Income Protection Insurance Nz Tax Deductible

Income protection insurance deductibility 31 january 2018 many people have income protection insurance policies and ask us about income protection insurance deductibility well the great news is that these policies are claimable in your personal income tax return whether you are in business or in paid employment as long as any proceeds upon making a claim are treated as taxable income.

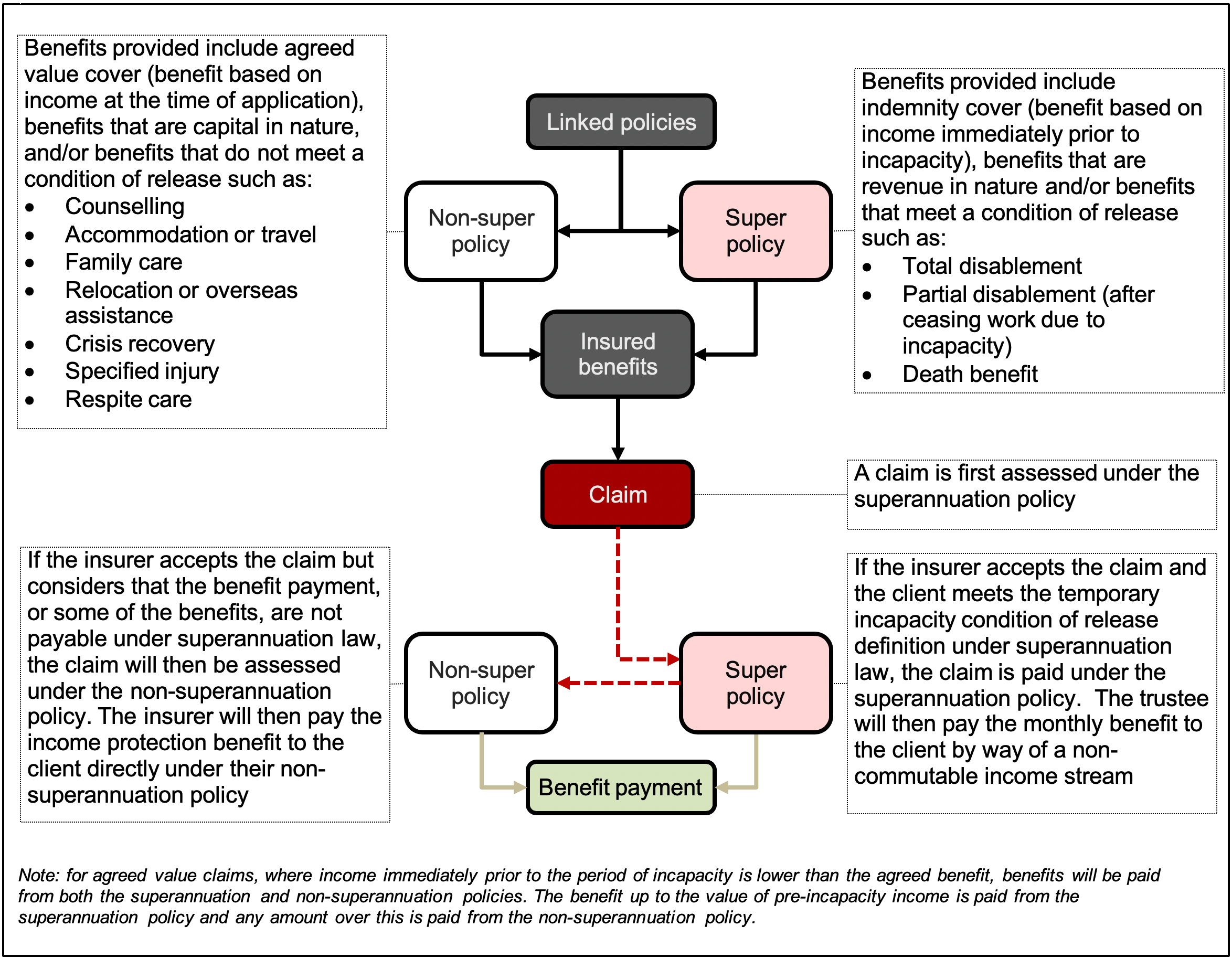

Income protection insurance nz tax deductible. These payments are called exempt income. For example any amount you paid an accountant or tax agent. In the interests of trying to provide some guidance on the tax position of income protection insurance we have outlined below our current understanding of the tax position. If you took a tax deduction on your agreed value income protection or any other benefit for that matter then the claim on that benefit will be assessed for tax.

