Income From Continuing Operations Calculation

Operating income net earnings interest expense taxes.

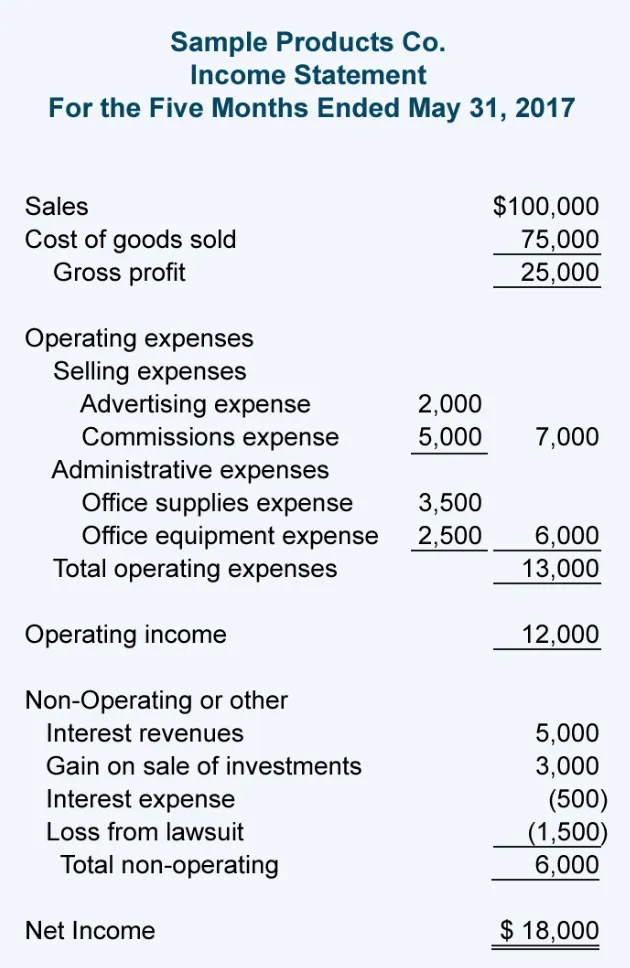

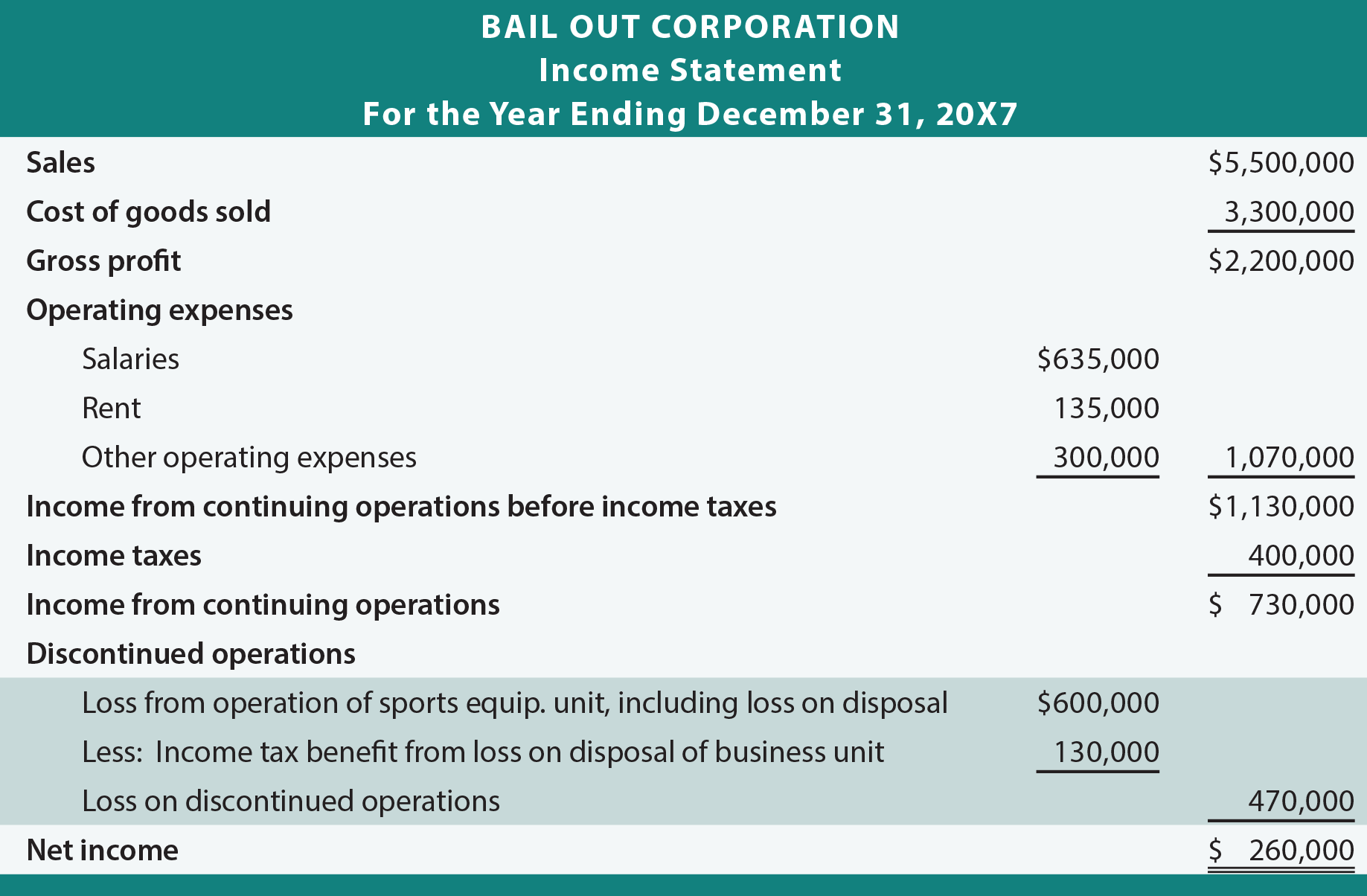

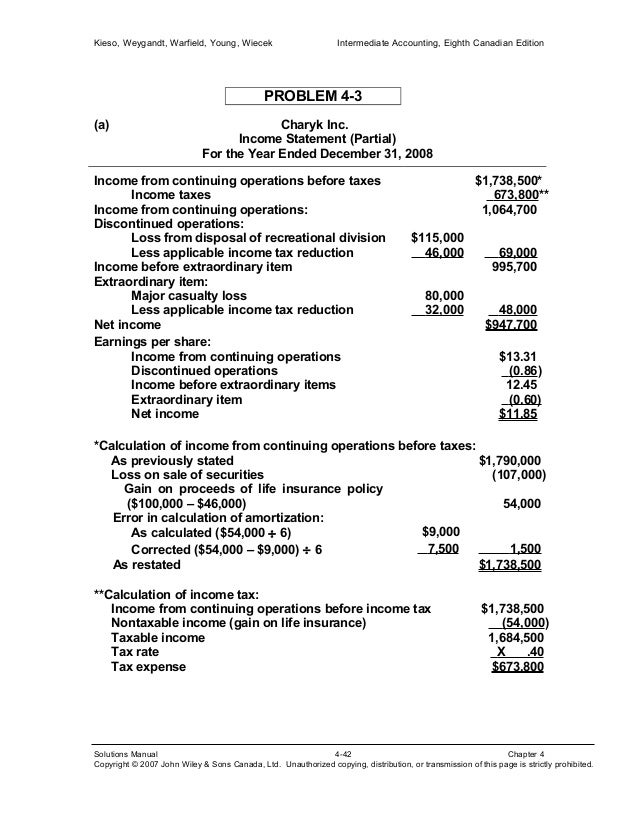

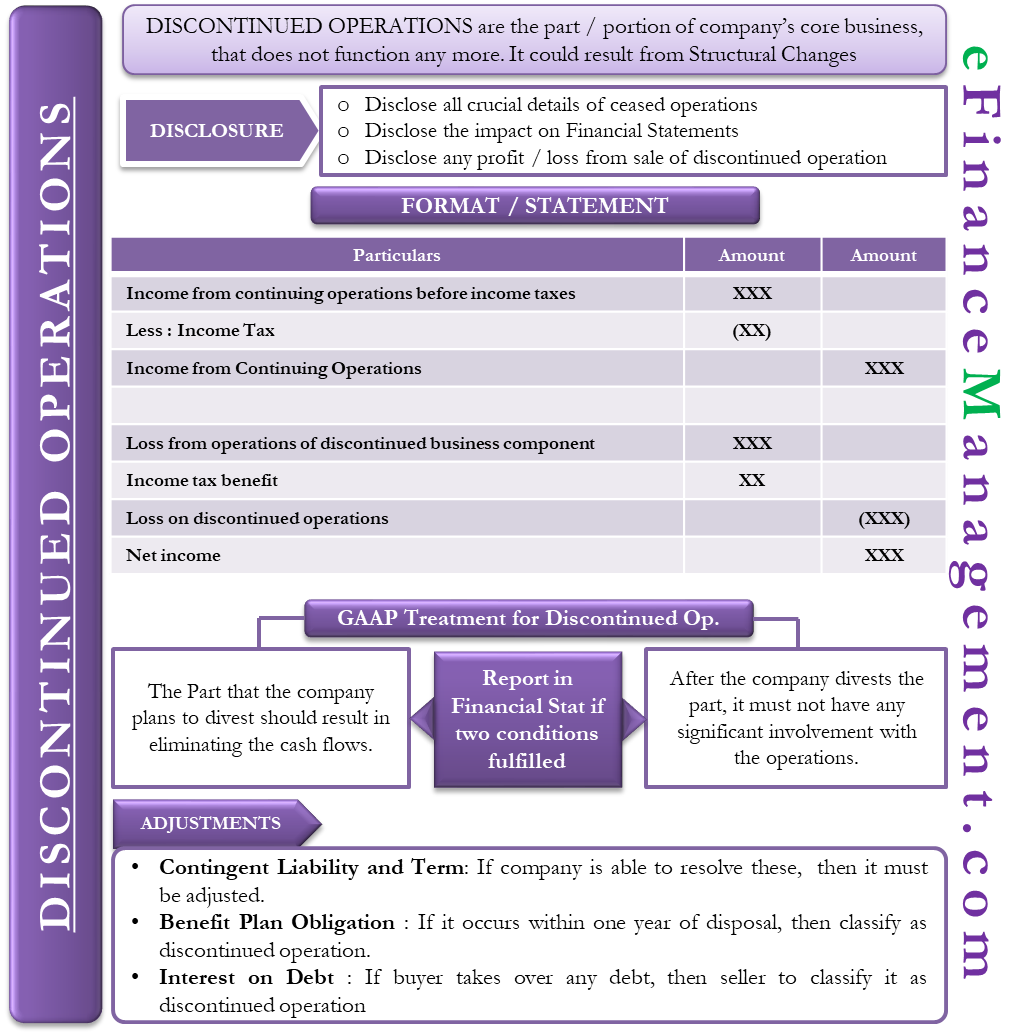

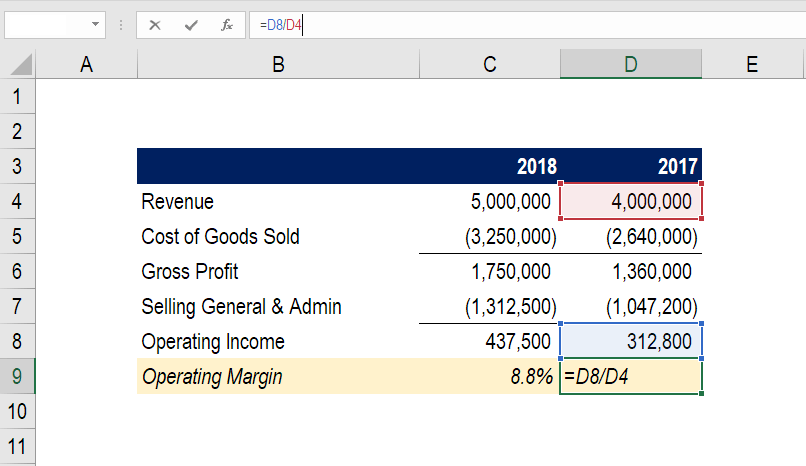

Income from continuing operations calculation. Subtract the tax expense from income before taxes to calculate the income from continuing operations. Operating income gross profit operating expenses depreciation amortization. To calculate the income from continuing operations subtract