Income Levels For Health Insurance Tax Credits

Who qualifies for obamacare subsidies.

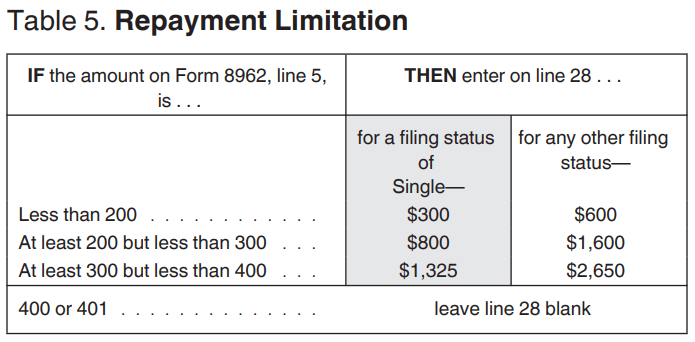

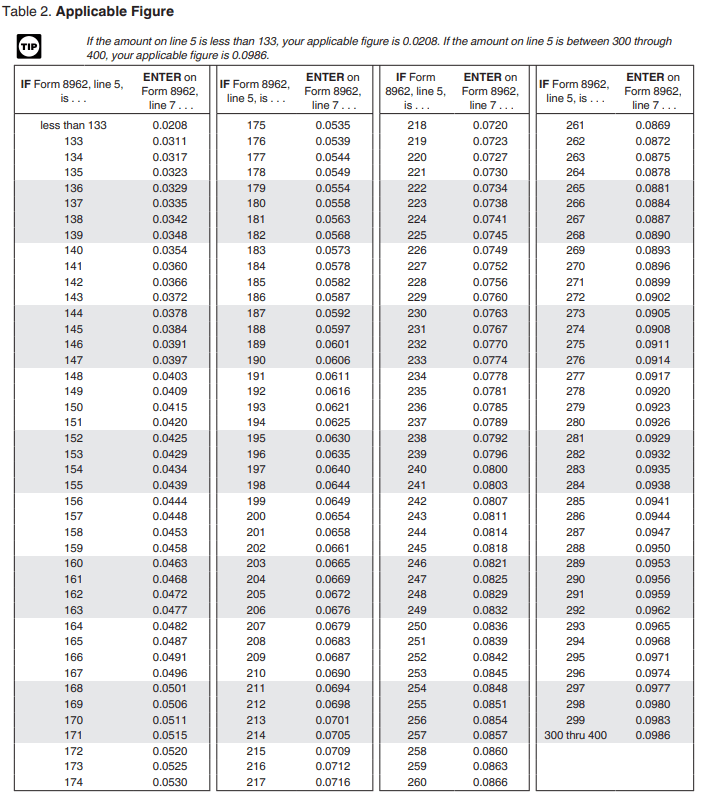

Income levels for health insurance tax credits. The credit implemented under the affordable care act aca is designed to help eligible families or individuals with low to moderate income pay for health insurance. Not all health insurance plans qualify for premium tax credits. For information about the two exceptions for individuals with household income below 100 percent of the federal poverty line see the instructions to form 8962. What s the minimum income for 2021 obamacare subsidies.

Answer the yes or no questions in the following chart or via the accessible text and follow the arrows to find out if you may be eligible for the premium tax credit. For a married couple the effect of paying 17 of the additional income toward aca health insurance is greater than the effect of paying 12 toward federal income tax. This tool provides a quick view of income levels that qualify for. Normally it s a good idea to consider roth conversion or harvesting tax gains in the 12 tax bracket but those moves become much less attractive when you receive a premium subsidy for aca health insurance.

Individuals and families whose modified adjusted gross income is between 100 and 400 of the. A health insurance tax credit also known as the premium tax credit lowers your monthly insurance payment either through advance payments to your insurer or through your tax refund. The tax credits help lower your insurance premium or the payments you make each month for your health plan. You can receive the tax credit in advance by having all or part of the money sent.

Remember that simply meeting the income requirements does not mean you re eligible for the premium tax credit. Learn more about who to include in your household. In general individuals and families may be eligible for the premium tax credit if their household income for the year is at least 100 percent but no more than 400 percent of the federal poverty line for their family size. The premium tax credit can help make purchasing health insurance coverage more affordable for people with moderate incomes.

First you have to project how much you ll make in advance since you generally apply for coverage before the year starts. The federal poverty guidelines sometimes referred to as the federal poverty line or fpl state an income amount considered poverty level for the year. When you apply for coverage in the health insurance marketplace you ll find out if you qualify for a premium tax credit that lowers your premium the amount you pay each month to your insurance plan. Doublecheck your tax forms and fill out the right one.

You must also meet the other eligibility criteria.