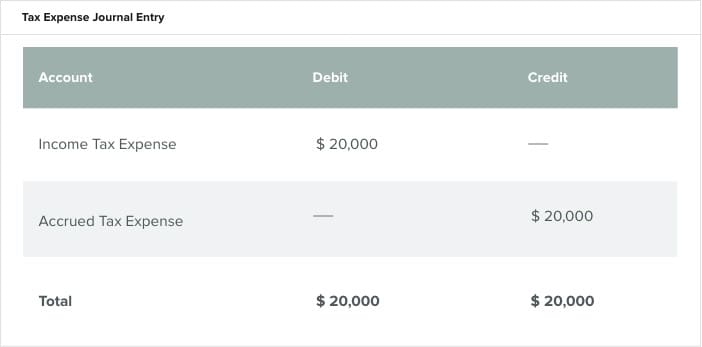

Journal Entry For Income Tax Provision

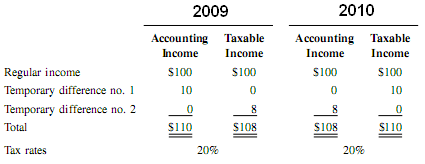

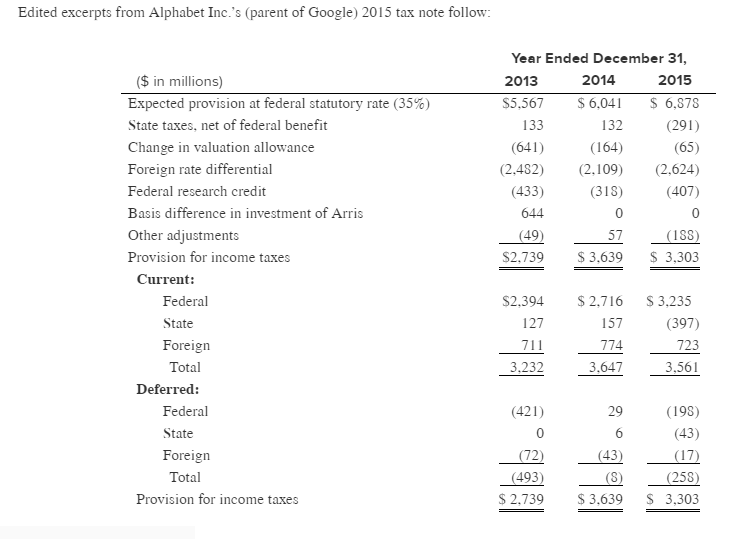

The under over provision is determinable only after the actual payment is usually made when the financial statements of the relevant year are already published and the subsequent year is already underway.

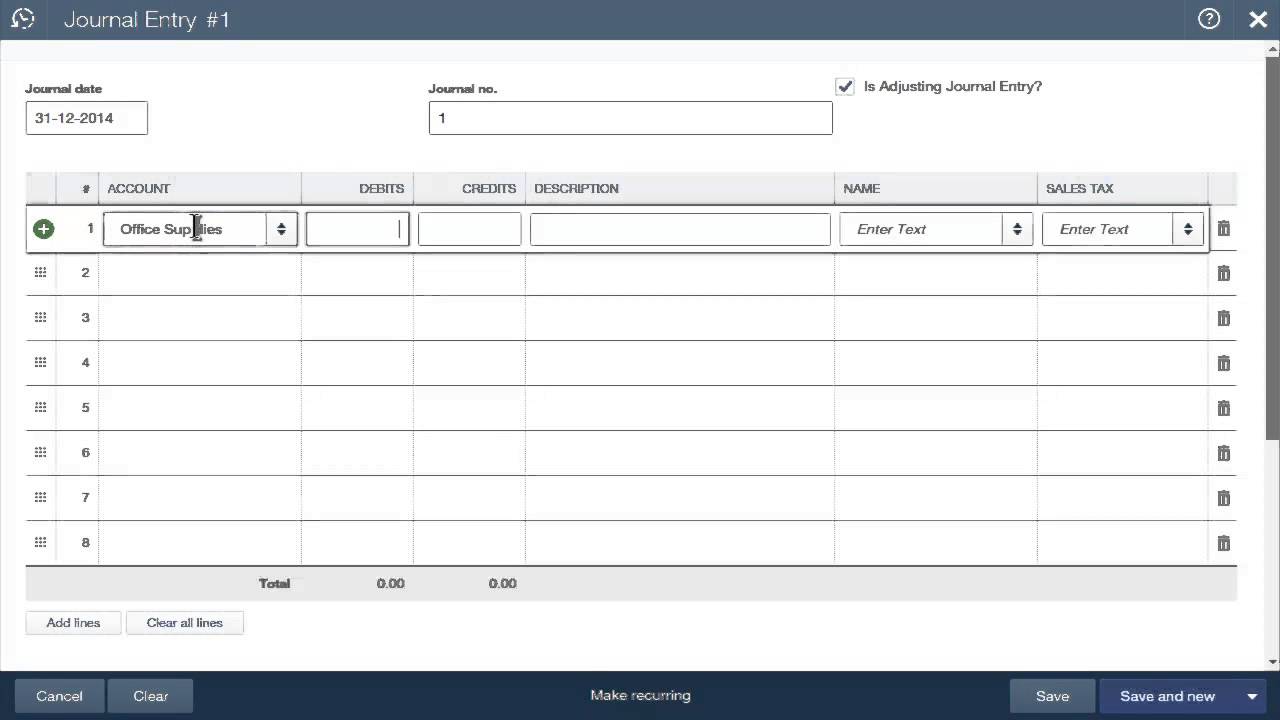

Journal entry for income tax provision. Sole proprietorship partnership and private limited company. My fiscal year end is 09 30 2012 on the income statement the income tax for year 2012 is 5000. Income tax refund receivable is to be grouped under other current assets. In this case we can have under or over provision of tax.

