Pretax Income From Continuing Operations

Rock corp has concluded that no valuation allowance is required at december 31 20x6 based on projections.

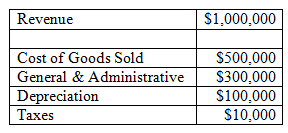

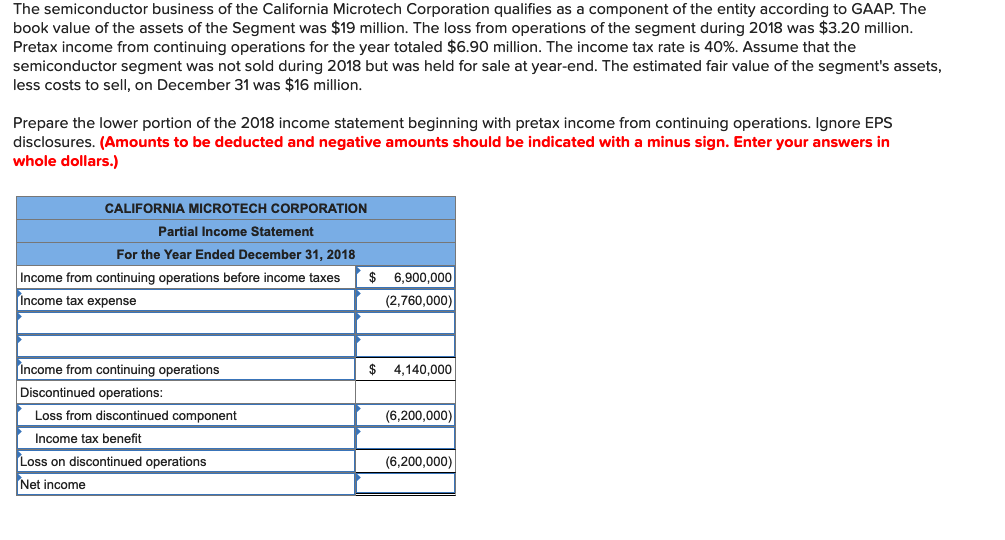

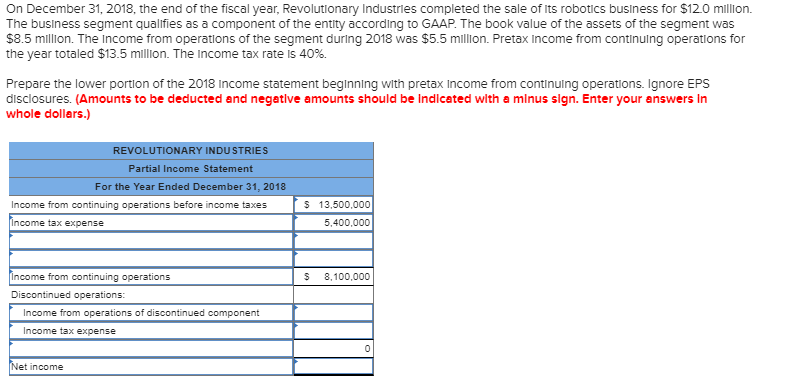

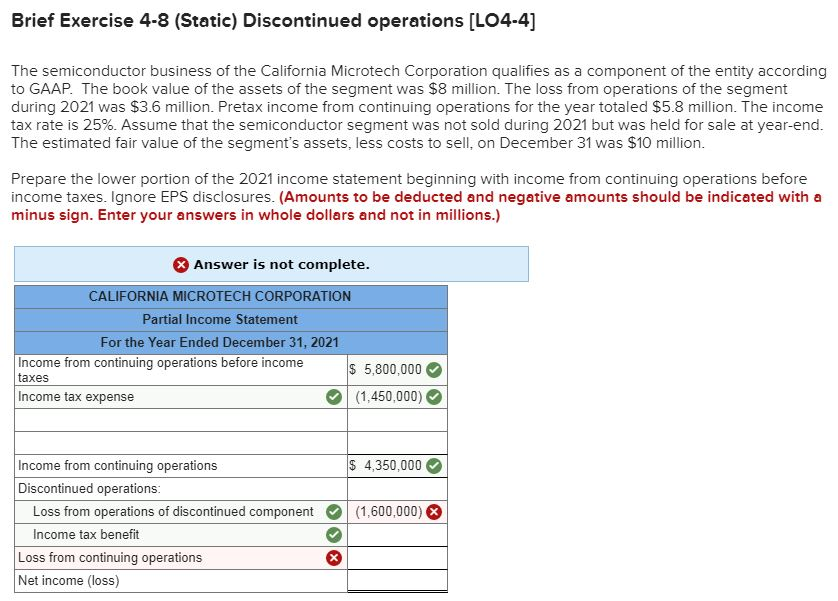

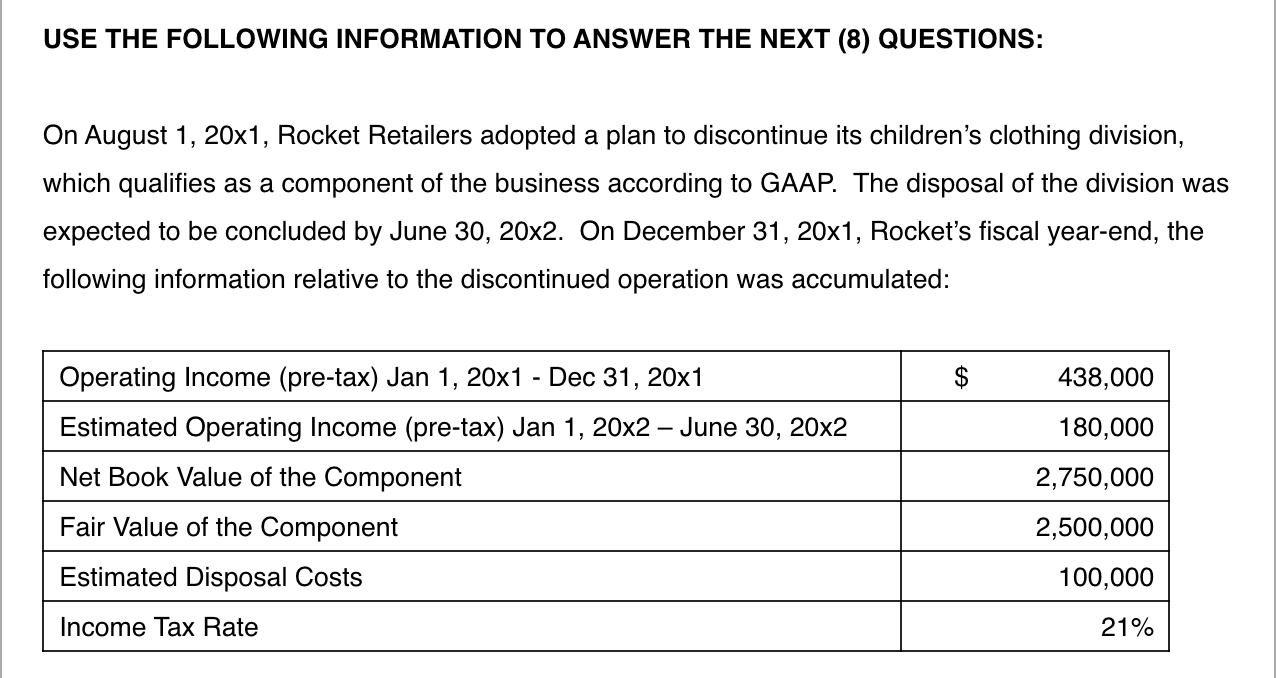

Pretax income from continuing operations. The pretax operating income of the division during 2011 was 4 866 000. At the end of that quarter the company estimated an effective annual tax rate of 29 5 based on a statutory tax rate of 30 on the first. Determine the book value of the division s assets on december 31 2011. The income tax rate is 25.

