Income Protection Insurance Through Super Tax Deductible

Pre existing medical conditions and lifestyle factors such as smoking may impact the cost of premiums whereas group insurance inside superannuation may have automatic acceptance.

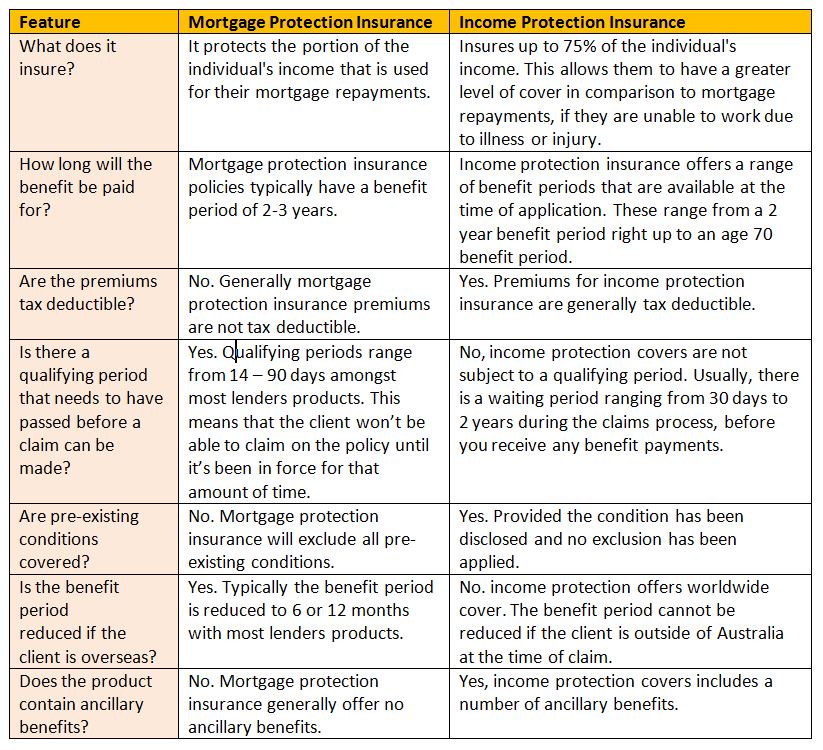

Income protection insurance through super tax deductible. Under section 295 465 of itaa 1997 when insurance is held within super premiums paid may be tax deductible to the super fund. And this point is important. If you prepay your income protection before 30 june you can claim your tax deduction in the current financial year e g. If your insurance is a policy outside of your super the costs are deductible.

Claiming tax deductions when insurance is held within super. Income protection insurance is tax deductible but super may have it covered. Group insurance through super funds is commission free. Term life insurance held within superannuation is generally 100 per cent tax deductible to the fund.

You pay 12 months of premium in advance to receive a tax deduction. Is income protection insurance tax deductible if i own the policy in my own name. If the policy is owned within superannuation the premiums are tax deductible to the superannuation fund and the super tax rate of 15 assuming that your account is in accumulation phase and that the deduction is effectively rebated into your account. Please be advised that this is a general guide only and we are not registered tax agents under the tax agent services act 2009.

If the income protection policy provides for benefits of an income and capital nature the ato s view is that only that part of the premium attributable to the income benefit is deductible 1. So if you have income protection as part of your super package the premium is not tax deductible. No if your income protection is held within and paid for by your super fund the premiums are not tax deductible.