Income Limit For Roth Ira Rollover

Tax consequences of the one rollover per year limit beginning in 2015 if you receive a distribution from an ira of previously untaxed amounts.

Income limit for roth ira rollover. You must include the amounts in gross income if you made an ira to ira rollover in the preceding 12 months unless. But a roth ira has income limits too. The income limits for a 2018 roth ira are as follows. If your magi is more than.

The most you can put into any ira in 2019 be it a roth traditional or combination of the two is 6 000 an increase from 5 500 in 2018. Can i roll over my ira into my retirement plan at work. Opening and contributing to a roth ira is currently restricted to those with an adjusted income limit agi of 122 000 individuals and 179 000 couples. If your income is at least 199 000 you cannot make a roth ira contribution.

But under the new roth ira rollover rules anyonecan perform a roth ira conversion regardless of income. 2020 roth ira income limits filing status modified agi contribution limit married filing jointly or qualifying widow er less than 196 000 6 000 7 000 if you re age 50 or older 196 000 to. The amount you can contribute is reduced if your magi is between 125 000 and 140 000. The maximum annual contribution to roth ira s is generally 5 000 for savers under the age of 50 and 6 000 for savers over 50.

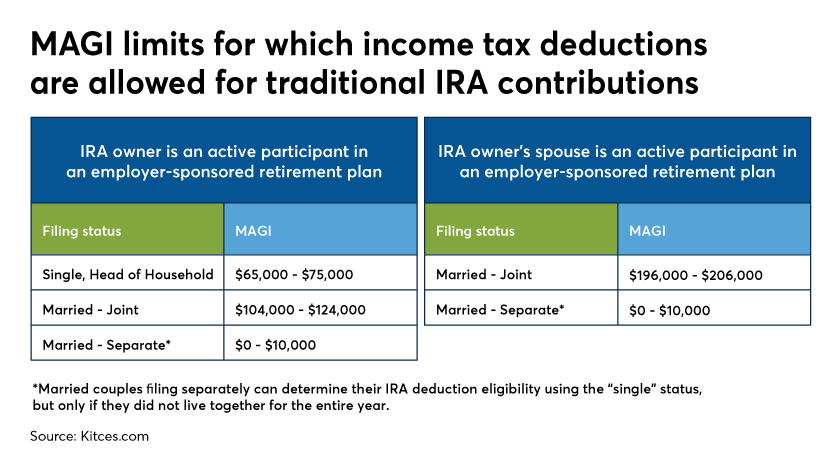

If you are married and filing a joint tax return your roth ira contribution is reduced if your income is at least 189 000. The contribution limits on a roth ira are primarily based on your income. Than a rollover from a traditional ira to a roth ira in the preceding 12 months and you may be subject to the 10 early withdrawal tax on the amount you include in gross income. Up to the limit 196 000 but 206 000 a reduced amount 206 000 zero married filing separately and you lived with your spouse at any time during the year 10 000 a reduced amount 10 000 zero single head of household or married filing separately.

See ira one rollover per year rule for more on this limit. Irs limits on adjustable gross income agi in past years the irs imposed a 100 000 income limit on roth ira conversions meaning if your adjustable gross income agi exceeded 100 000 you were prohibited from performing a rollover. If you are married and filing separately single or filing as a head of household you can contribute to a roth ira in tax year 2021 up to the limit for your age if your modified adjusted gross income magi is less than 125 000.