Japan Income Tax Withholding

Tax treaty network as of 1 august 2020 japan has entered into 79 tax treaties with 136 countries and or regions.

Japan income tax withholding. In addition a tax withholding system where companies salary payers collect income tax on the date of payment and pay the tax on behalf of individuals income earners is also introduced for. 1 11 1 withholding income tax credits. The surtax is comprised of a 2 1 tax that is assessed on an individual s national income tax. As of 1 august 2020 26 jurisdictions which are among the japanese covered.

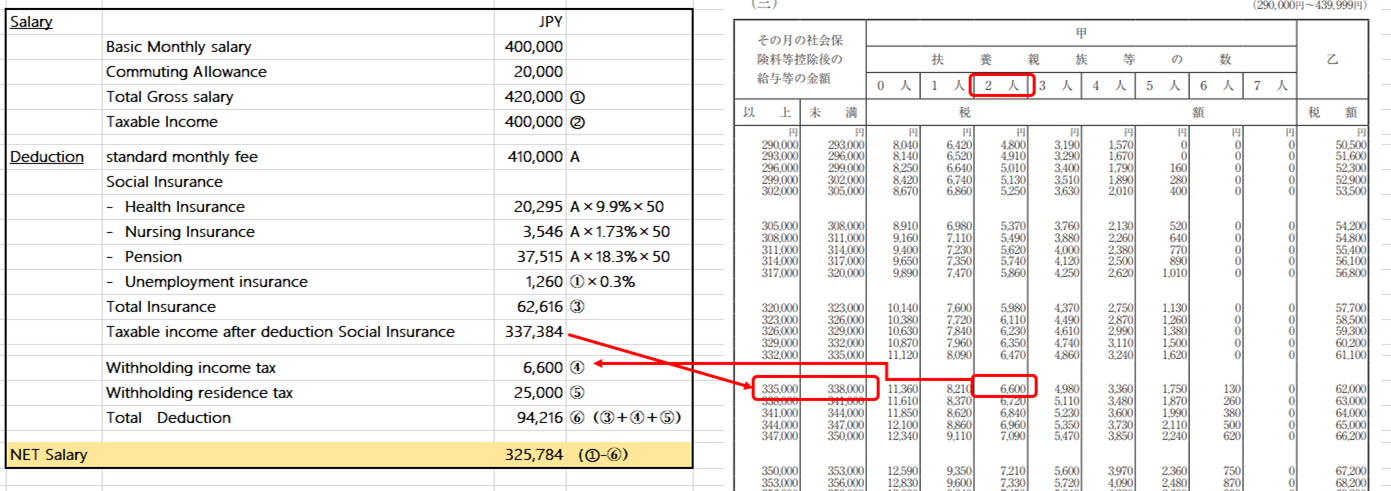

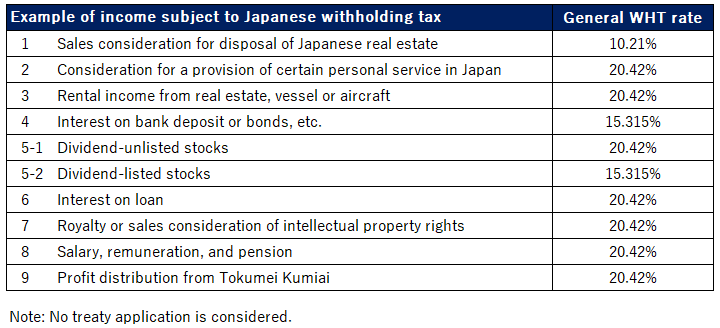

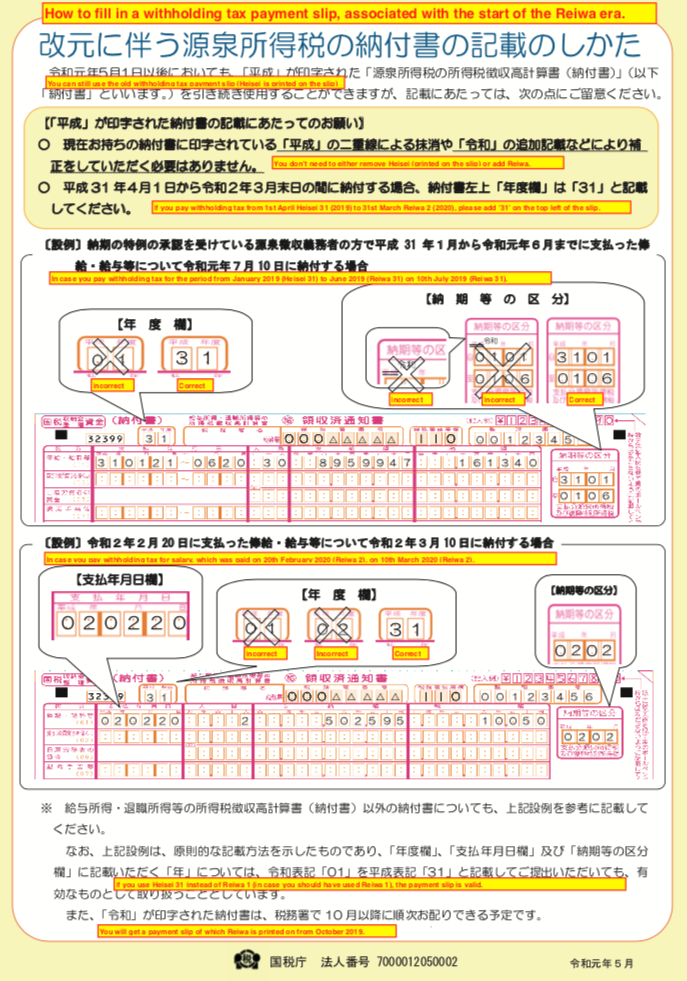

