How Do You Calculate Net Income From Continuing Operations

Calculating net income and operating net income is easy if you have good bookkeeping.

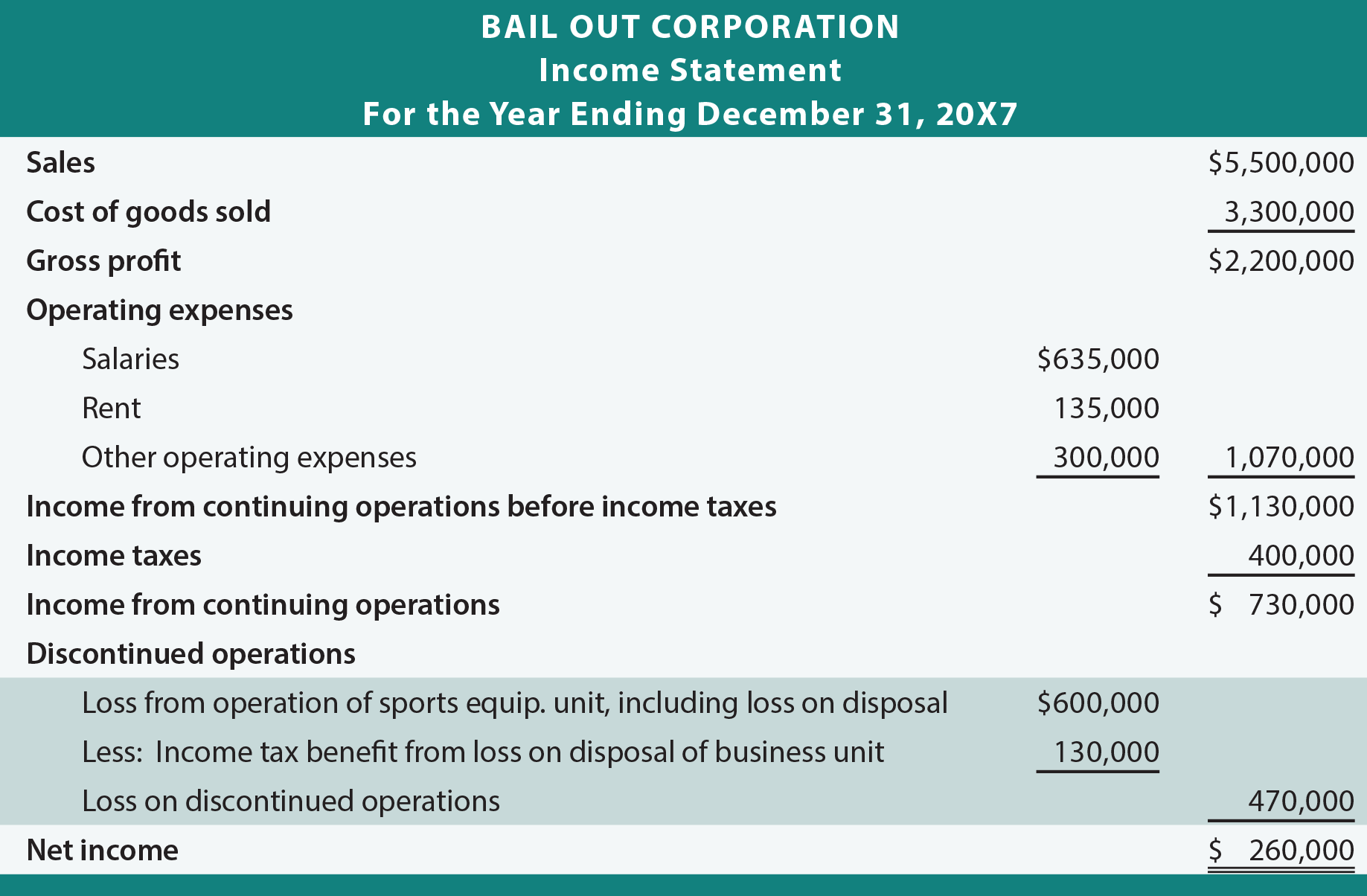

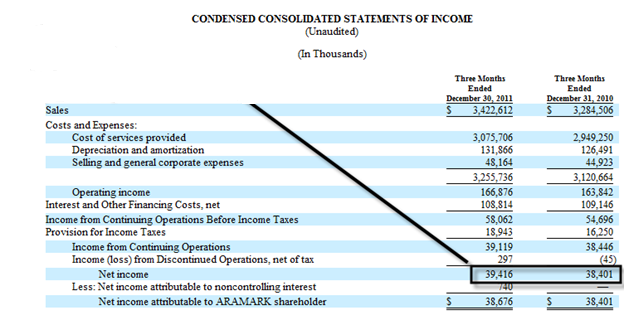

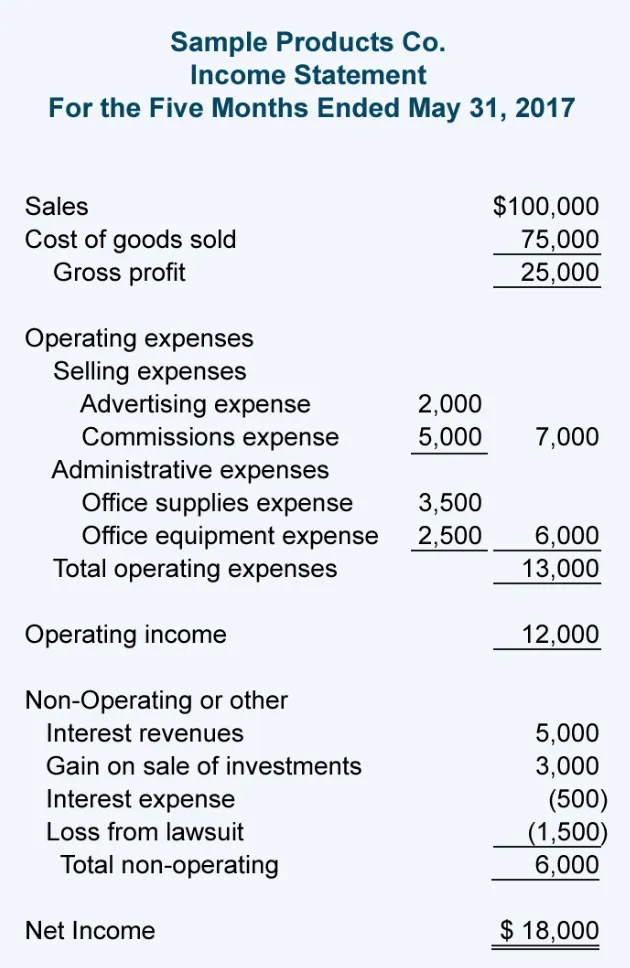

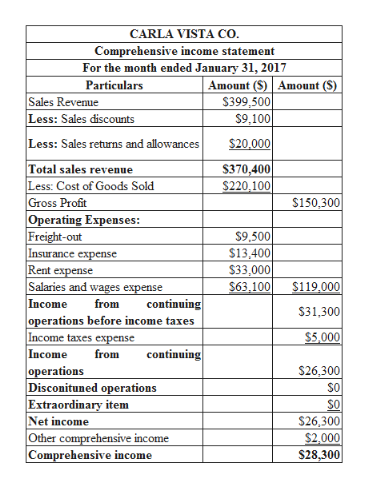

How do you calculate net income from continuing operations. Total revenue means the combined amount of money taken for the sale of goods or services. It just requires two figures. This is a calculation of the profit generated by continuing operations during the period covered by the income statement. While the net income includes the income from the continuing operations as well as the unusual and irregular income and the income from discontinued operations the income from continuing operations only takes into account the revenue generated from regular business activities.

Treat expenses and losses as negative numbers. On that basis i have left it out above. Net income from continuing operations. This is a common method used by analysts to calculate ebit ebit guide ebit stands for earnings before interest and taxes and is one of the last subtotals in the income statement before.

20 000 net income 1 000 of interest expense 21 000 operating net income. The total revenue and the total expenses. In this example add 50 000 in income and the 10 000 tax expense to get 40 000 in income from discontinued operations net of taxes. Let s say that you figure out you owe 10 000 in taxes but you have that 1 000 tax credit so you owe 9 000.

An income statement item would be income taxes or income tax applicable to income from continuing operations. Another way to calculate income from operations is to start at the bottom of the income statement at net earnings and then add back interest expense and taxes. Once you do this then you ve arrived at your business net income. Mcdonalds revenue comes from food sales netflix s revenue comes from subscription fees and wanda s wonderful.