the cost of goods sold and other operating expenses such as cost from labor from the revenue earned from the day to day operations of a business. For example a company reports 180 000 of sales 80 000 cost of goods sold and 15 000 of operating expenses.

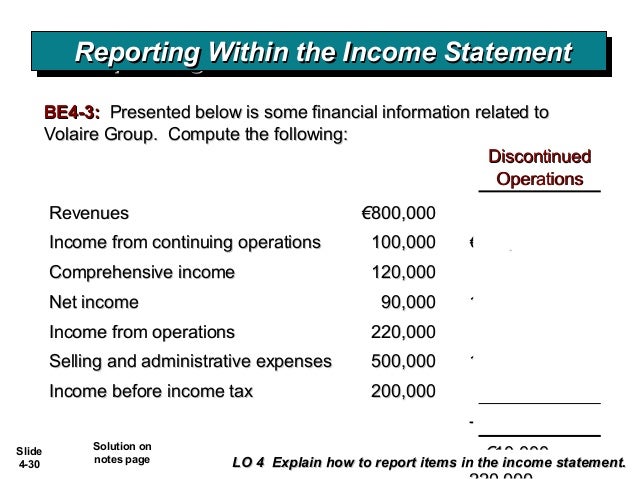

Since one time events and the results of discontinued operations are excluded this measure is considered to be a prime indicator of the financial health of a firm s core activities. Net income from continuing operations is a line item on the income statement that notes the after tax earnings that a business has generated from its operational activities. Income from continuing operations is a net income category found on the income statement that accounts for a company s regular business activities. Income from continuing operations is also known.

:max_bytes(150000):strip_icc()/dotdash_Final_Income_Statement_Aug_2020-02-23bef448b8aa4c9bac46c8e15b2b9f0a.jpg)

:max_bytes(150000):strip_icc()/dotdash_Final_Gross_Profit_Operating_Profit_and_Net_Income_Oct_2020-01-55044f612e0649c481ff92a5ffff1b1b.jpg)

:max_bytes(150000):strip_icc()/NetProfitMargin2-edf5ae45cbe048208913caa9d3b03110.png)