Income Tax Payable Journal Entry Philippines

1601e with monthly alphalist of payee the sample entry would be.

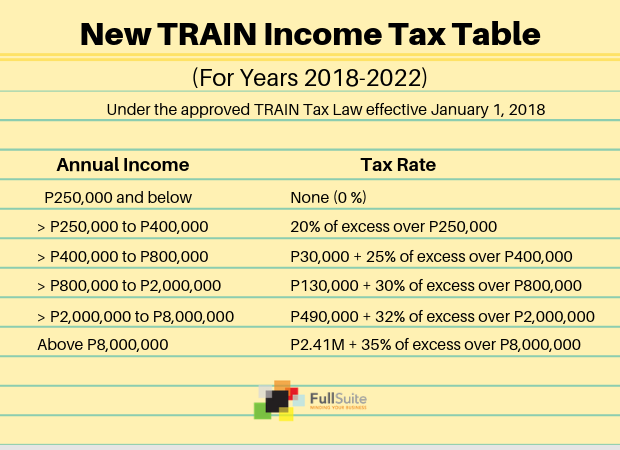

Income tax payable journal entry philippines. As the income tax is estimated a demand for the amount has not yet been received and the expense has not been recorded in the accounting records. Cr 1368 in 2014. Journal entry for income tax. Income tax payable p 19 400.

At the end of an accounting period one of the adjusting entries is to accrue for estimated income tax payable due on the profits of the business. How to record a journal entry for a tax refund. You can record a journal entry for a tax refund with the following two steps. It is really important to ensure the books are up to date before filing the next tax return.

Creditable withholding tax p10 000. Suppose a business has an estimated annual income tax expense of 14 000. The income tax payable account has a balance of 1 850 representing the current tax payable to the tax authorities. Sole proprietorship partnership and private limited company.

Upon remittance of company a to bir using bir form no. Filing income tax returns in philippines is a recurring obligation of every taxpayer and made quarterly and annually for registered individuals in trade or business or practice of profession sole proprietorship or freelancers in philippines bir form no. Tax refunds are not considered revenue. Income tax expense p 72 000.

Dr cra penalty interest 114 55 cr income tax payable on the date you received the refund cheque book dr bank 50 45 cr income tax payable. Large taxpayers in the philippines 4 635 recent post. Using double entry bookkeeping you reverse the original entries you made for paying taxes. On the books of payee mr.

1701q and or 1701 and corporations that includes partnerships one person corporations resident foreign. It all depends on the type of assesse and the type of method of treatment they are adopting. You need to keep a few things in mind to record an income tax refund journal entry. Income tax is a form of tax levied by the government on the income generated by a business or person.

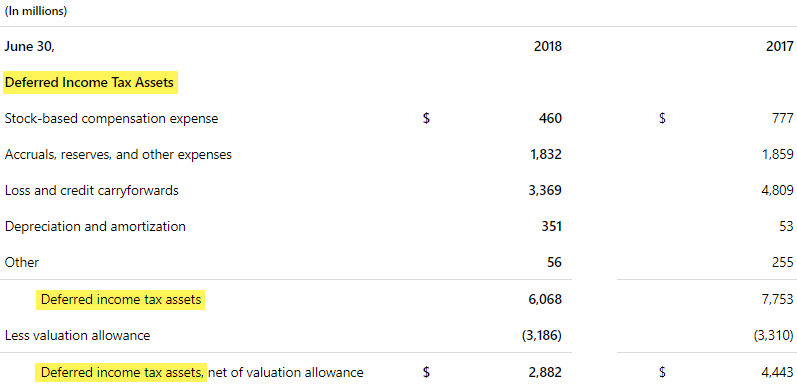

The balance on the deferred tax liability account is 150 representing the future liability of the business to pay tax on the income for the period. Types 1 without creating provisions for income tax applicable to companies firms etc income tax ac dr to bank cash account profit and loss acco. The journal entry in the above example would be as follows. A you may take the sample journal entry below.

The effect of accounting for the deferred tax liability is to apply the matching principle to the financial statements by ensuring.

/dotdash_Final_Deferred_Tax_Asset_Definition_Aug_2020-01-dab264b336b94f939b132c55c018f125.jpg)