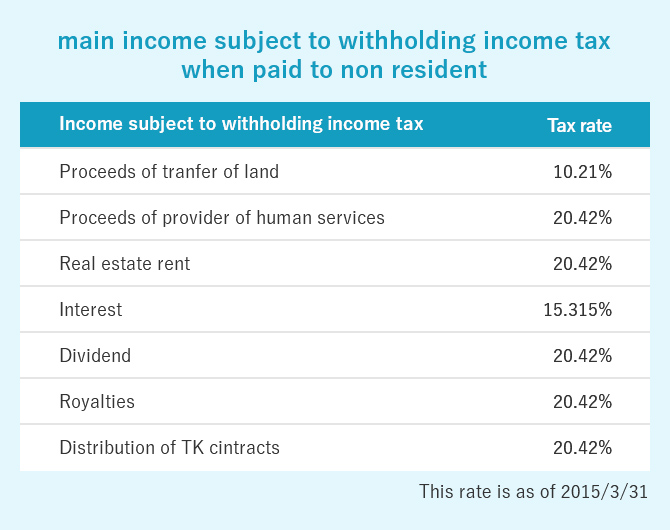

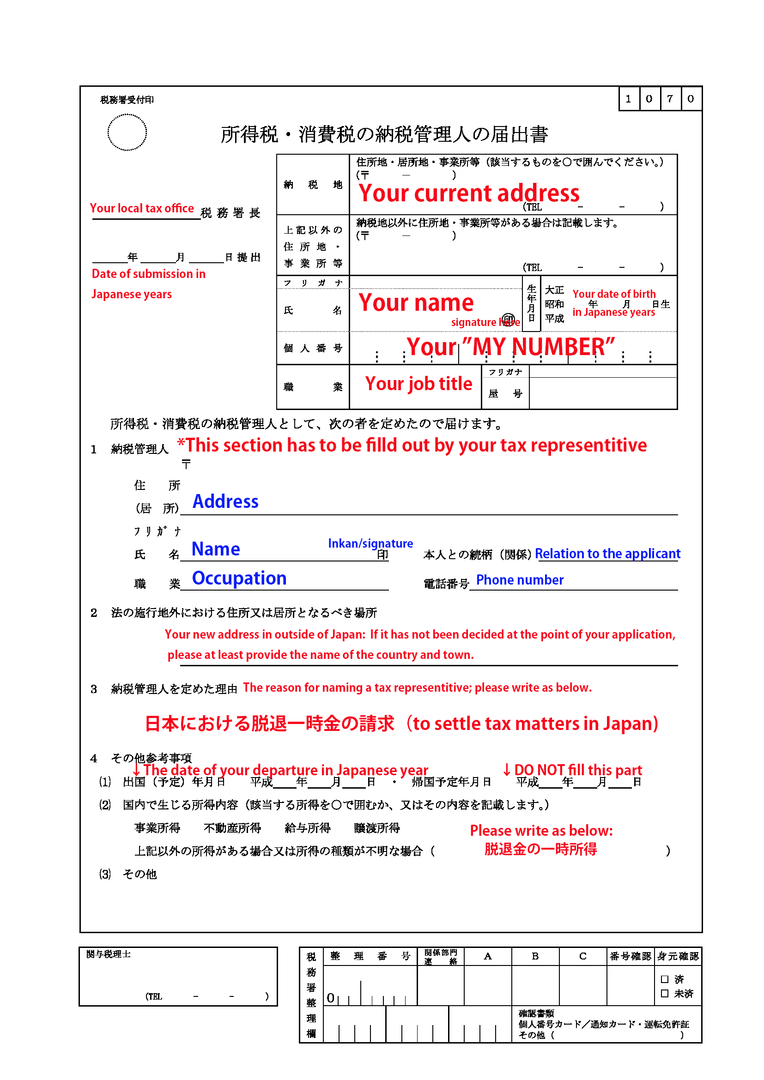

Withholding tax a withholding tax is defined as an amount that an employer withholds from employees wages and pays directly to the government. The most important regarding smes is the individual income tax. Japan s tax filing system is based as a rule on self assessed income tax payment where individuals tax payers calculate their annual income and tax amount and file tax returns by themselves. A non resident taxpayer whose employment income has not been subject to a 20 42 percent withholding tax must file a return by the day of their departure from japan or by 15 march of the following year if a tax agent is appointed and pay the 20 42 percent.

