Negative Income Journal Entry

It is income earned during a particular accounting period but not received until the end of that period.

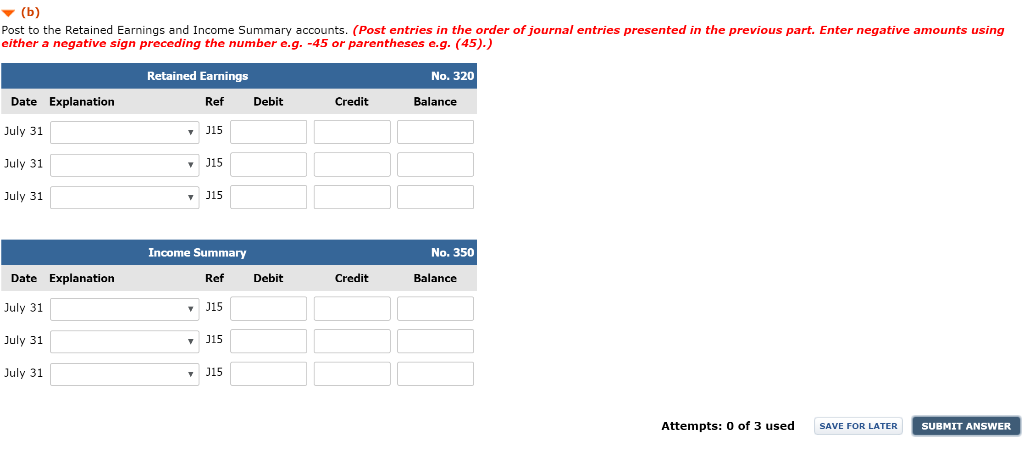

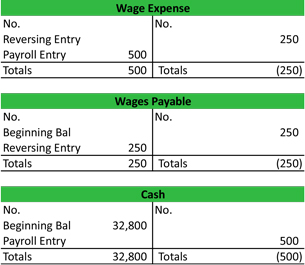

Negative income journal entry. The retained earnings account is adjusted every time a new entry is added to the income or expense account. Accounting and journal entry for income tax is done in a distinct way for different types of business establishments i e. No journal entry for net income it is the difference between total expenses and total revenue and it is the balancing figure. Sole proprietorship partnership and private limited company.