But if that is meant to be income taxes on continuing op ns then it should be below the line income from continuing operations 155 000 and the subtotals below that would change accordingly. Net income from continuing operations is a line item on the income statement that notes the after tax earnings that a business has generated from its operational activities. Since one time events and the results of discontinued operations are excluded this measure is considered to be a prime indicator of the financial health of a firm s core activities. Calculating net income is straightforward.

Add the income or loss from operations and the income tax benefit or expense together to calculate income from discontinued operations net of taxes. After all of the expenses are deducted the investor is left with a figure called net income from continuing operations. After you figure out what you owe in taxes subtract that number from your taxable income. If wyatt wants to calculate his operating net income for the first quarter of 2020 he could simply add back the interest expense to his net income.

Income from continuing operations is a net income category found on the income statement that accounts for a company s regular business activities.

:max_bytes(150000):strip_icc()/dotdash_Final_Gross_Profit_Operating_Profit_and_Net_Income_Oct_2020-01-55044f612e0649c481ff92a5ffff1b1b.jpg)

:max_bytes(150000):strip_icc()/NetProfitMargin2-edf5ae45cbe048208913caa9d3b03110.png)

:max_bytes(150000):strip_icc()/dotdash_Final_Cash_Flow_Statements_Reviewing_Cash_Flow_From_Operations_Oct_2020-02-c2254626b9bb4e8eacbfaf47e4e83784.jpg)

:max_bytes(150000):strip_icc()/dotdash_Final_How_to_Calculate_Return_on_Assets_ROA_With_Examples_Sep_2020-01-43bbd8c00ab24868899a202af2f7ba30.jpg)

/TeslaQ2-19IncomeStatementInvestopedia-1466e66b056d48e6b1340bd5cae64602.jpg)