Japan Income Tax Calculator

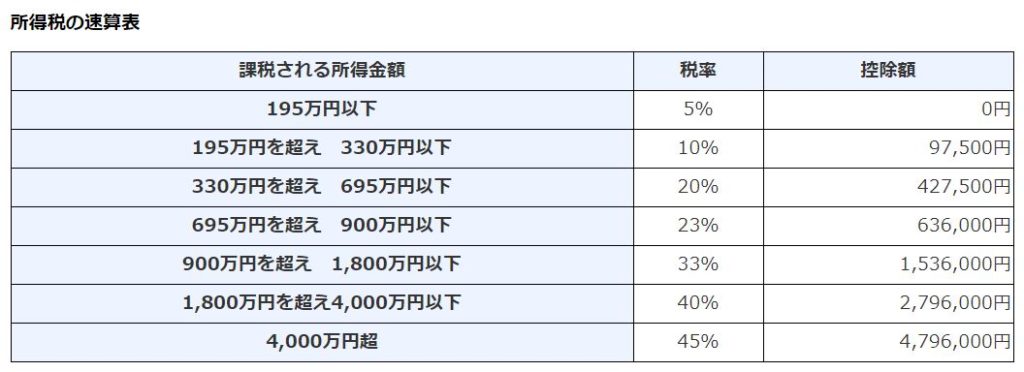

This rate includes 2 1 of the surtax described above 20 x 102 1 20 42.

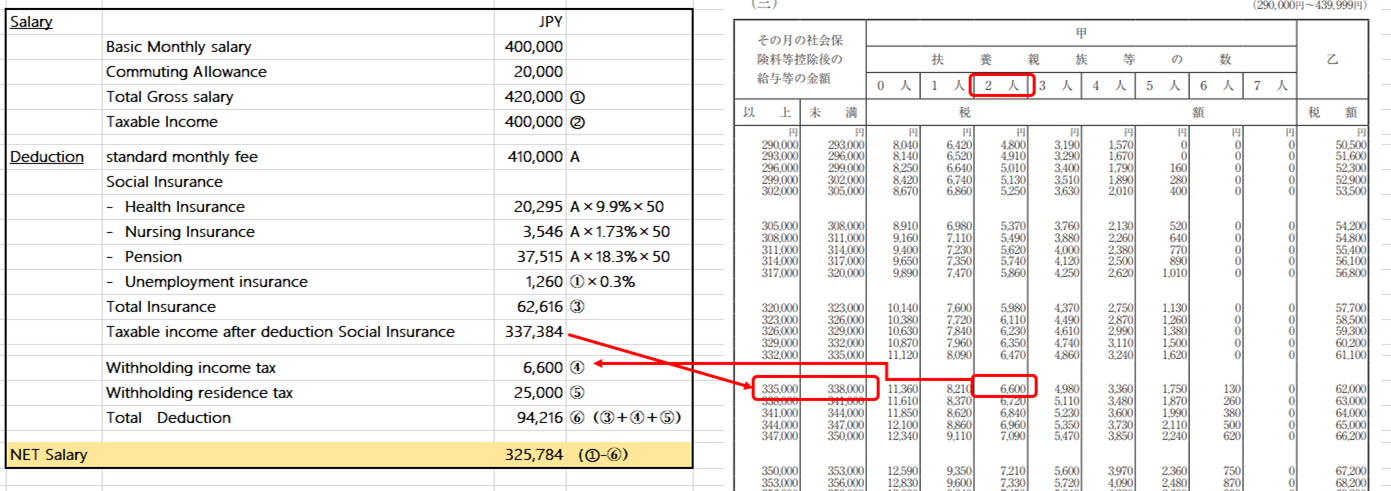

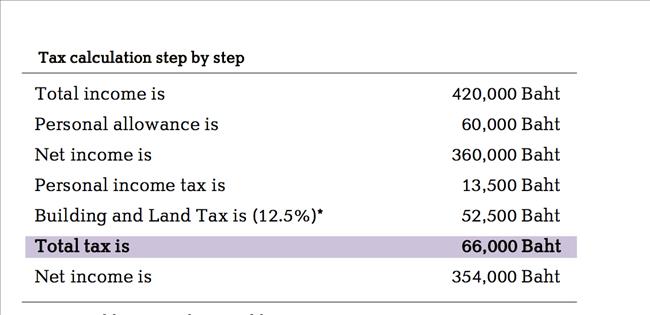

Japan income tax calculator. A non resident taxpayer s japan source compensation employment income is subject to a flat 20 42 national income tax on gross compensation with no deductions available. Easy to use salary calculator for computing your net income in japan after all taxes have been deducted from your gross income. Net income salary insurance income tax residence tax income tax salary insurance residence tax net income the japan tax calculator is a useful tool to find the taxes. Income tax resident tax insurance pension.