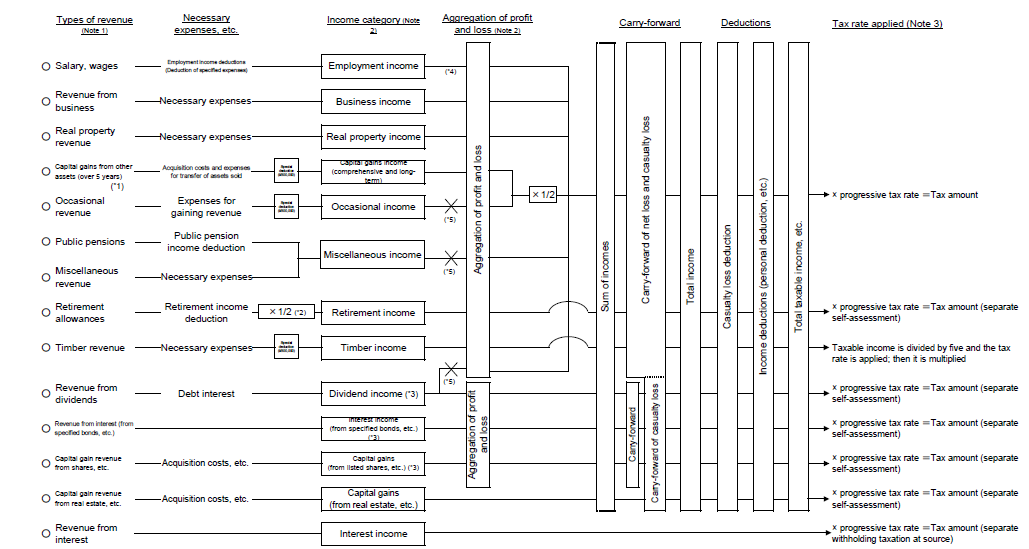

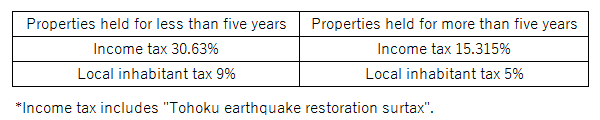

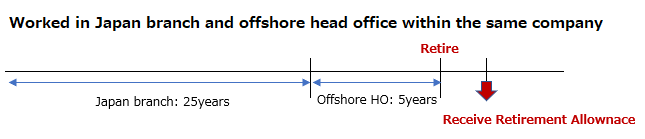

Income tax in japan is based on a self assessment system a person determines the tax amount himself or herself by filing a tax return in combination with a withholding tax system taxes are subtracted from salaries and wages and submitted by the employer. Japanese local governments prefectural and municipal. For certain types of income the employer is required to pay income tax withheld at the time the employee is paid. Rates national income tax rate taxable income rate up to jpy 1 950 000 5 5 105 including surtax jpy 1 950 001 jpy 3 300 000 10 10 21 including surtax jpy 3 300 001 jpy 6 950 000 20.

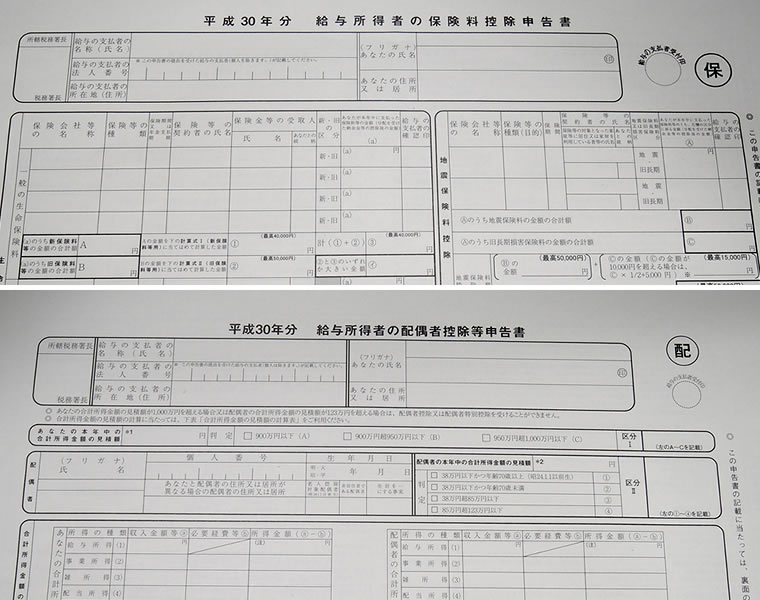

Tax withholding system japan is using a withholding system for the payment of many taxes. Taxation in japan preface this booklet is intended to provide a general overview of the taxation system in japan. Japan highlights 2020 page 4 of 10 individual taxation. For 2019 application for deduction for insurance premiums for employment income earner pdf 243kb for 2019 application for exemption for spouse of employment income earner pdf 287kb outline of japan s withholding tax system related to salary.

Any company which is employing people in japan has to withhold the individual income tax on the.