Income Threshold Roth Ira

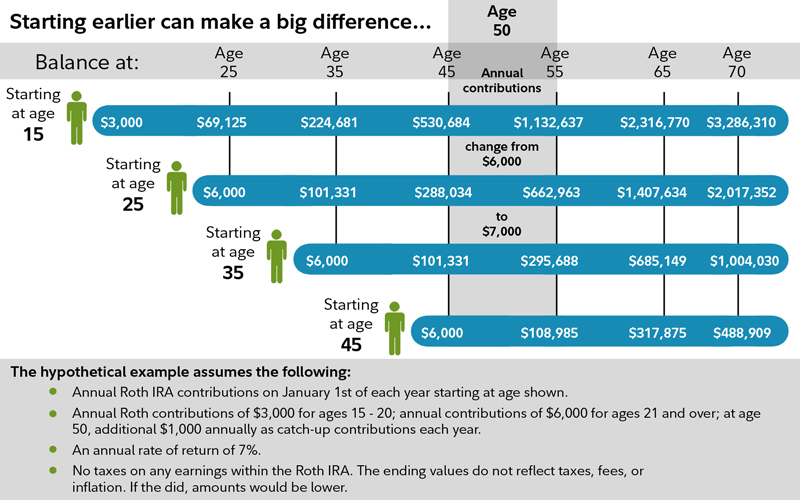

Currently the roth ira contribution limit is 6 000 for 2020 or the total amount of income you earned for that year.

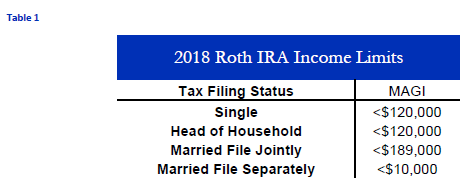

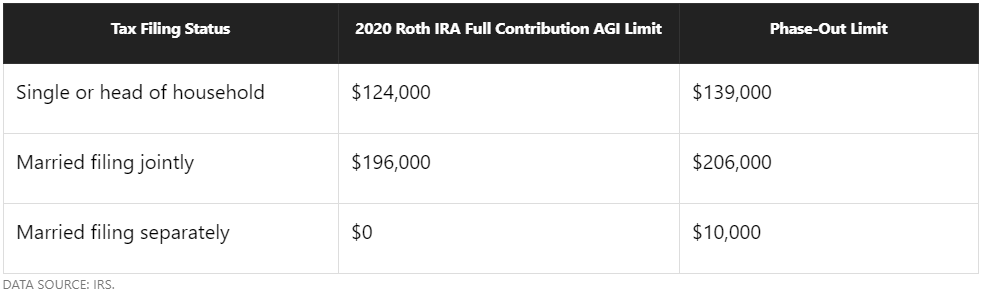

Income threshold roth ira. The 2020 limit for contributions to roth and traditional iras is 6 000 or 7 000 if you re aged 50 or older remaining unchanged from 2019. In 2020 most people can contribute up to 6 000 to a roth ira or 7 000 if they re 50 or older. The amount you can contribute is reduced if your magi is between 125 000 and 140 000. If you file taxes as a single person your modified adjusted gross income magi must be under 137 000 for the tax year 2019 and under 139 000 for the tax year 2020 to contribute to a roth ira and if you re married and file jointly.

The income cap to contribute to a. You re allowed to increase that to 7 000 if you re age 50 or older. Single head of household or married filing separately and you did not live with your spouse at any time during the year. But things get messier if you earn a lot of money.

If you are married and filing separately single or filing as a head of household you can contribute to a roth ira in tax year 2021 up to the limit for your age if your modified adjusted gross income magi is less than 125 000. Roth ira contribution limits for 2019 you may know that the contribution limit for traditional and roth iras for 2019 is 6 000 or 7 000 if you re 50 or older. But there are restrictions that could affect how much. Up to the limit.

Here s a closer look at how the irs decides how. Married filing separately and you lived with your spouse at any time during the year. If your magi is more than. Your earnings are exempt from tax if you hold your roth for at least five years and make no withdrawals prior to reaching the age of 59 1 2.

The amount you can contribute to your roth ira depends on your income level. For 2020 the maximum amount you can contribute to a roth ira is 6 000. Other withdrawals of earnings are generally subject to. Roth ira contributions are made on an after tax basis.

However keep in mind that your eligibility to contribute to a roth ira is based on your income level.