Fixed Income Mutual Fund Taxation

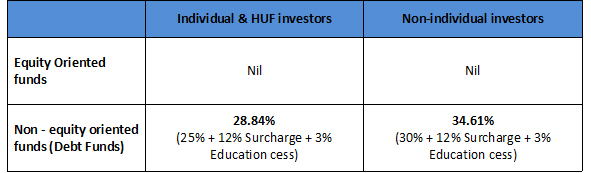

For taxation purpose the mutual funds can be divided into two categories.

Fixed income mutual fund taxation. The other way to minimize your income tax bill is to invest in so called tax free mutual funds. In this article we want to discuss mutual fund taxation and help you understand how your mutual fund returns are taxed. Learn more about fixed income funds components of fixed income funds features of fixed income funds disadvantages of fixed income fund and more. Additionally as an owner of the shares in the fund you must report and potentially pay taxes on transactions conducted by the fund that is whenever the fund sells securities.

This income may not be a fixed amount and will depend on the performance of the fund. These fixed income funds come in many shapes and styles. The fund s return on investment is 3. As a result the tax on the income is dependent on the types of securities held by the fund.

However mutual funds are broadly categorized as equity funds debt funds and hybrid funds. Mutual funds that invest in bonds typically provide regular income from a portfolio of many securities. What s more since fund managers regularly buy and sell bonds there may also be capital gains and losses incurred. Taxes on bond funds.

Tax on mutual funds types of mutual funds in india. Types of mutual funds. Equity mutual funds schemes investing more than 65 of its assets in shares of indian listed companies. This will result in lower return on investment in bond funds.

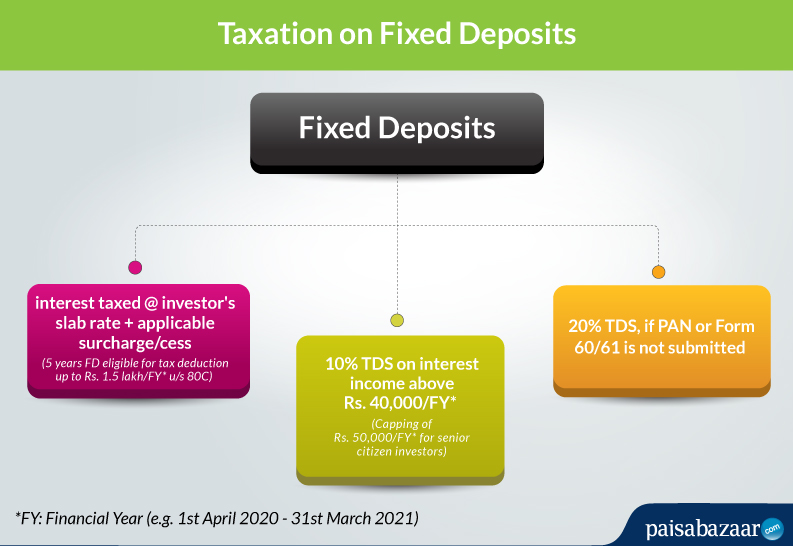

Because of the amendment of the law the mutual fund must be subject to withholding tax. The taxes imposed on fixed income investments are as follows for long term capital gains the tax on fixed income funds with indexation is 20 and without indexation is 10. Non equity mutual funds all other schemes which do not qualify as equity funds by above definition. For short term capital gains the tax imposed on income earned is in accordance to the income slab of the investor.

These funds invest in government and municipal bonds also called munis that pay tax free interest. Taxation on fixed income investments. This is where the ministry of finance sees that there is inequality. Commonly called bond funds fixed income funds are simply mutual funds that own fixed income securities such as us treasuries corporate bonds municipal bonds etc.

You may have heard of words like debt funds equity funds elss funds index funds liquid funds income funds being used often. This includes debt funds international funds of funds gold funds monthly income. And the issuer is obliged to withhold tax from the fixed income fund. Fixed income funds are mutual funds that give you returns at fixed intervals.

:max_bytes(150000):strip_icc():saturation(0.2):brightness(10):contrast(5)/GettyImages-590769645-572f83e23df78c038e62c185.jpg)