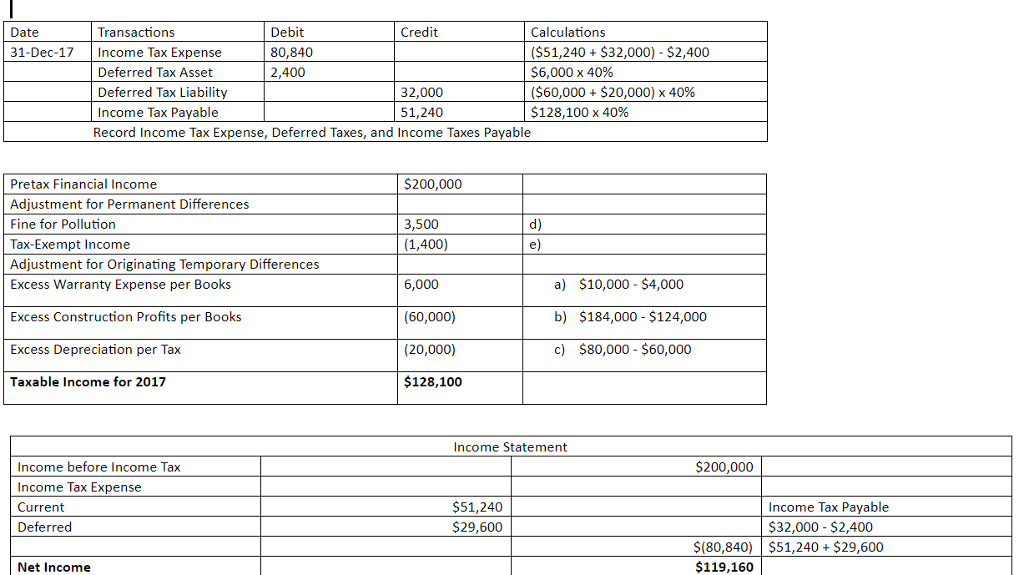

Journal Entry Of Income Tax Provision

Query on income tax provision accounting entries accounts 27 may 2009 mr rajdeep thank very much for your detailed reply.

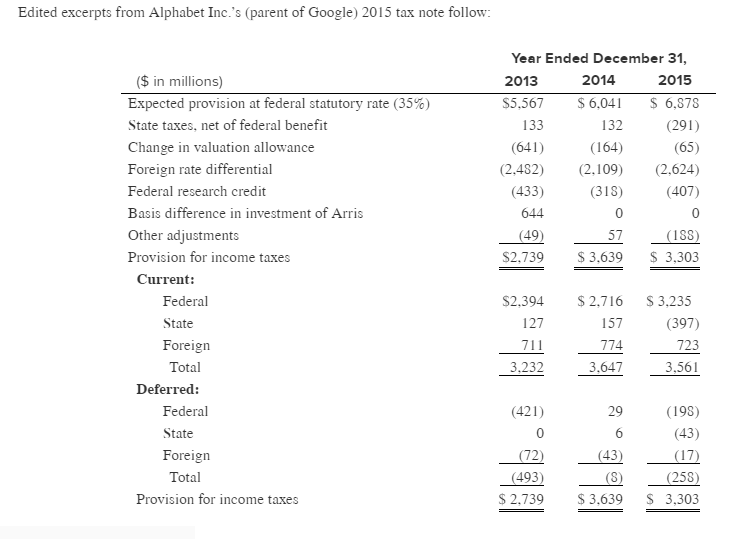

Journal entry of income tax provision. Tax refunds are not considered revenue. The major problem which we come across is that tax deducted at source receivable is not segregated year wise. Accounting and journal entry for income tax is done in a distinct way for different types of business establishments i e. Provision of income tax provision of income tax recorded in books of account by debiting profit loss a c and it will show under liability in balance sheet.

