Journal Entry For Quarterly Income Tax Philippines

Sole proprietorship partnership and private limited company.

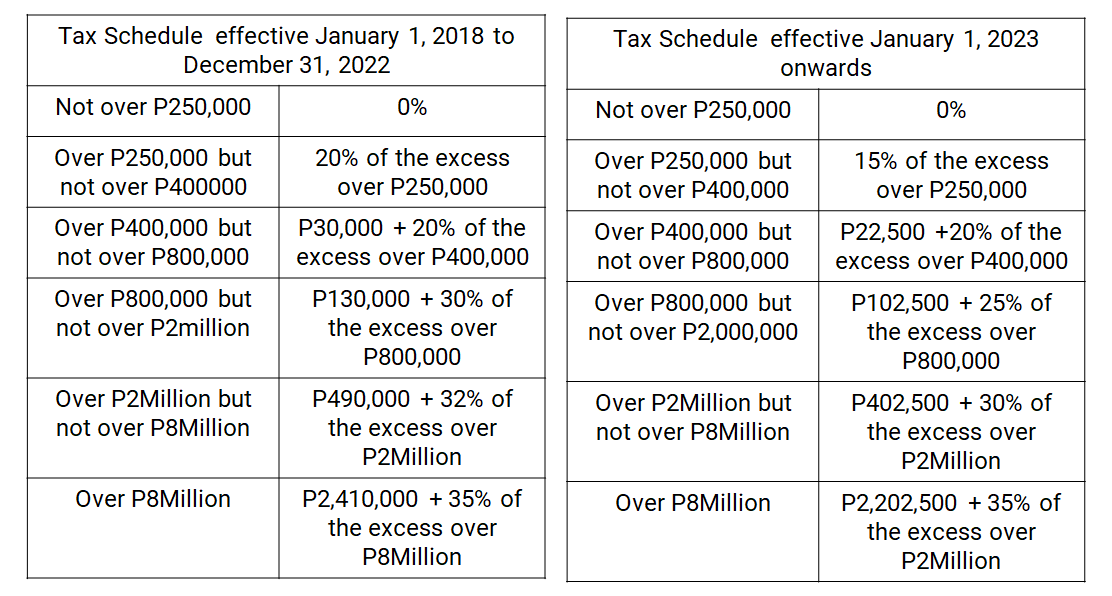

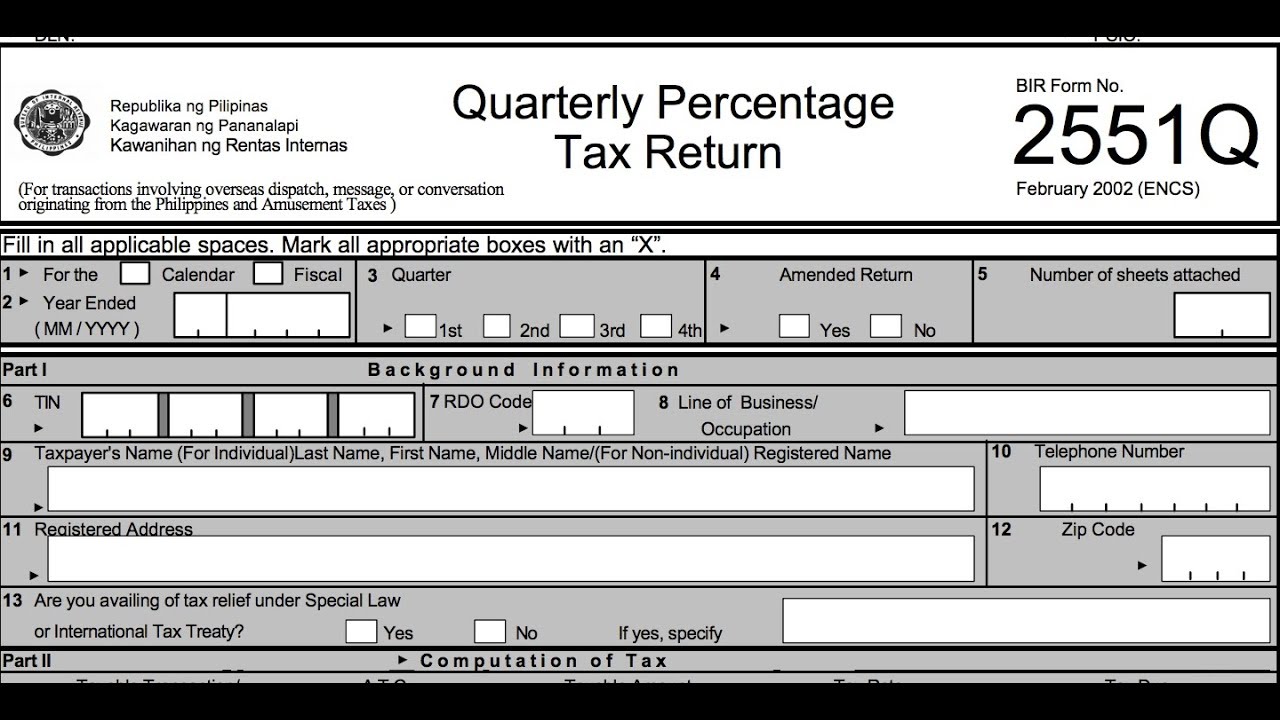

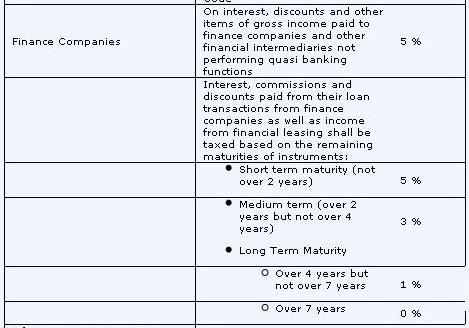

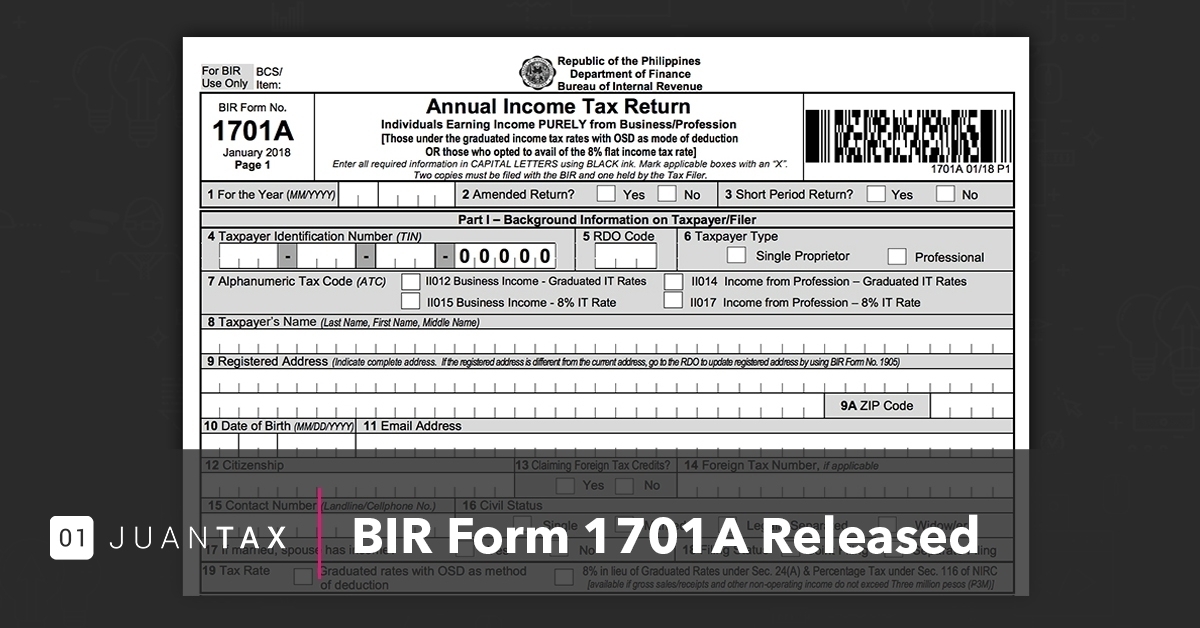

Journal entry for quarterly income tax philippines. Provision amount is calculated by applying rate as per tax rules on profit before tax figure. The journal entry to record provision is. 2550m and quarterly bir form no 2550q. 1701q and or 1701 and corporations that includes partnerships one person corporations resident foreign.