This amount needs to be. If you wish to enter you monthly salary weekly or hourly wage then select the advanced option on the japanese tax calculator and change the employment income and employment expenses period. If you get non monetary benefits as part of your job for example if your employer provides you a house to live in this will also be treated as taxable income. The japanese tax calculator assumes this is your annual salary before tax.

Taxation in japan income tax is a progressive tax meaning that individuals with. Job status age prefecture and work industry affects social insurance and dependents affect income taxes. The income tax calculation is based on your taxable income minus the standard personal deduction which is equal to 380 000y. This is the amount of salary you are paid.

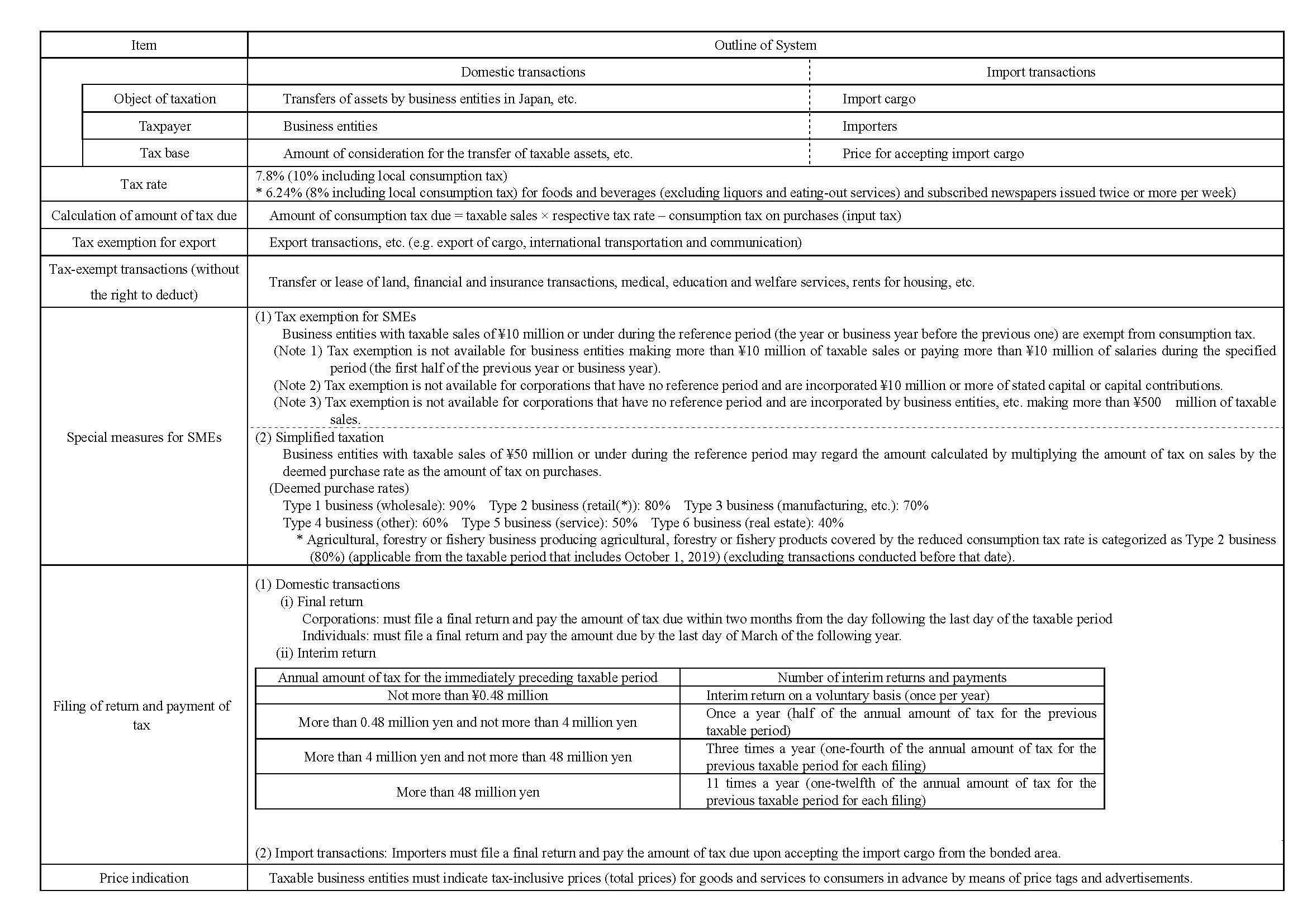

Japan income tax calculator for tax calculation purposes in japan you ll need to report income from your salary along with any benefits or bonus payments that you receive. Htm provides comprehensive payroll services for foreign companies in japan including human resources data management tax adjustments payment to employees and reporting. Using the japan tax calculator you can get an idea of the amount of taxes you might have to pay. Resident a resident is an individual who has a living base in japan or has resided in japan for a continuous period of 1 year or more.

According to the income tax law of japan there are two categories of individual taxpayers a resident and a non resident.