Formula For Income From Continuing Operations

There are three formulas to calculate income from.

Formula for income from continuing operations. A multistep income statement reports income from continuing operations separately from nonoperating income. Income from continuing operations comprise of. This is a calculation of the profit generated by continuing operations during the period covered by the income statement. The profit or loss from continuing operations attributable to the parent company.

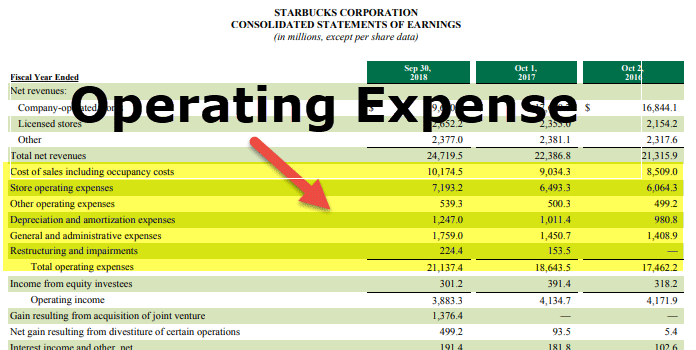

In other words it measures the amount of money a company makes from its core business activities not including other income expenses not directly related to the core. Formula to calculate operating income. I after tax net income before discontinued operations. In addition this calculation should be subdivided into.

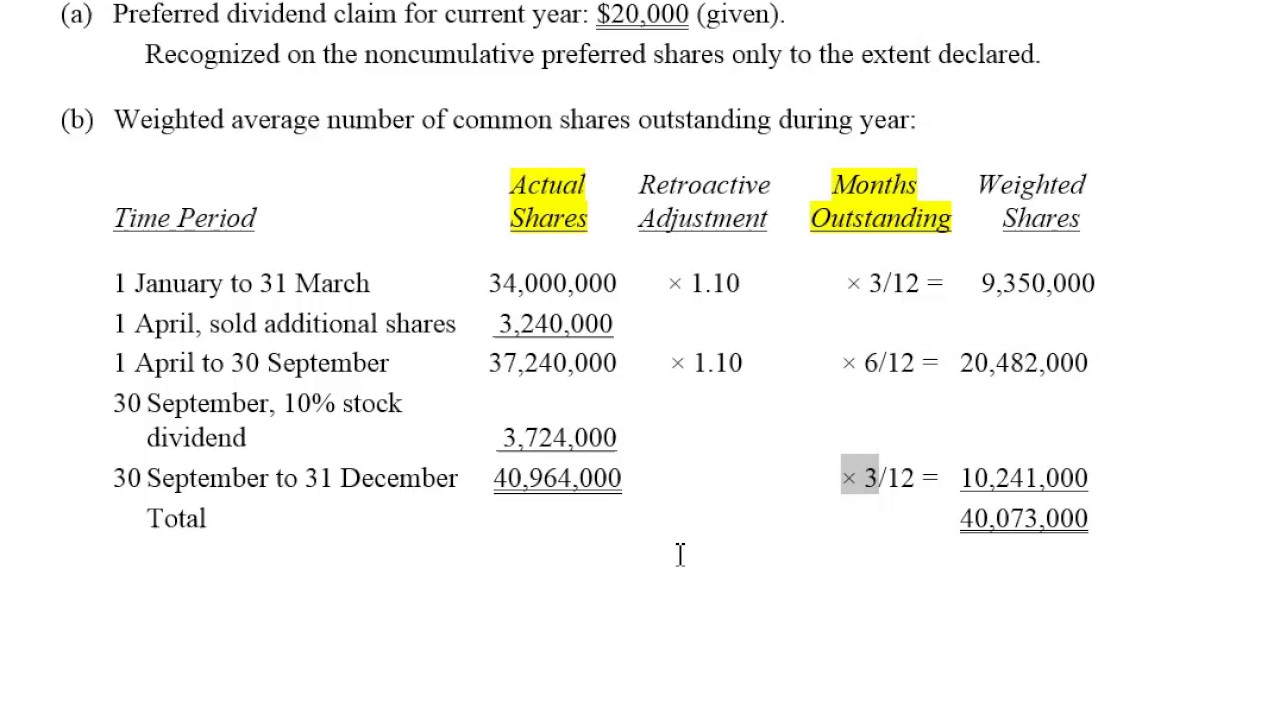

Interest expense interest income and other non operational revenue sources are not considered in computing for operating income. Ii extraordinary items and the cumulative effect of changes in accounting principle. Operating income formula also referred to as ebit formula is a profitability formula that helps in the calculation of a company s profits generated from core operations. The formula for basic earnings per share is.

For example if a car company spends 100 000 building and selling cars then sells them for 110 000 it has 10 000 in income from operations. To calculate the income from continuing operations subtract the cost of goods sold and other operating expenses such as cost from labor from the revenue earned from the day to day operations of a business. After all of the expenses are deducted the investor is left with a figure called net income from continuing operations. Since one time events and the results of discontinued operations are excluded this measure is considered to be a prime indicator of the financial health of a firm s core activities.

Net income from continuing operations is a line item on the income statement that notes the after tax earnings that a business has generated from its operational activities. Formula for operating income. Example of income from operations. Net income from continuing operations.

For example a company reports 180 000 of sales 80 000 cost of goods sold and 15 000 of operating expenses. Profit or loss attributable to common equity holders of the parent business weighted average number of common shares outstanding during the period. Operating income often referred to as ebit or earnings before interest and taxes is a profitability formula that calculates a company s profits derived from operations.

:max_bytes(150000):strip_icc()/dotdash_Final_Income_Statement_Aug_2020-02-23bef448b8aa4c9bac46c8e15b2b9f0a.jpg)

:max_bytes(150000):strip_icc()/dotdash_Final_Gross_Profit_Operating_Profit_and_Net_Income_Oct_2020-01-55044f612e0649c481ff92a5ffff1b1b.jpg)