After adjusting necessary items from gross profit e g. Helen what is the journal entry for income tax re assessment. As provision for tax is an estimate of probable cash outflow the actual tax payment can be different. This is below the line entry.

Accounting and journal entry for income tax is done in a distinct way for different types of business establishments i e. Private limited companies. Journal entry for corporate income tax re assessment for pervious year by. Provision for income tax refers to the provision which is created by the company on the income earned by it during the period under consideration as per the rate of tax applicable to the company.

By end of sep 30 you. Credit provision for income tax 15 000 00 now let s look at a sole trader individual s treatment. Bobby munson operates a small ice cream shop called samcro sweets. Dep i am a partner of a firm in firm s capital a c debit side to drawings rs 60000 to advanced tax rs 15000.

Income tax refund receivable. 1 provision for income tax this provision is created from profit. In the 2017 financial year it is expected to have net profit of 50 000 00. The journal to record the.

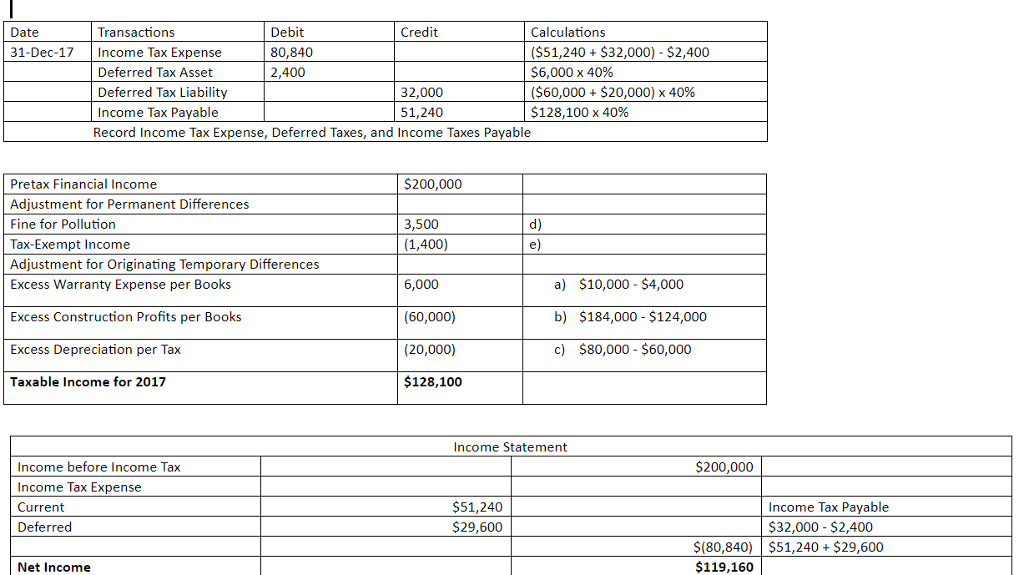

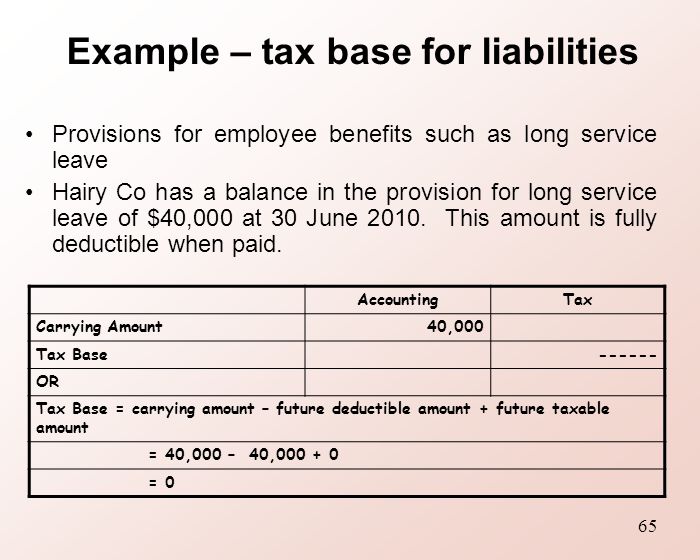

What will be journal entry of provision for income tax in current year and adjustment entry in nex. As at 31st march the balance sheet will show income tax. Journal entry for income tax income tax is a form of tax levied by the government on the income generated by a business or person. Provision definition in bookkeeping provisions are established by recording an appropriate expense in the income statement of the business and establishing a corresponding liability as a provision account in the balance sheet statement.

This entry sets off the provision with the asset and gives rise to another asset i e.