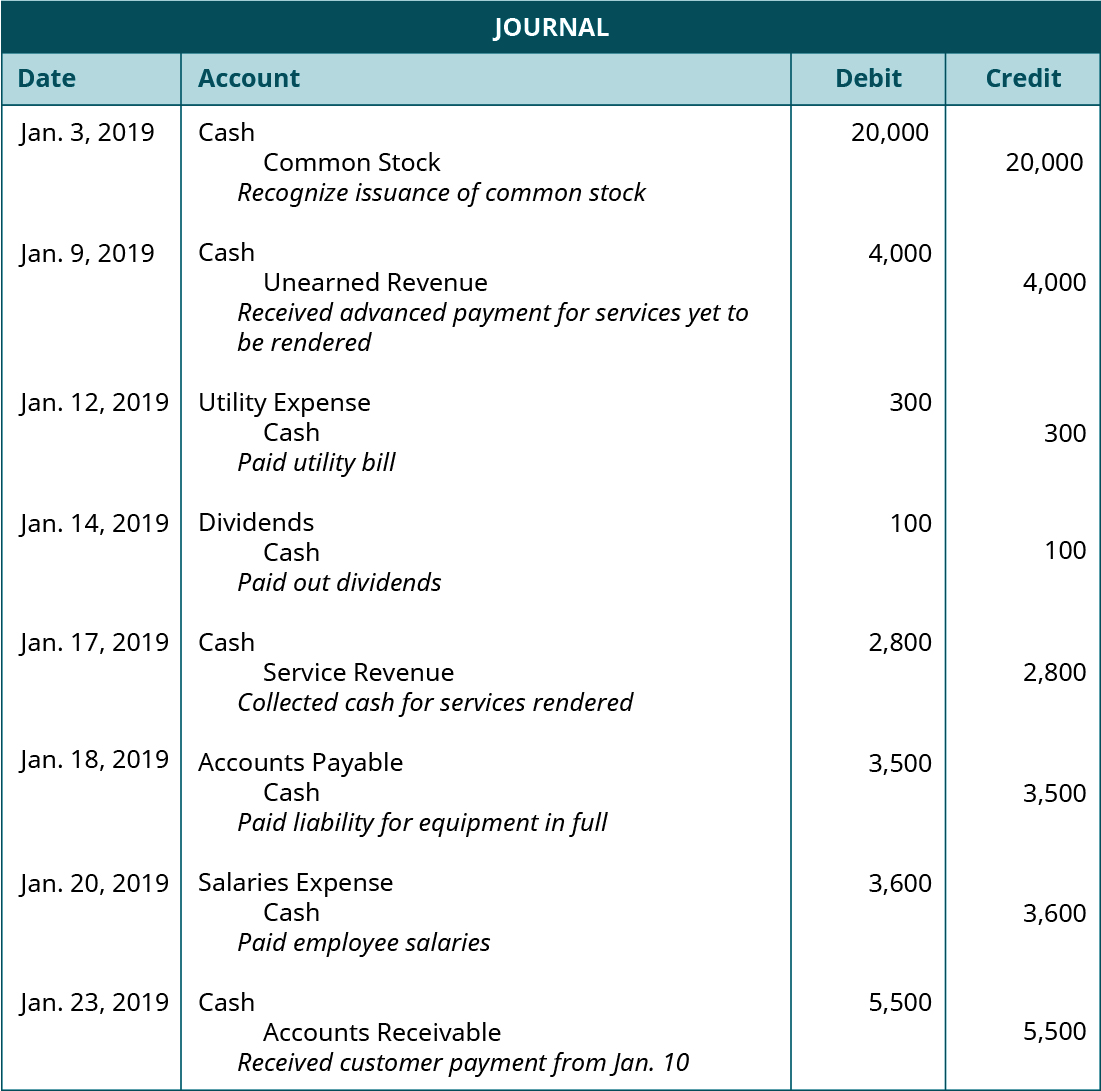

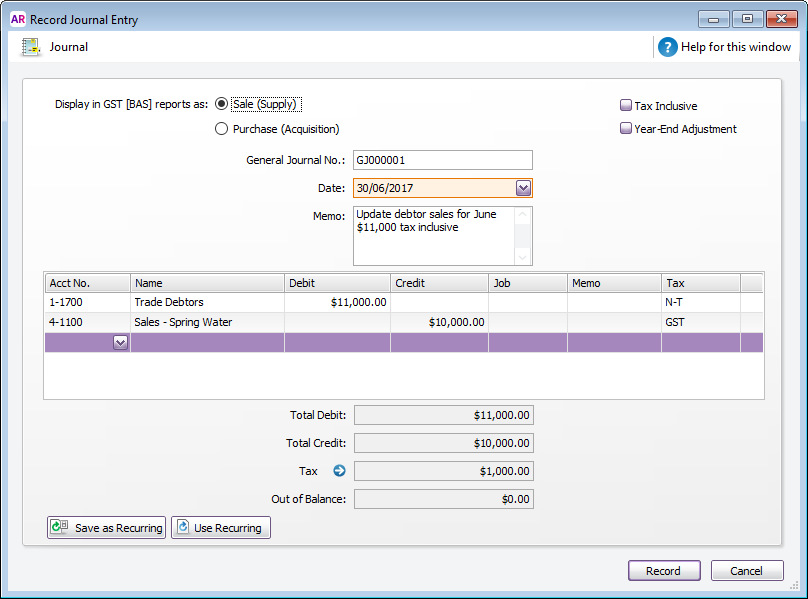

Journal entries are the first step in the accounting cycle and are used to record all business transactions and events in the accounting system. The income statement shows the company s revenues and expenses. When the expenses exceed the revenues the company has a negative income. The company may receive revenues from sales of goods and services dividends and interest.

Journal entries of unearned revenue. If he wishes to use the negative liability to offset potential tax liabilities in the next accounting period he can make a debit entry to cash for the refund received and a credit entry to the income tax expense account decreasing the expense account. If the business receives payment or invoices in advance then the revenue is classified as unearned and carried as a liability on the balance sheet until the business has carried out the services or supplied the product. Journal entry for accrued income.

Journal entry for income tax. Income tax is a form of tax levied by the government on the income generated by a business or person. It is treated as an asset for the business. Journal entry for accrued income recognizes the accounting rule of debit the increase in assets modern rules of accounting.

Unearned revenue journal entry revenue is only included in the income statement when it has been earned by a business. Equity structure if the net loss for the current period is higher than the retained earnings at the beginning of the period those retained earnings on the balance sheet may become negative. The following unearned revenue journal entry example provides an understanding of the most common type of situations where such a journal entry account for and how one can record the same as there are many situations where the journal entry for unearned revenue pass it is not possible to provide all the types of examples. What is a journal entry.

As business events occur throughout the accounting period journal entries are recorded in the general journal to show how the event changed in the accounting equation.