iras there are no required minimum distributions rmds for roth iras. Roth ira withdrawal rules differ depending on whether you take out your contributions or your investment earnings.

Roth ira rules not everyone is eligible to contribute to a roth ira. Roth iras boast big tax perks. You can take out your roth ira contributions at any time for any reason. A roth ira is an ira that except as explained below is subject to the rules that apply to a traditional ira.

Roth ira withdrawal rules your age 5 year rule met taxes and penalties on withdrawals qualified. How much can you put into a roth ira.