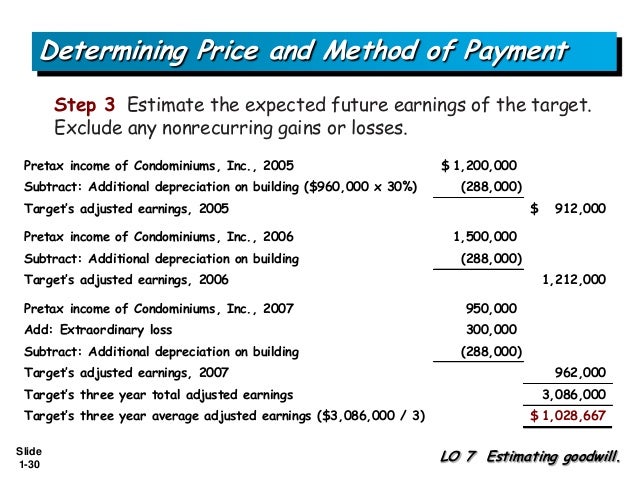

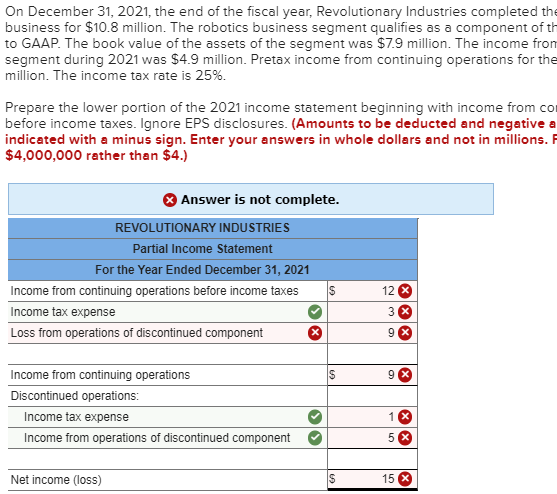

Richardson company reported pretax income from continuing operations in the first six months of the current year in the amount of 100 000. Ziltech reported net income for the year of 7 189 000. Income from continuing operations is a net income category found on the income statement that accounts for a company s regular business activities. As well as non cash expenses like depreciation and other charges from the total income generated but before deducting the amount income tax expense.

Assume that the semiconductor segment was not sold during 2016 but was held for sale at year end. Rock corp historically has been profitable and expects to continue to be profitable. Pretax income from continuing operations for the year totaled 5 8 million. The book tax difference of 369 000 was due to a 205 000 favorable.

