Income Tax Journal Entry In Partnership Firm

Journal entries in case of partnership companies for a partnership firm income tax is payable by the business itself and not individually by the partners in this case income tax is reduced from the net profits.

Income tax journal entry in partnership firm. The company tax rate is 28 5 and thus the projected tax payable will be 14 250 00 we account for this by the following end of year journal entries. Your former partner. Income allocation once net income is calculated from the income. Partnership firm will have to file income tax return irrespective its income.

Assessment of income of partners any amount of interest salary commission bonus and other remuneration received by the partners from partnership firm shall be shown by the partners under the head of income from business or profession. Debit income tax expense 14 250 00. Section 4 of the india partnership act has defined the word partnership as the relation between persons who have agreed to share the profits of a business carried on by all or any of them acting for. It is shown in the profit and loss appropriation account.

There have been no income tax instalments paid in advance. And what will be grouping head of advance tax in tally aditi kaur practising ca 24 october 2016 cci online learning offers a library of courses for ca cs cma aspirants from the best faculties in india. Even though you paid 1 000 for a 25 interest in the partnership the business did not receive this cash. What will be the journal entry when partners make payment their advance tax fy16 17 from their firm account.

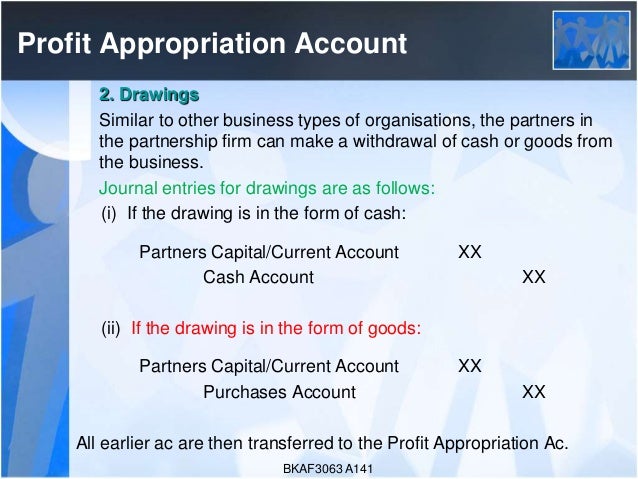

Just as in the previous example the entries could also be combined into one entry with the credit to cash 23 000 8 000 from sam 15 000 from ron and the debits as listed above instead. This journal entry records your new investment in the partnership. What will be the entry of a partnership firm for provision of income tax should it be part of profit loss account or appropriation account profit to be shared between partners is before income tax or after income tax please guide with accounting entry what will be.