Income Tax Journal Entry Philippines

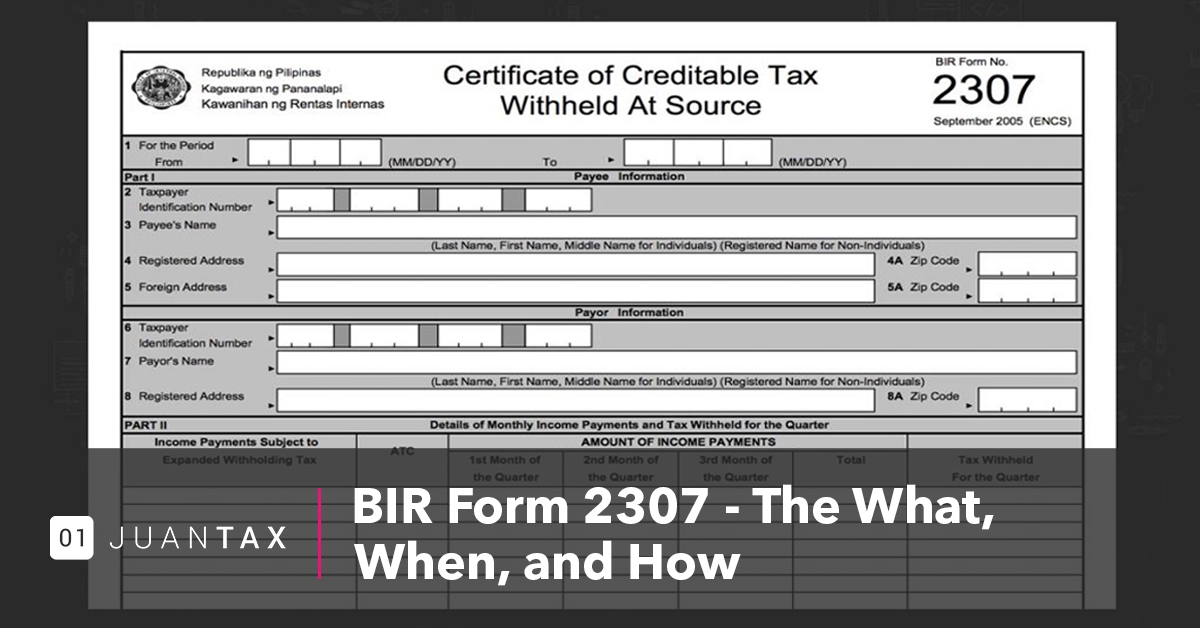

Upon payment you may take the sample journal entry on the books of company a as payor.

Income tax journal entry philippines. Net operating loss means the excess of allowable deduction over gross income of the business in a taxable year. Journal entry of income tax accounting. Advance income tax payment advance income tax will show under assets in the balance sheet. Juan de la cruz income does not exceed p720 000 00 and the withholding tax rate is 10.

Professional fees expense p100 000 00. The bir has mandated. Accounting and journal entry for income tax is done in a distinct way for different types of business establishments i e. You need to keep a few things in mind to record an income tax refund journal entry.

Provision amount is calculated by applying rate as per tax rules on profit before tax figure. Types 1 without creating provisions for income tax applicable to companies firms etc income tax ac dr to bank cash account profit and loss acco. Profit before tax is usually a gross profit less operating financial and other expenses plus other income. The journal entry to record provision is.

How to record a journal entry for a tax refund. Pagaspas value added tax vat is imposed upon any person who in the ordinary course of trade or business sells barters exchanges leases goods or properties renders services and any person who imports goods. Income taxes are determined by applying the applicable tax rate to net income of a business calculated in accordance with the accounting rules given in the tax laws. Payment of expense subject to withholding.

Accounting for direct taxes. It all depends on the type of assesse and the type of method of treatment they are adopting. Tax refunds are not considered revenue. Sole proprietorship partnership and private limited company.

Journal entry for income tax. What are the related accounting entries assuming mr. Revenue regulation 14 2001 implements a statute that the allowance to net operating loss carry over will be a deduction from gross income. Income tax is a form of tax levied by the government on the income generated by a business or person.

You can record a journal entry for a tax refund with the following two steps. It is an indirect tax and the amount of vat maybe shifted or passed on to the buyer transferee or lessee of the goods properties or services. Using double entry bookkeeping you reverse the original entries you made for paying taxes. Provision of income tax provision of income tax recorded in books of account by debiting profit loss a c and it will show under liability in balance sheet.

/dotdash_Final_Deferred_Tax_Asset_Definition_Aug_2020-01-dab264b336b94f939b132c55c018f125.jpg)