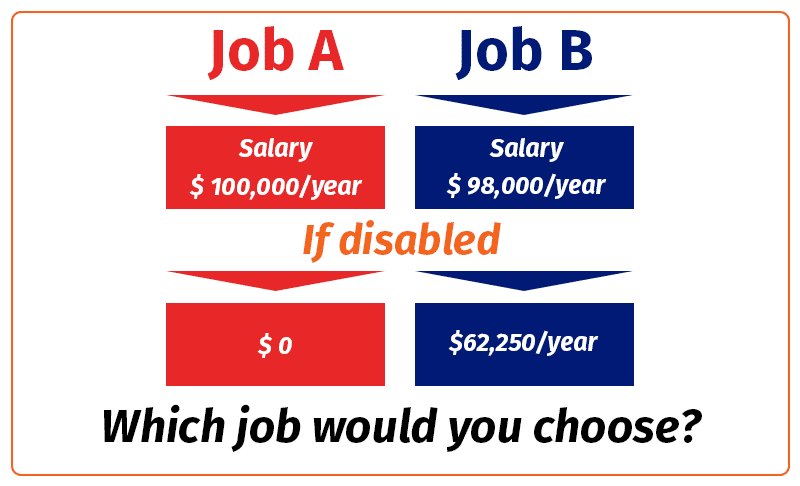

This is the deductible assessable rule. Basically works like this. What is the income tax treatment of payments made or received under a term life. The good news is that any income or proceeds paid out isn t taxable either.

New zealand s tax laws make it a little complicated. The premiums are not deductible. If you take a tax deduction on a policy the proceeds of that policy become tax assessable. This is also called loss of earnings insurance.

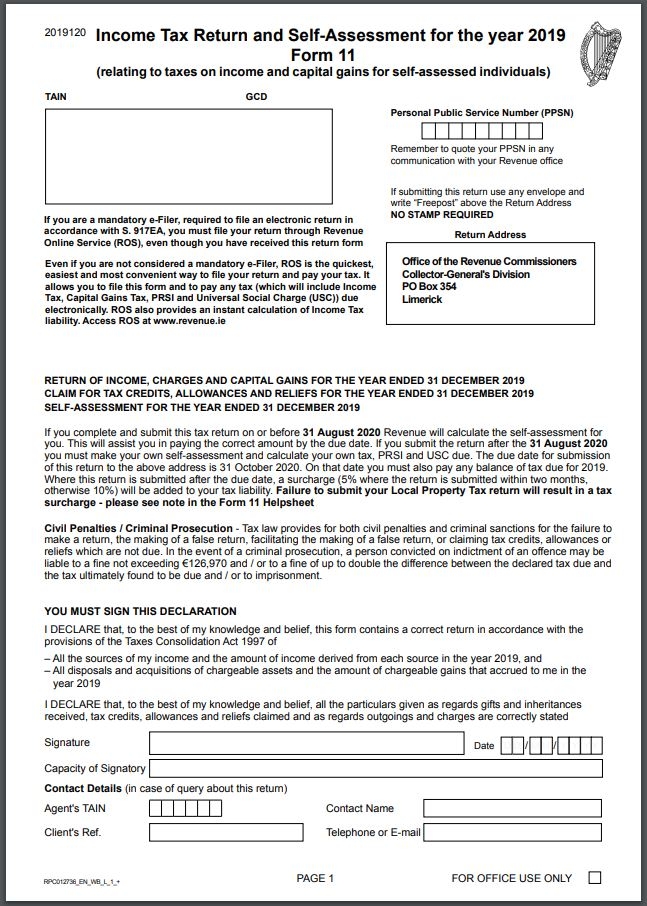

Part 15 01 10 relief for contributions to permanent health benefit schemes. The answer is it depends and every policyholder is unique. If you take a tax deduction for the insurance premium paid then the proceeds on a claim become tax assessable. Section 471 taxes consolidation act 1997.

Where the fun begins. This last one is the one that. Income protection and loss of earnings. You can claim the cost of income protection insurance if the insurance payout would be taxable.

For more information on which insurance premiums are and aren t tax deductible speak to your accountant or financial adviser. The short answer is yes provided the benefit from the insurance policy is taxable. This question we ve been asked is about ss ca 2 cb 1 cg 5b da 1 da 2 1 and da 2 3. Personal illness and accident insurance.

Income protection insurance is usually tax deductible. We look at the circumstances where it is tax deductible and potential issues you should be aware of. Insurance key person insurance policies all legislative references are to the income tax act 2007 unless otherwise stated. Premiums are generally deductible.

It doesn t matter if you are self employed or on a paye salary.