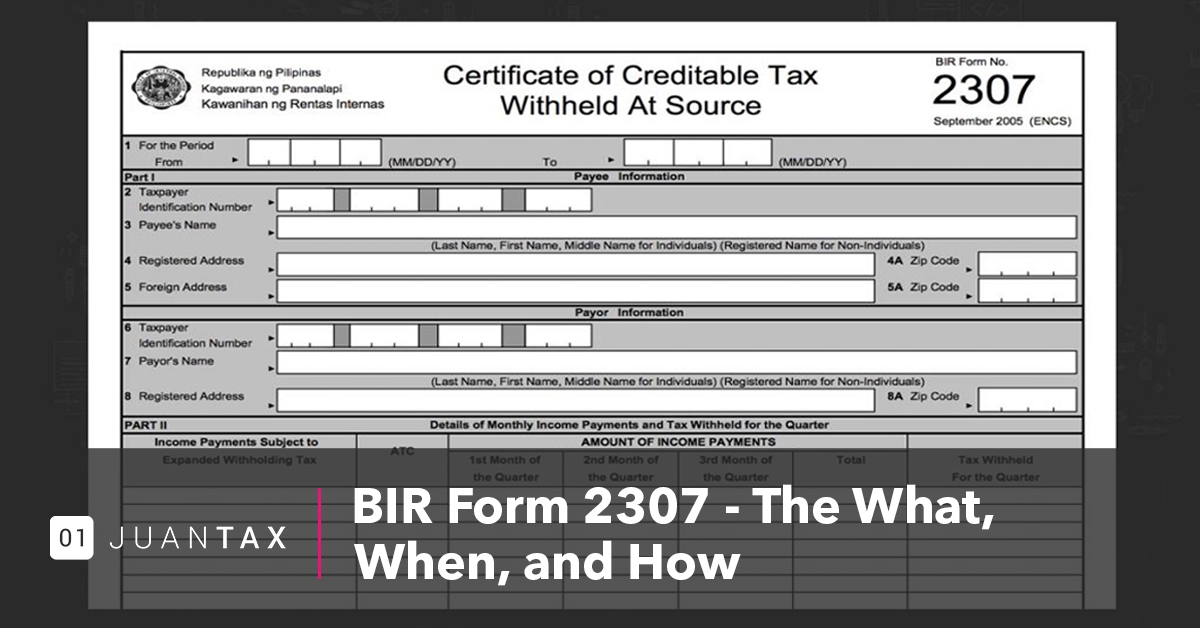

Private limited companies. Any help would be greatly appreciated. Asis cpa filing income tax returns in philippines is a recurring obligation of every taxpayer and made quarterly and annually for registered individuals in trade or business or practice of profession sole proprietorship or freelancers in philippines bir form no. 2307 from company a you may have the sample journal entry as follows.

Jul 24 back to home prepaid income tax in accounting prepaid income tax is defined as an asset listed on the balance sheet that represents taxes that have been already paid despite not yet having been incurred. A of the cwt against his quarterly or annual income tax liability based on bir form no. Accounts receivable cash 3 45 m sales 3 m sales tax payable 0 45 m when abc inc. For illustrative purposes let us assume the following transactions or figures and to emphasize vat journal entries let us assume no withholding taxes applies unless so stated.

Accrued income tax journal entry example shows how to record an estimated income tax expense due on profits of a business at the end of an accounting period at the end of an accounting period one of the adjusting entries is to accrue for estimated income tax payable due on the profits of the business. Accounting and journal entry for income tax is done in a distinct way for different types of business establishments i e. Prepaid income tax is defined as an asset listed on the balance sheet that represents taxes that have been already paid but not yet incurred. I need to record an estimated quarterly income tax payment and am not sure of what the entry would be.

Upon receipt of income payment with creditable withholding tax the sample entry may be made on the books of accounts in the philippines say p10 000 professional fee withheld 15 upon payment. You have part of the calculation correct. Journal entry for income tax income tax is a form of tax levied by the government on the income generated by a business or person. For better appreciation i suggest you read further below with the monthly bir form no.

Profit before tax is usually a gross profit less operating financial and other expenses plus other income. Corporate income tax employer portion of the social security tax examples of indirect taxes include. Deposits the 0. They are prepayments of income tax that has future economic benefits being deductible from income tax due of the taxpayer on a quarterly income tax return and or annual income tax returns.