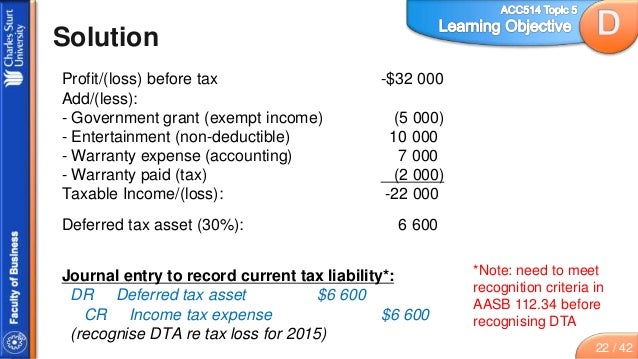

It is generally seen in most of the cases that many people find difficulty in passing the correct journal entry for provision of taxation. Provision amount is calculated by applying rate as per tax rules on profit before tax figure. What will be the entries if there is following case 1 income as per return 100 2 assessed income 120. Answer sreeram hi sankeerthana here the provision you have created in the earlier year you should reverse with corresponding payment.

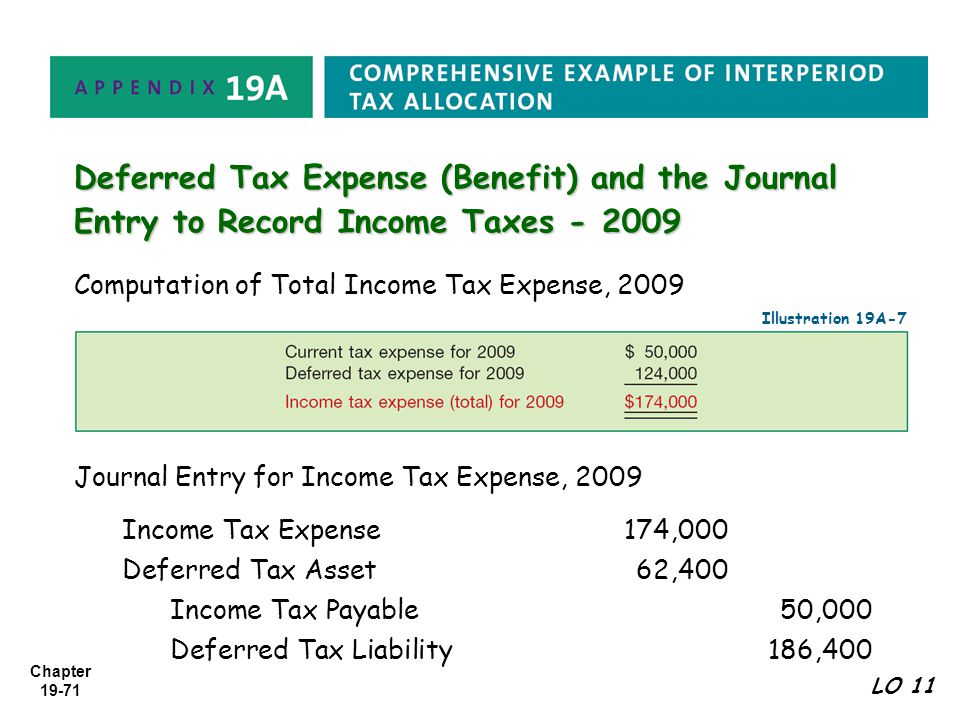

Sole proprietorship partnership and private limited company. Journal entry of income tax accounting 1. Provision for income tax a c. Using double entry bookkeeping you reverse the original entries you made for paying taxes.

Ensure that the tds receivable is segregated according to the year in which it is to be receivable. Depreciation booked in books of accounts and depreciation allowable as per income tax rules taxable income arrives. Provision for income tax. As the income tax is estimated a demand for the amount has not yet been received and the expense has not been recorded in the accounting records.

This is below the line entry. Profit or loss a c. The journal entry to record provision is. What will be journal entry of provision for income tax in current year and adjustment entry in nex.

Accrued income tax journal entry at the end of the accounting period the business needs to accrue the estimated income tax expense due the accrued income tax payable journal entry is as follows. By end of sep 30 you. This provision is created from profit. How to record a journal entry for a tax refund you need to keep a few things in mind to record an income tax refund journal entry.