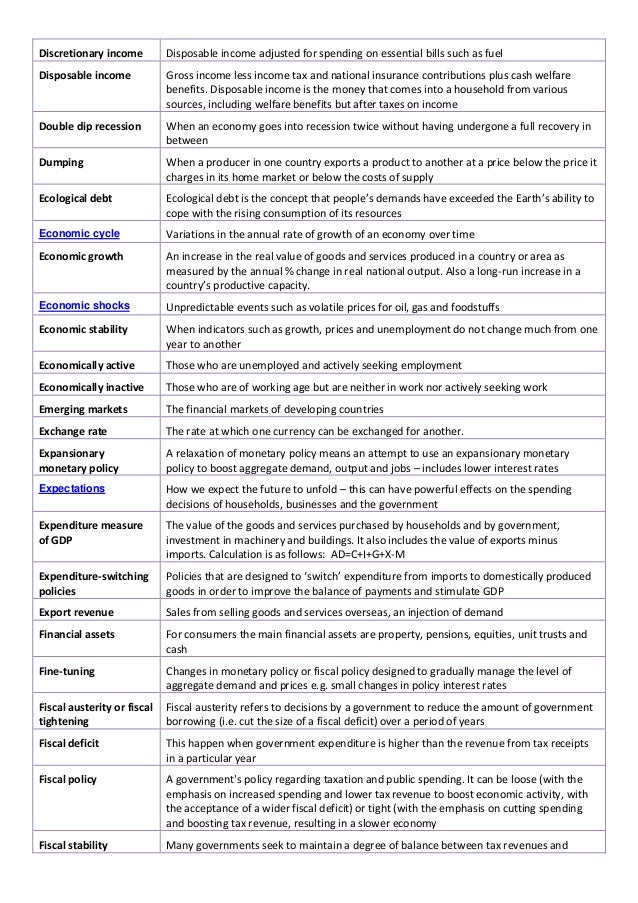

Disposable Income Key Terms

It s sometimes known as your net pay.