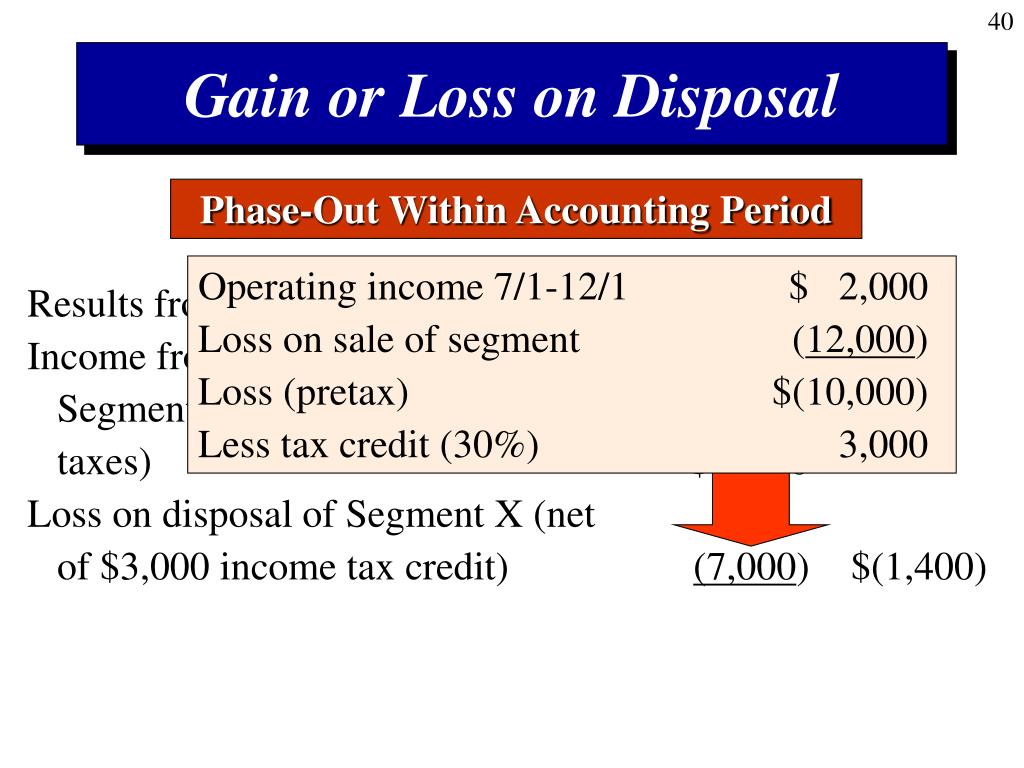

An accounting term that refers to the difference between a company s operating revenues from its primary businesses and its direct expenses except taxes tied to. At that point projected pretax income for the rest of the year was 1 000 000. Pretax operating income ptoi. The income tax rate is 30.

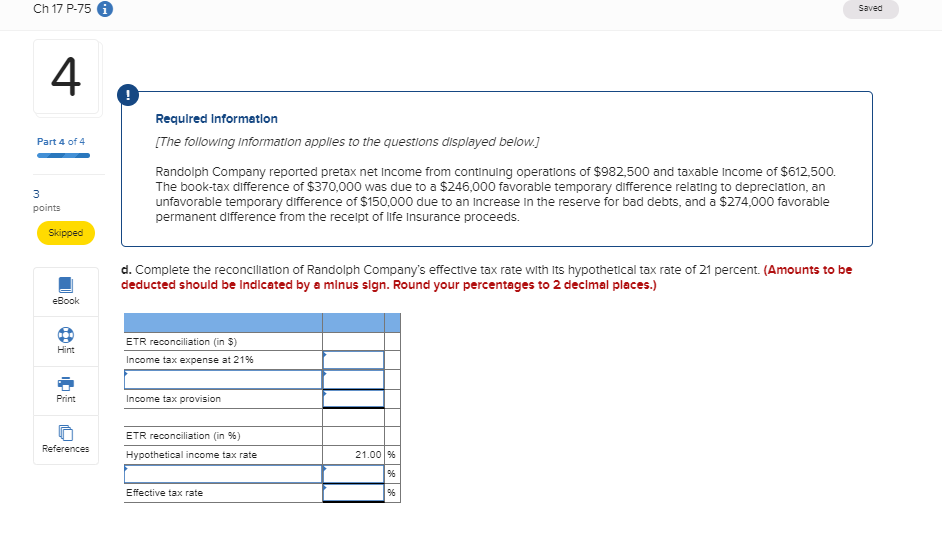

Pretax income from continuing operations for the year totaled 14 749 000. Projected pretax operating income for the balance of the year is 110 000 estimates of annual income include income from municipal bonds in the amount of 5 000 that will never be subject to income tax. The estimated fair value of the segment s assets less costs to sell on december 31 was 10 million. Randolph company reported pretax net income from continuing operations of 959 000 and taxable income of 590 000.

Pretax income is the net earnings of the business calculated after deducting all the expenses including cash expenses like salary expense interest expense etc. Pretax income from continuing operations excluding special and other non core items business in millions molson coors brewing company 2 december 25 2010 december 26 2009 144 2 102 2 1 057 0 842 8 a dd back.