Monthly Income Guidelines For Medicaid In Ohio

2 349 month for applicant.

Monthly income guidelines for medicaid in ohio. 1 qualified income trusts qit s qit s also commonly referred to as miller trusts offer a way for individuals over the medicaid income limit to still qualify for long term care medicaid as. Monthly fpl guidelines family size 90 fpl 150 fpl 200 fpl 1 735 1225 1634 2 990 1650 2200 3 1245 2075 2767 4 1500 2500 3334. Medicaid waivers home and community based services. For ohio residents 65 and over who do not meet the eligibility requirements in the table above there are other ways to qualify for medicaid.

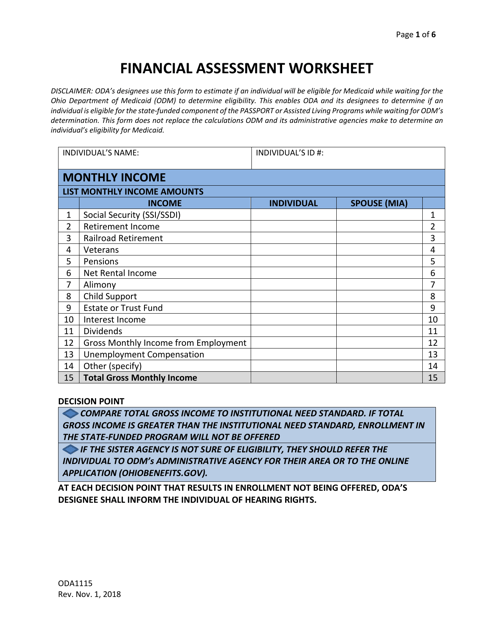

Therefore it does not include retroactive and backdated eligibility. Adults ages 19 to. Institutional nursing home medicaid. If a medicaid applicant has income greater than this amount it is necessary to establish a qualified income trust.

For the eligibility groups reflected in the table an individual s income computed using the modified adjusted gross income magi based income rules described in 42 cfr 435 603 is compared to the income standards identified in this table to determine if they are income eligible for medicaid or chip. 2 349 month for applicant. Monthly ohio medicaid eligibility january 2020 this information is a point in time report which is produced at the beginning of the following month. In 2020 the maximum total monthly income from all sources social security pensions etc that a person seeking medicaid may have is 2 349 an increase of 36 from the 2019 limit of 2 313.

Spenddown medicaid spenddown is for individuals in this. Single family households can make up to 15 800 per year while a four person family can bring in 32 319 per year to qualify. Like most states medicaid income requirements are determined by the modified adjusted gross income magi calculator. Regular medicaid aged blind and disabled.

You can apply for medicaid online at www benefits ohio gov or by. Home uncategorized what is the monthly income limit for medicaid in ohio posted on november 6 2020 by leave a comment when this trust is used the person who established the trust can move extra income into the trust where it is no longer counted toward the medicaid monthly income limit. Ohio income requirements for medicaid take into account your household size your income and any assets you may have all measured up against the current federal poverty levels divided into patient groups. Income requirements for ohio medicaid household size and total amount of income versus outgoing bills plays a part in determining the income limit for each family.

Income to become medicaid eligible. Step parent income should be included in monthly income calculation. If your gross monthly income is lower than the guidelines in chart number 1 you must apply for medicaid before sending your financial application to cmh even if you have private health insurance.