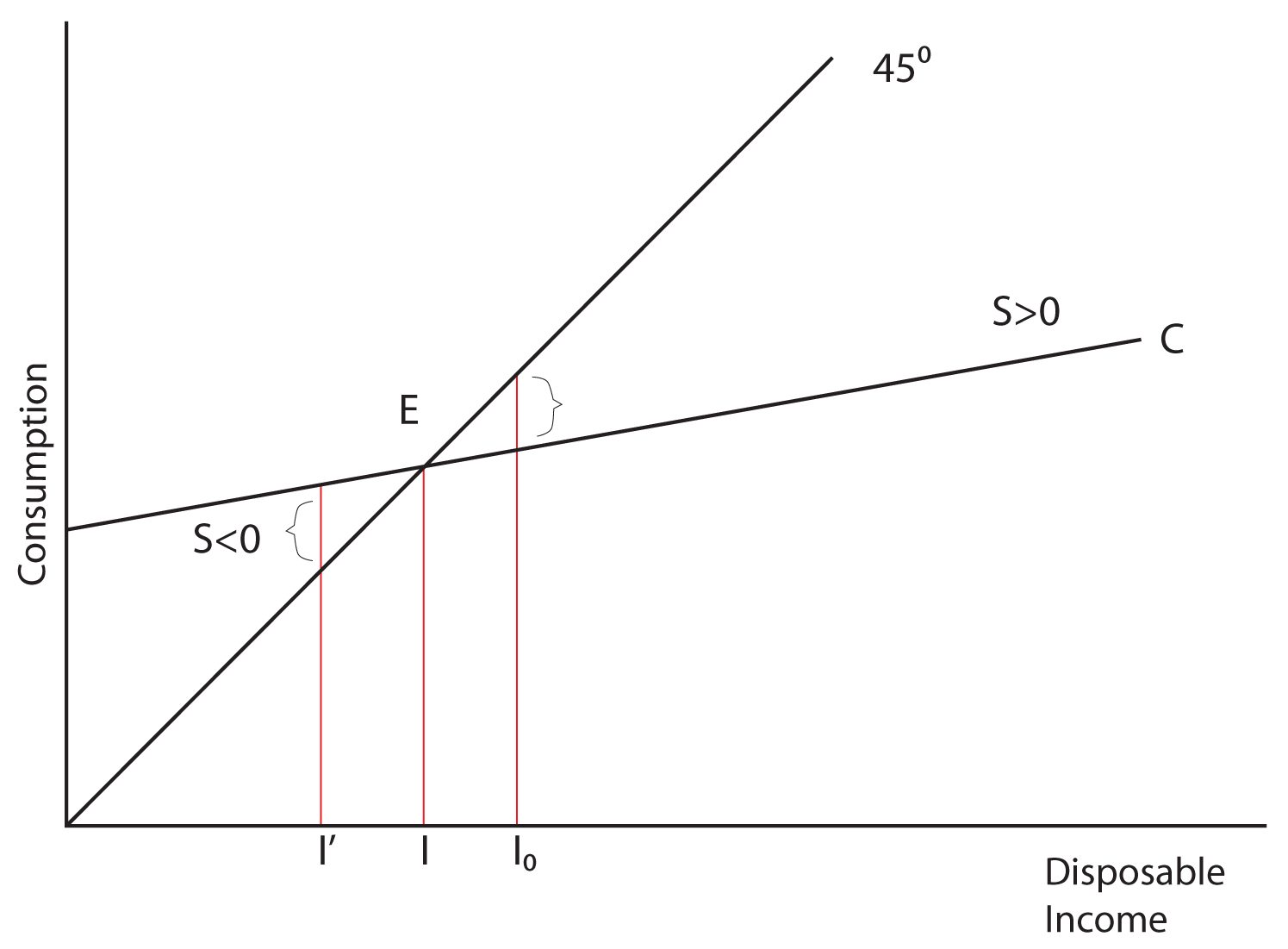

Disposable income key terms. Disposable income is an important economic concept as it is one of the key determinants of consumer demand. Next assume that disposable income increases by 40 billion consumption rises by 32 billion and saving goes up by 8 billion. Note that this is distinctly different from discretionary income which is what remains after you subtract taxes and other necessary costs. Disposable if disposable income increase from 410 to 430 billion and savings increase from 5 to billion the marginal propensity to save is 0 25.

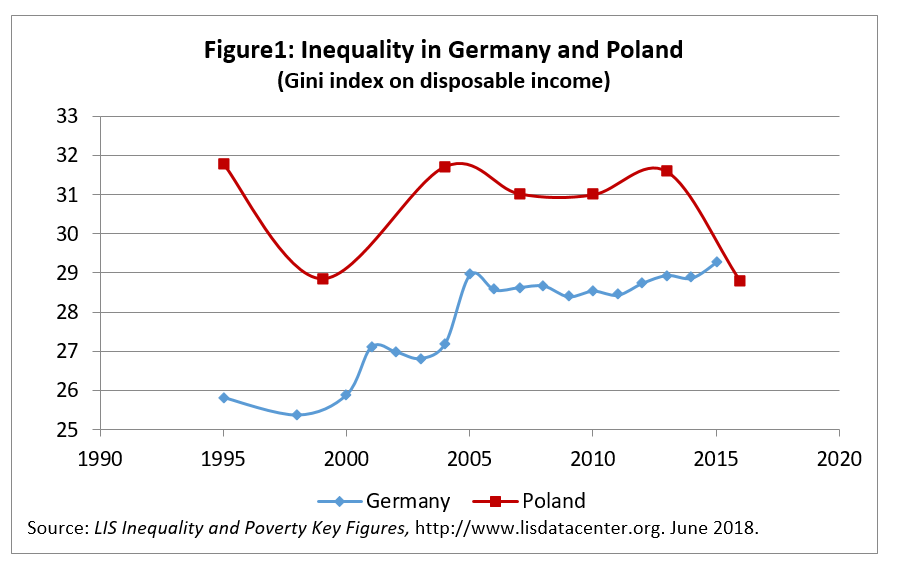

Both are key economic. If higher interest rates on savings are offered individuals are encouraged to save more. Disposable income is a key concept in budgeting as it refers to the income that s leftover after you pay taxes. Disposable income is closest to the concept of income as generally understood in economics.

Discretionary invome disposable income is the amount of money you have left over from your total annual income after paying federal state and local taxes. Often savings are considered once the necessities are covered. As disposable income increases it means consumers have more money to spend in the economy. Break even income is the income level at which consumption is equal to entire income.

Disposable income also known as disposable personal income dpi is the amount of money that households have available for spending and saving after income taxes have been accounted for. These are two different measures used to analyze the amount of consumer spending. Income can be divided into two different categories. Understanding what disposable income and discretionary income are and how they differ is the key to creating and living comfortably within a manageable budget.

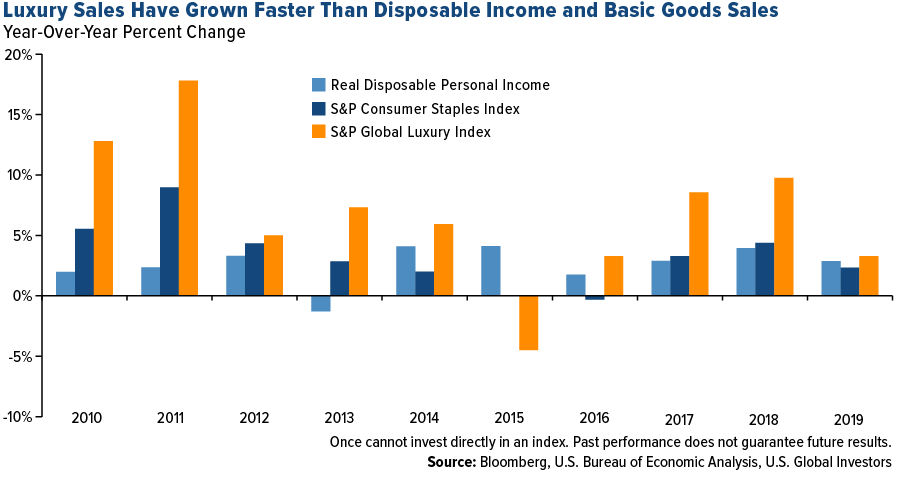

Household disposable income measures the income of households wages and salaries self employed income income from unincorporated enterprises social benefits etc after taking into account net interest and dividends received and the payment of taxes and social contributions. For policymakers this is important because higher disposable incomes can prove beneficial to the health of the economy and employment but a decline could signal a slowdown in the economy. Terms in this set 34 disposable economists define personal saving as not spending or as that part of income not consumed aggregate economists use what term to mean total or combined. Discretionary income is very similar to disposable income and is derived from disposable income.